- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

There is no doubt the bull market now seen in the China H-shares and HK50 is supporting the China proxies (such as the AUD, NZD and KRW), as is the strong rally in the CNH (yuan) – but there has been broad USD weakness and that has further lifted industrial metals and seen commodity currencies outperform.

We can also see bond market dynamics working for the AUD, so in some capacity, the AUD has really had everything working for it – whether this nirvana-like environment continues is obviously up for debate, and as traders, we react to the ebb and flow and changes in price action.

So, what have we seen?

Positioning, as always, is at the heart of the move – where, as of Tuesday last week the weekly CFTC positioning report highlighted non-commercial FX accounts held a 46k net short AUD futures position. Leveraged accounts are short 21k contracts of AUD futures, with asset managers short 28k contracts – CTAs and other systematic rules-based funds would have part closed a sizeable AUD exposure on this move higher into 0.6700 and are likely running a more neutral position - repositioning has given the AUDUSD rally real tailwinds.

Getting out of longs when momentum shifts

(AUDUSD daily)

Momentum accounts on the longer timeframes are net long and many of these will refrain from using price target and hold until the rules get them out – perhaps adopting a 3 and 8-day EMA cross-over system or a trailing stop (using an ATR or Donchian Channel). I am sympathetic to this approach. That said, the 200-day MA at 0.6954 and 52-week high at 0.6916 look like clear target zones. We can see price hugging the upper Bollinger Band, naturally a sign of bullish trend and momentum.

The China side of the argument is clearly inspiring - China supporting the property sector through its 16-point plan to help developers is big news, while authorities also come out with pivotal changes to its Covid policy, with a renewed focus on growth. Global growth, while still an obvious concern has been revaluated and a significant economic hard landing is being priced out – this has resulted in the closing of USD ‘doomsday’ hedges.

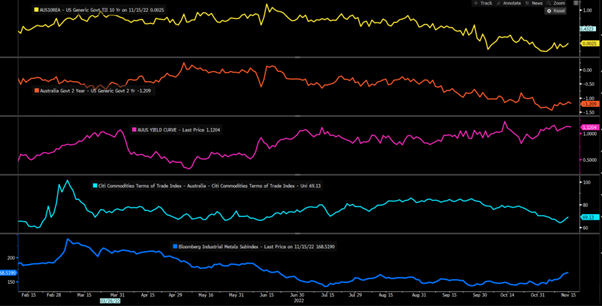

We can see other classic fundamental inputs working near-term in the AUDs favour – Aus v US 10yr real rate differentials have worked for the AUD, with the Aus and US real rates (bond yields adjusted for expected inflation) yield spread moving from negative to zero. We see the discount Aussie 2yr bond yields offer relative to US 2yr Treasurys rising from -146bp to -114bp. We can see Australia’s terms of trade outperforming the US as well. While the relative steepness of the Aussie bond yield curve has lifted vs the US.

On the day, we’ve seen Aussie Q3 wages out today at 1% QoQ vs 0.9% eyed, taking the year-on-year pace to 3.1% - the market was priced for this and hence we’ve not seen much of a move – while wages are still rising slower than some expect, the RBA should hike by 25bp on 6 Dec, and again on 2 Feb – it's here we may get a pause on the hiking cycle. Rates aside, there are still clear risks to the AUD – geopolitics could become a more prevalent concern and we watch developments on the low probability that NATO’s Article 5 is invoked, in the wake of Russian-made missiles landing in Poland. There is also a window of tier 1 US economic data to get through to mid-Dec and that will need to confirm a cooling in the labour market and inflation, or the USD will stage a solid rally into year-end.

For now, the AUD looks the goods, and the 200-day MA is a real possibility – one for the radar

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.