What is spread betting and how does it work?

Spread betting is a fast, flexible way to speculate on price movements without owning the underlying asset. Here we explain how spread betting works, along with its key features, risks and strategies.

Reviewed & edited by: Maria Stylianou | Senior Copywriter

What is spread betting?

Spread betting is a derivative, leveraged trading product that allows you to speculate on the price movements of different assets without having to own the underlying. Instead of buying a portion of the asset, you place a bet on whether its price will rise or fall. You can control your exposure by deciding how much to stake per point of price movement.

How does spread betting work?

Traditionally, someone who wants to gain exposure to an asset like Microsoft, for example, would buy Microsoft stock. They’d then hold it until its value increases, and then sell it to make a profit.

Spread betting offers an alternative to physically buying, holding and selling an asset. Instead, it gives you exposure to an asset’s price movements by placing a bet on whether its price will rise or fall. The further the price moves in your chosen direction, the more profit you make. However, the more the price moves against your chosen direction, the greater your loss.

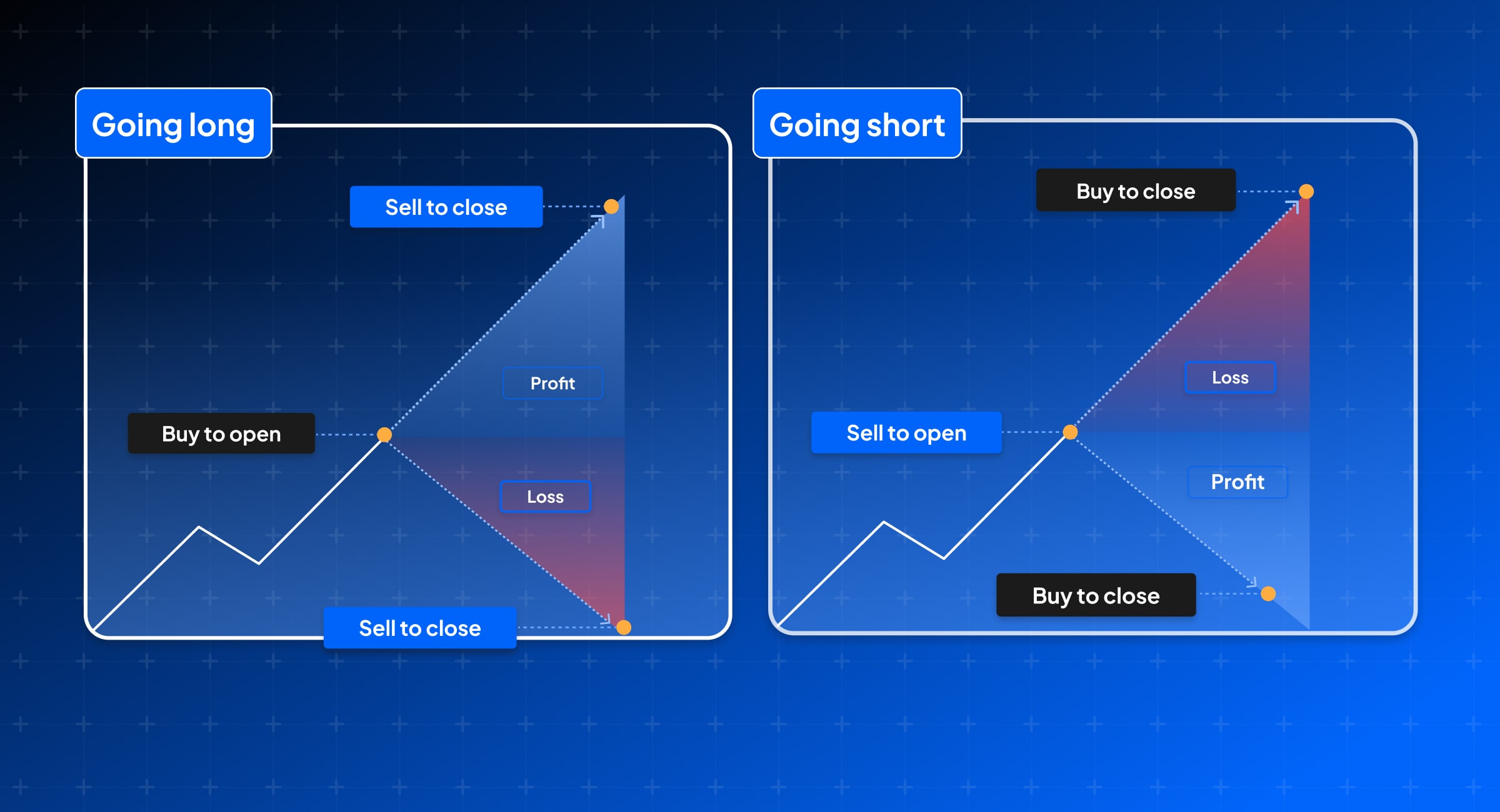

Going long in spread betting

If you think an asset’s value will rise, you can open a long (buy) position. If your prediction is correct and the market price moves up, you stand to make a profit. However, if the market goes in the opposite direction, you’ll incur a loss.

Going short in spread betting

Since spread betting doesn’t involve buying the underlying instrument, you can go short just as easily as long. This strategy enables you to capitalise when an asset’s price declines.

Suppose you have a bearish outlook on the price of gold. You can open a short position to ‘sell’ gold. If the market then declines in value, your bet will generate a profit. Conversely, if the price of gold rises, your position will incur a loss.

- Buy price (offer price): The price at which you can open a long (buy) position. It will always be slightly higher than the underlying market price.

- Sell price (bid price): The price at which you can open a short (sell) position. It will always be slightly lower than the underlying market price.

Interested to learn more about how to spread bet on gold? Then read out expert guide to find out more.

Understanding the bet size

In spread betting, your bet size or ‘stake’ signifies the amount of money you’ll gain or lose for each point of movement in the underlying asset’s price.

For example, if a UK share moved one penny in the underlying market, that's the equivalent of one point. Depending on the market you’re betting on, a point of movement could be a pound, a penny or one-hundredth of a penny – check the deal ticket of your chosen market to ensure you know what constitutes a point of movement.

