- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A Traders’ Playbook - A defining Week for Financial Markets

Contents:

- Trading the markets this week

- Marquee event risks and expectations

- The stock of the week – NVIDIA

- Central bank speeches to navigate

- Implied moves on the week in G10 FX and gold

- Interest rate pricing – market expectations

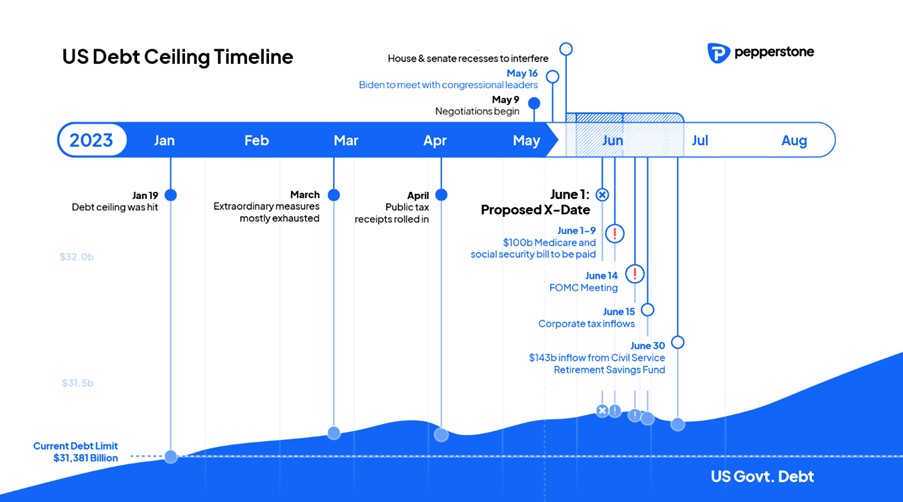

- A timetable for the US debt ceiling

After an eventful week for the NAS100, US500, JPN225, GER40 and the USD, traders should be open-minded for further twists in the market script this week.

At one stage last week better-than-feared US data and some modestly hawkish Fed chatter saw US interest rate futures price a 40% chance of a hike at the June FOMC meeting - the USD naturally benefited from this pricing. Yet after Jay Powell’s speech on Friday market pricing is firmly back to thinking the Fed will pause. I look at the data flow due in the week ahead and question how the outcome could affect market pricing for Fed action in June (and further rout the rates curve) and what that means for the USD, equities, and gold.

However, it still feels like the US debt ceiling, and the price action in US banks, are going to dominate the narrative.

In the art of brinkmanship, it feels that to get a deal we must see greater market volatility and so far, we’ve not really seen really any stress outside of US Treasury bills. That could change this week and while for much of last week the headlines were that a deal is within reach, the breakdown in talks from Republican negotiators on Friday has many thinking that we could be pushed right to the June deadline before we see an agreement – where in the spirit of political negotiations politicians simply have to take this to the wire to make it seem like they’ve truly fought for the best deal.

Volatility markets are calm as they come, but don’t be surprised if that changes this week.

Marquee event risks for the week ahead

US core PCE

(Friday 22:30 AEST) – The market expects core PCE at 4.6% YoY, with economists’ range of estimates set between 4.7% to 4.2%. A number below 4.4% could weigh on the USD, while above 4.7% and the USD should find buyers. Much obviously depends on the news flow at that time around the US debt ceiling.

FOMC May meeting minutes

(Thurs 04:00 AEST) – while the minutes are backwards-looking in nature it could give us some understanding as to the appetite within the Fed ranks to pause in the 14 June FOMC meeting.

S&P Global US manufacturing and services PMI

(Tues 23:45 AEST) – the market has moved on this data release before, and above consensus numbers could push the USD higher. With US growth data points under the spotlight, we look to see if manufacturing grows or contracts (month-on-month) and how it stacks up vs UK and EU PMIs – the consensus is for manufacturing to print 50 (from 50.2) and for services at 52.5 (53.6).

*Above 50 shows expansion vs the prior month, below 50 shows contraction.

UK CPI

(Wed 16:00 AEST) – the market expects headline inflation to fall rapidly to 8.2% (from 10.1%), while core inflation is expected to be steady at 6.2% (6.2%). The form guide suggests a modest risk of an above consensus outcome and could have meaning on the 22 June BoE meeting, where the market ascribes an 80% chance of a hike. GBPUSD support is seen at 1.2355 and a weak print could see this tested.

