- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The Week Ahead: S&P 500 and NASDAQ 100 Hit New Highs Amid Low Volatility

While not everything went the bull’s way last week, the momentum and trends seen in risky markets portray an almost nirvana environment in which to operate – The S&P500 recorded its fourth new all-time high for 2025 with the NAS100 also printing new highs and eyeing a push to 23k. Bullish technical breakouts were seen in the NKY225 and TAIEX, with strong underlying momentum evident in the DJ30 and German Dax.

S&P500 20-day realised volatility fell to a YTD low of 10.3%, taking the VIX index to 16.3% and the floor for S&P500 30-day implied volatility seen since the start of May. On the week, US high-yield credit spreads tightened 7bp to the best levels since March, copper gained 4.9% and the USD (DXY) fell to the weakest levels since March 2022.

Those set in long SPX500 positions will be hoping that the July seasonal effects repeat, with the S&P500 seeing positive monthly returns in July for the past 10 consecutive years, with an average monthly gain of 3.4% over this period.

The tailwinds for risk

A surprisingly rapid reduction of the geopolitical risk premium, headlines of at least 10 imminent trade deals, Germany’s fiscal plans and UST Secretary Bessent’s requesting that Congress remove the Section 899 “Revenge Tax” from the ‘One Big Beautiful Bill Act’ (OBBB) all adding tailwinds to risk markets.

A dovish tilt from various Fed officials was also fuel for the bull's, allowing traders to overlook some of the more concerning US data points released through the week, with speeches from Jay Powell, Christopher Waller and Michelle Bowman, providing a defined roadmap and the triggers for a resumed easing cycle.

The US interest rate swaps market responded to the Fed chatter (and to the data flow) and now sees the 30 July FOMC meeting as a ‘live’ affair, placing an 18% chance of a cut here – the bar to cut in July remains a high one and one suspects we’d need to see a shocker of a payrolls print and an unemployment rate at 4.4% (or above), even marrying with a US core CPI (released 15 July) print at or below 0.1% m/m for a cut to truly come into play in July. A 25bp rate cut at the September FOMC meeting seems far more realistic (the Fed don’t meet in August) and the market pricing implies a cut as a slam dunk. Interest rate traders also added 13bp of implied cuts for the December Fed meeting, to price 2.5 25bp cuts or 64bp of cumulative cuts through to year-end.

We also saw the US 10-year Treasury yield closing 10bp lower on the week to settle at 4.27%, with the US 10yr real rate settling below 2% - the lower discount rate offering a small, but welcome uplift to the net present value of the high beta and high growth US equity plays.

With inflation front and centre, Friday’s US core PCE inflation print (+2.7% y/y) failed to trouble the market, with the 3-month annualised rate now running at just 1.7%. Inflation markets offer tailwinds to risk, with US 2-year inflation swaps -10bp w/w to 2.73%, while longer-term inflation expectations (US 5y5y inflation swaps) – a gauge closely monitored by the Fed – closed little changed on the week to settle at 2.48%.

An interesting factor to consider is that the higher tariff regime has resulted in the US Customs Department recording a revenue boost of over 150% since February – yet despite this recent uplift in excise collections, there has been no uplift in US goods or services inflation. Fed chair Powell expects goods inflation to become increasingly evident in the June, July and August inflation data releases, and as such implied volatility will marked up for US CPI dates.