Profits or losses are calculated by multiplying the stake by the number of points the price has moved.

For instance, if a trader bets £2 per point on the US500 and it rises by 100 points from 5,290 to 5,390, the profit will amount to £200 (£2 x 100 points). On the other hand, a 100-point decline would result in a £200 loss.

It’s important to note that profits or losses are calculated based on the entire position’s value, which means losses may exceed the initial amount required to open the trade. Therefore, it’s key to have a robust risk management strategy in place to manage potential losses.

How are spread bets priced?

Spread betting prices are based on the underlying price of the market, with a ‘spread’ wrapped around it by the provider.

What is a spread?

The spread is the difference between the buy price (also called the offer or ask price) and the sell price (also called the bid price) of a tradable instrument. This is essentially one of the ways a broker makes money.

It represents the cost of opening and maintaining a spread betting position, which is part of the overall trading expenses.

For example, the US500 market (based on the underlying S&P 500) might have a spread of 2 points. This implies that the buy price is set at 1 point above the current market price, while the sell price is 1 point below it. The market price will need to move through the spread in your chosen direction before you turn a profit.

How the spread is determined

The pricing of spread bets closely follows real-time market trends and is influenced by market conditions, liquidity, and volatility. For instance, if the market is highly liquid, the spread may be tighter due to easier buying and selling; whereas during times of low liquidity or heightened volatility, the spread may widen. This happens to account for the higher risk of price movement and the difficulty in executing trades at a consistent and requested price. Wider spreads often occur around major economic events, crises or market disruptions, where the uncertainty causes providers to seek to protect themselves from potential market shifts.

For a full view of the fees associated with spread betting, visit our costs and charges page.

Types of spread bets

Unlike traditional investments with fixed durations, spread bets can be closed at any time during trading hours. However, the expected duration of a bet depends on the type you choose.

Spread bets are typically divided into two categories, based on duration:

- Cash bets: They are short-term, and positions are settled at the current market price, usually within the same day. Profit or loss is determined by the difference between the asset’s entry and closing prices at the time you exit the position.