UK Global manufacturing and services PMI

(Tues 18:00 AEST) – the market sees the manufacturing index coming in at 48.0 and services at 55.5 (55.9). Unlikely this data series materially impacts interest rate expectations for the June BoE meeting - so in turn, I’m not expecting this to influence the GBP in any great capacity, but that depends on the outcome of course.

EU Global manufacturing and services PMI

(Tues 18:00 AEST) – the market sees a modest improvement in the pace of contraction in manufacturing, with the diffusion index eyed at 46.0 (45.8). Services PMI is eyed at 55.5 (56.2), which would be a healthy pace of growth. EURUSD is likely sold into rallies this week, although higher volatility driven by a worsening in the debt ceiling talks could see the USD offered.

RBNZ meeting

(Wed 12:00 AEST) – the market prices 33bp of hikes (a 32% chance of a 50bp hike), with 16/17 economists calling for a 25bp hike. With the economist community of the view we get a 25bp hike, there are risks of a quick drop in the NZD (given the small premium for a 50bp hike). We’ve seen traders covering NZD shorts into the meeting, with the NZD the best performer in G10 FX last week. Are we close to the end in the hiking cycle? The market prices a 25bp hike at this meeting and at least one more by October.

Tokyo CPI

(Fri 09:50 AEST) – the market sees headline inflation at 3.4% and core inflation at 3.9% (from 3.8%) – last week the JPY attracted good selling flow as the carry trade kicked in in earnest. Again, much depends on the feel towards the US debt ceiling as the JPY is probably the best trade to be long if we do see higher volatility as we roll towards 1 June.

Stock of the week:

NVIDIA

(report Thursday at 06:20 AEST) – it’s been an incredible hold throughout all of 2023 and a momentum juggernaut, driven largely by a constant wave of short-dated call (options) buyers. Into Q1 24 earnings, we find the stock +113% YTD with valuations at sky-high levels. Investors can buy NVDA for a hefty 68x earnings, well above the long-term average - the idea of buying growth at any price rings true here. Nvidia is the poster child of the AI revolution, with many now using the word “bubble” more liberally towards AI equities.

The implied move on the day of earnings is 3.3% and given the incredible run through 2023 this level of expected movement seems rather conservatively priced by options market makers. With the street expecting the company to report 91c of EPS, on $6.503b in sales, one questions if earnings and guidance truly matter - or do management just need to offer inspiration on the future of AI and Nvidia’s leadership in the AI/ML space to keep the bull run intact.

Central bank speakers in the week ahead:

For the full timetable of speakers see this tweet

Fed speakers – Bullard, Bostic, Barkin, Daly, Logan, Waller, Collins

ECB speakers – There are 19 speakers due this week I won’t list them all – see the tweet for the full timetable.

RBA speakers – David Jacobs (Head of Domestic markets) speaks (Wed 17:10 AEST)

BoE speakers – Haskel, Bailey

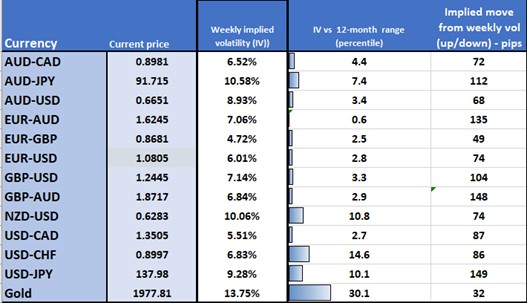

Implied moves in G10 FX and gold

The table shows the implied volatility in 1-week FX and gold options. We can use this to calculate the expected move on the week in the spot price. We can also see how this implied level of volatility sits within its 12-month range. It can be useful to help with position sizing and a heightened anticipation of the market environment in which we trade. Typically the higher the expected movement the wider the stop loss and the smaller the position size (and leverage rate) and vice versa.

Possible scenarios ahead of us:

1) We see a deal passed before early June that pushes out the debt limit into 2025.

If so:

a. A deal that is brokered this week to be voted in the House with the Senate forced back from recess.

b. Agreed shortly before early June and passed through Congress in a matter of days.

2) Congress fails to pass a deal by early June

If so:

a. A short-term extension to push negotiation into September or October

b. Prioritizing and halting/deferring payments with cash balances too low by 13 June

3) Politicians call Yellen’s bluff and roll the dice with no deal reached and the hope the US Treasury have the cash to muddle through to Mid-June and into July.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.