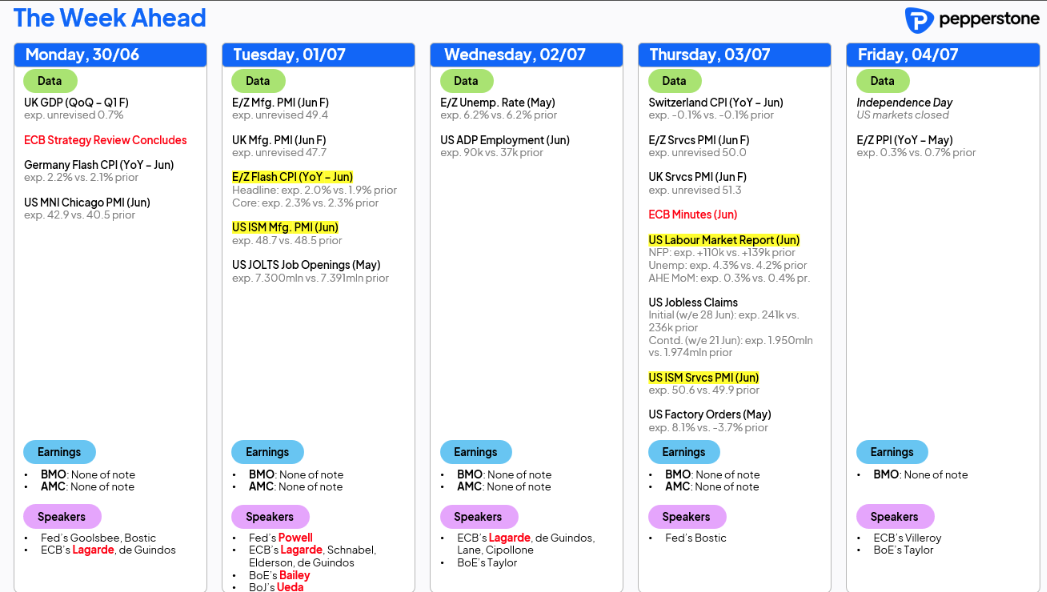

Event risk to navigate in the week ahead

This week’s US economic data releases come in on the heavy side, with ISM manufacturing & services, JOLTS job openings, weekly jobless claims and nonfarm payrolls (NFP) set to impact.

The NFP report is the marquee risk event with the market looking for payrolls to come in at 113k and the U/E rate to rise a tick to 4.3%. The risk to rates pricing and the USD seems asymmetric given the Fed’s reaction function is biased towards the timing of the next cut – subsequently, the USD is likely to have a more significant sell-off on a poor NFP / higher U/E print than a rally on a hotter payrolls outcome.

Equity rallying on reduced participation With just 15 days until the start of the US Q225 earnings season, resilient S&P500 earnings estimates add its own contribution to the recent equity appreciation, with analysts collectively revising up their 12-month forward EPS assumptions by +1.2% over the past 4 weeks.

The investor flows are skewed towards tech, consumer discretionary and Comms Services. With the S&P500 printing its fourth ATH of 2025, the concentrated leadership and reduced market breadth does feel a bit like Q425, where the S&P500 was driven higher by a handful of mega-cap momentum plays - fading the rally on breadth concerns alone was a poor trade into 2024, and like shorting risk on valuation concerns, it will likely be so again through this bull run.

Notably, Nvidia added $340b in market cap last week, with CEO Jensen Huang giving an update and outlook at its annual shareholder meeting that clearly hit a home run with investors – Nvidia is a business that the street is falling in love with once again, and while many still have the scares from January with DeepSeek releasing its R1 model, traders are running core longs in NVDA equity, but hedging against a tail risk buying puts, and diversifying into other areas of tech.

USD flows - Can we see an 8th consecutive close lower?

The USD finds few friends in this market with the DXY closing lower for 7 consecutive days – it will therefore not surprise that EURUSD has closed higher for 7 straight days, a run of form seen only 23 other times since 2000. The reaction function of the USD seems clear cut this week, with bad news on the US data front taking the USD lower on a broad basis, while better-than-expected data will likely see traders sell USD rallies.

A 'shadow' Fed chair is a USD negative

Trump’s threats of nominating a new Fed chair as early as October are a clear USD negative and will limit the USD upside stemming from better data or the potential passing of the OBBB act this week. Whether Trump does choose to put in a “shadow” Fed chair and risk undermining Jay Powell in his final months as Chair is unclear – perhaps if the Fed sufficiently guide to a cut in September in the July meeting Trump will TACO and hold off making the early nomination – or maybe the markets will force the call on him – of course, the chair is but one vote and the incoming Fed would still need to guide policy to the realities of the unfolding economics – but no foreign investor would want to hold a lumpy USD exposure if the Fed chair was truly seen as executing Trump’s obvious agenda and these institutions would become insensitive to USD hedging costs.

We also consider the other side of the USD equation and key data ex-US – EU CPI, China PMIs, and the ECB’s Sintra Forum offering keynote speeches from BoE Gov Bailey, BoJ Gov Ueda and ECB President Lagarde.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.