- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

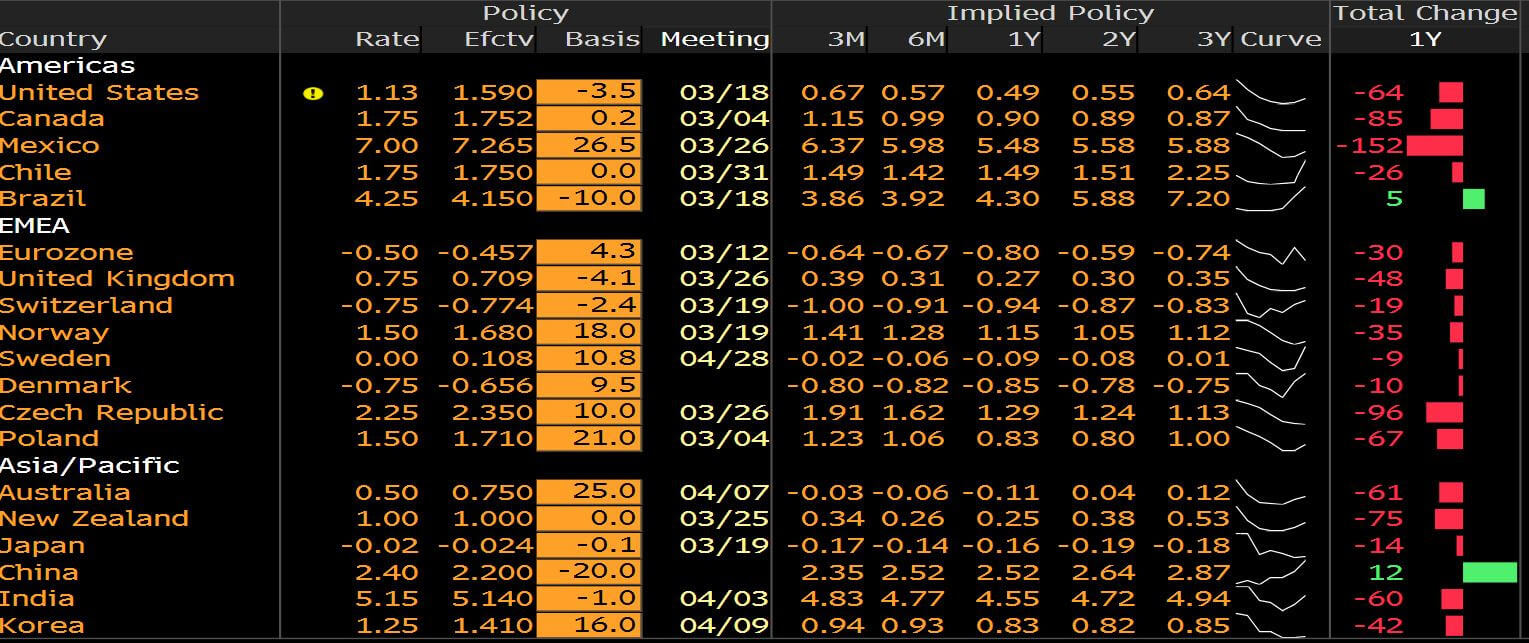

I will be writing a piece on the growing prospects for Aussie QE soon, but when we see swaps pricing negative rates in these here shores, we know things are extreme. We’ve seen the first emergency FOMC meeting since 2008, with the subsequent 50bp cut from the Fed, yet traders used the initial pop in the S&P 500 to raise cash and reduce equity exposure with the index closing -2.8%. Gold will find buyers when equities are falling and it’s this backdrop I want to explore.

Source: Bloomberg

We haven’t seen much concern in investment-grade credit markets just yet and that is an asset class gold traders should be watching. Debt matters when economics are deteriorating. Italy is also a growing concern given they are at the centre of the worry, therefore, we have an eye on Italy 10-year bonds (BTPs) spreads over German 10-year. That said, yield differentials have only widened modestly and not given FX traders any reason to sell EUR’s, which could be a trigger to buy gold in EUR terms. That is, if Italian bonds do sell offer more aggressively.

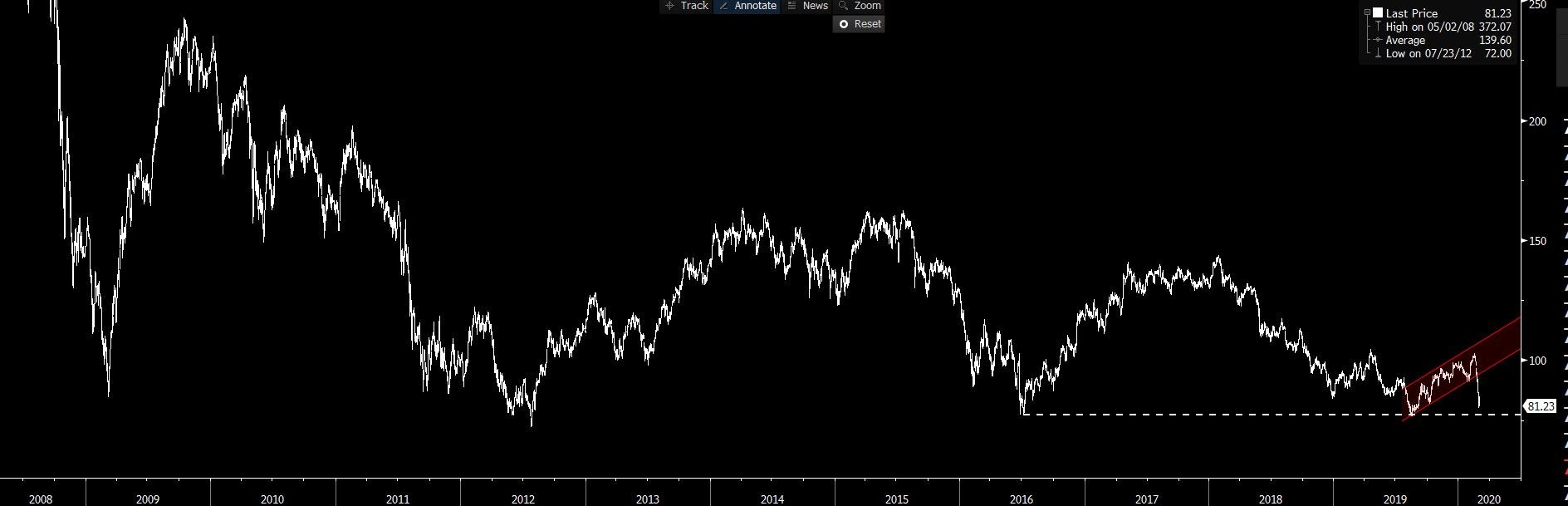

I have a focus on EU banks, which are coming into worrying levels and could weigh on the EUR more intently and could again be a reason to look favourably at gold.

EU STOXX banking index

I continue to like gold and feel we need to let the market compel and push the trade. This means a push through 1649 and even 1660/5, as this would tell me a lot about the bull’s dominance and the view that a body in motion stays in motion. I can see the options market is very upbeat about the prospect of golds upside, we just need to see this in the price action. Happy to turn more bearish on gold through 1548/5.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.