CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

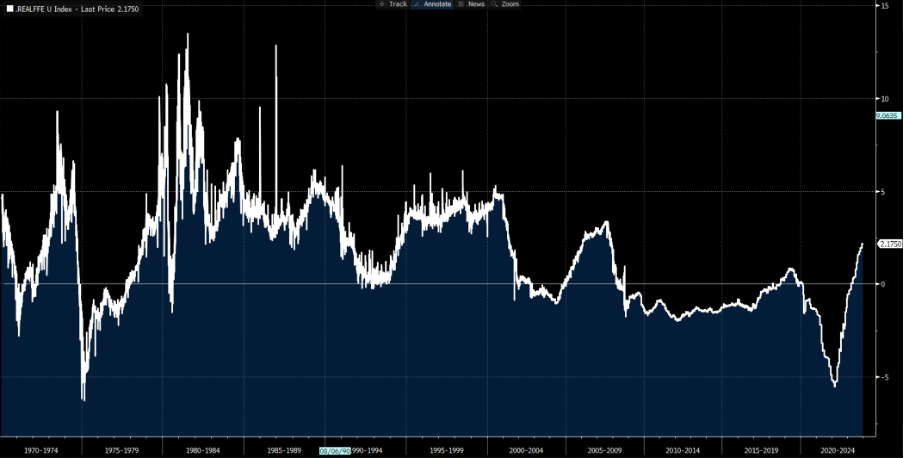

US real policy rate – fed funds rate minus core PCE inflation

US real policy rate – fed funds rate minus core PCE inflation

Will we see greater market volatility because of the turn to 2024?

Obviously, we don’t yet know the answer to that, but I would be eyeing both the VIX expiration (17 Jan) and S&P500 equity/index expiration (19 Jan) as dates that could be very important – I’d imagine once we move past that period, we could see higher vol, at a time when liquidity is on the rise. Short positions – for those working outside of day trading systems – may start to work far more effectively.

Of course, we could see equity just keep going on its merry ascent and we need to be open-minded to all possibilities. But with fund manager sentiment the most upbeat since Jan 2022, cash levels having been reduced and many other signs of broad exuberance, it feels like the distribution for risk is becoming more evenly distributed.

China gets increased attention after Xi’s weekend address to the nation in which he vowed to get in front of the economic fragility - this seems like a meaningful development. With China property sales -34% yoy, and a set of underwhelming PMIs (released yesterday), it feels like we’re moving to a firmer regime of bad news being good news for Chinese markets.

It’s investor flows that matter, and we’ll also see this in the market price action – but after an 87% decline in net foreign investment in China mainland equity funds in 2023, any signs that international money managers are taking a nibble at China equity risk, at a time of exuberance in US equity markets and I’ll be looking at a tactical idea here in earnest and will look to size the trade. Long CN50 / short US500 would be a play or for the ETF heads, long FXI / short SPY.

As detailed in the key events for January, Crypto traders are watching for the SEC's verdict on the much-anticipated BTC ETF. The reaction to a possible rejection would be clear cut and likely see an immediate spike lower. However, should we see the green light the obvious question is whether we get a buy the rumour, sell-on-fact scenario playout or whether it promotes another leg higher. Reaction over prophesying could be the play.

Good luck to all, and here’s to a healthy and prosperous 2024.

The key event risks for the week ahead

China Caixin manufacturing PMI (2 Jan 12:45 AEDT) – after the weekend release of the NBS PMIs (the composite print came in below consensus at 49.0) through the week we get to see the Caixin PMIs (manufacturing on 2 Jan, services on 4 Jan). The consensus estimate is for the manufacturing index to print 50.3 (from 50.7), but unless it’s a big decline/improvement then it shouldn’t move Chinese assets or its proxies (AUD, NZD etc) too intently.

US Richmond Fed president Barkin speaks on the US economy (4 Jan 00:30 AEDT) – Thomas Barkin is a voter on the Fed in 2024 and leans on the hawkish side of the ledger, so his comments on the US economic outlook could carry weight – any talk of rate cuts from Barkin will likely be firmly data dependent.

US ISM manufacturing (4 Jan 02:00 AEDT) – the market sees a small improvement with the diffusion index eyed at 47.2 (from 46.7). Unlikely to be a market mover, given we’ve seen manufacturing in contraction since October 2022, so it may take a shock to move the dial.

US JOLTS jobs openings (4 Jan 02:00 AEDT) – the median estimate is we see 8.86m job openings, a decline from 8.73m seen in the prior month.

FOMC minutes (4 Jan 06:00 AEDT) – with the US rates/swaps market fully pricing a 25bp rate cut in March, the minutes from the Dec meeting could be a risk event for broad markets. Recall the significant dovish reaction post-December FOMC meeting statement, the Dots, and Jay Powell presser, so traders will explore further details on the appetite to ease the fed funds rate.

UK Decision Maker Panel (DMP) 1-year CPI expectations – The prior inflation call was set at 4.4%, and given the recent below consensus CPI print, we could see this being taken lower - the call on inflation from the DMP could influence the GBP. GBPAUD is on the radar and a close below 1.8600 would suggest a probability of a continuation of the recent bearish trend.

US ADP payrolls (5 Jan 00:15 AEDT) – the market will likely put greater emphasis on Friday's NFPs, but a blowout beat/miss to expectations (currently at 115k jobs) could move the USD.

EU (estimate) CPI (5 Jan 21:00 AEDT) – the consensus is for EU headline CPI inflation to lift to 3% (from 2.4%), while core CPI is eyed lower at 3.4% (3.6%). With EU swap markets pricing a 66% chance of a 25bp cut in the March ECB meeting, the CPI data could impact that pricing and by extension the EUR. A potential uplift in headline inflation, but a lower core CPI makes predicting a likely EUR reaction challenging.

US nonfarm payrolls (6 Jan 00:30 AEDT) – the marquee event of the week, the consensus is for 170K with the economist’s range of estimates set between 200k to 80k. The 3-month average sits at 203k jobs, so a print at 170k (if the median estimate is indeed on the money) would take this average to 173k. Also, we see expectations for the unemployment rate at 3.8% (from 3.7%), while average hourly earnings are expected to pull down a tick to 3.9%, but this is conditioned on the number of hours worked. Given the current pricing in US swaps and USD positioning, I’d argue we should see a bigger rally in the USD on a beat, than the potential USD sell-off on a downside surprise. But as always with NFP it's never straightforward, as we could see a beat on jobs but a rise in the unemployment rate.

US Services ISM (6 Jan 02:00 AEDT) – the market eyes the index at 52.5 (from 52.7), so a small deterioration expected by 52.5 is still healthy.

Other marquee event risks for January (dates in AEDT):

JP Morgan commences the US Q4 corporate earnings season

US CPI – 12 Jan

UK CPI – 17 Jan

VIX options expiration – 17 Jan

US equity, equity index and ETF options expiration – 19 Jan

China 1 & 5-year Prime Rate decision – 22 Jan

BoJ meeting – 23 Jan

BoC meeting – 24 Jan

ECB meeting – 25 Jan

AUS Q4 CPI inflation – 31 Jan

US Treasury Quarterly Refunding Announcement (QRA) – 31 Jan

FOMC meeting – 1 Feb

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.