- Forward bets: They are long-term trades where you bet on the price movement of an asset to occur over a longer period (weeks or months). The price is agreed upon at the time of placing the bet, and the bet settles at a future pre-determined date.

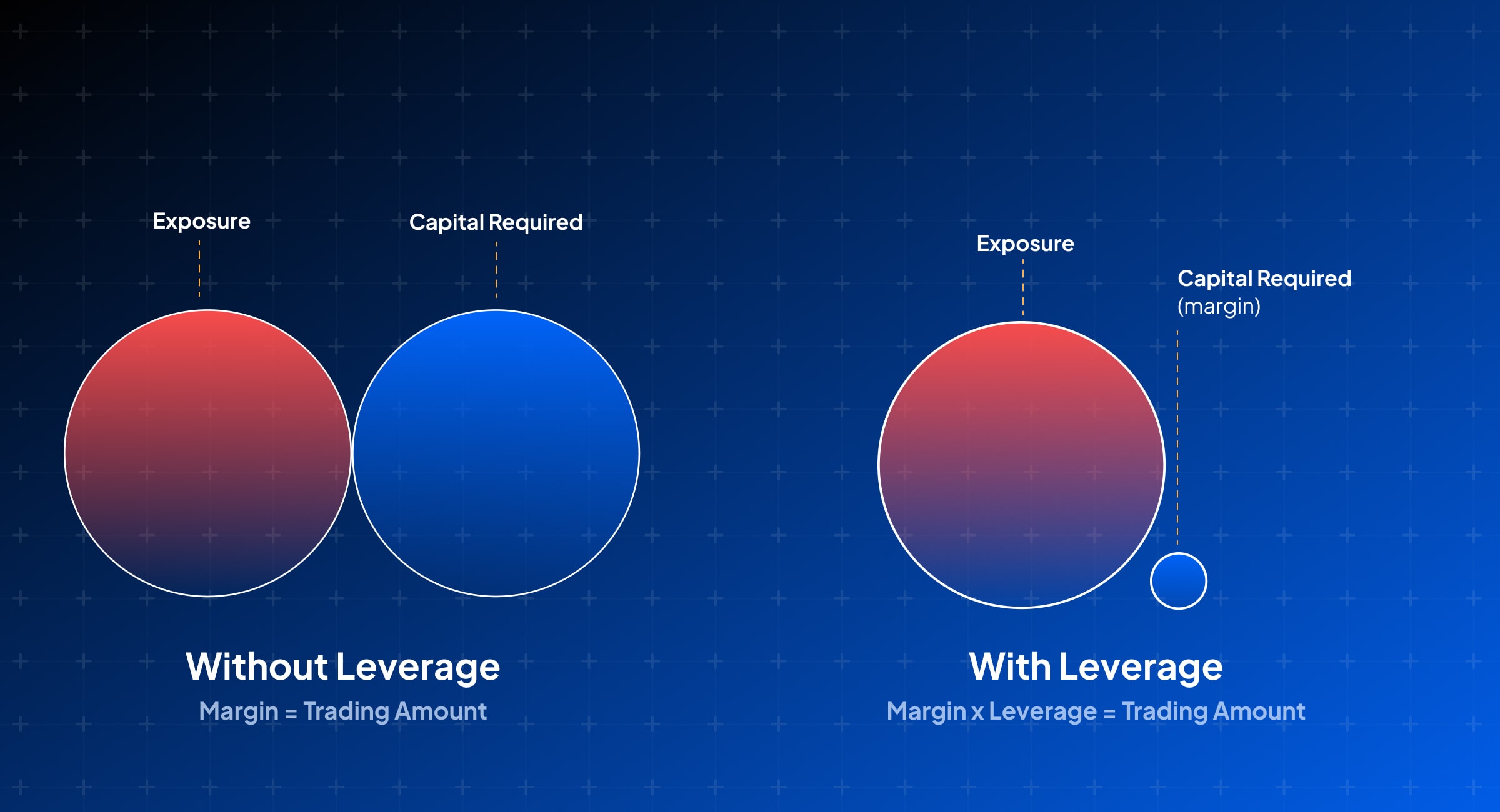

Leverage and margin in spread betting

Leverage

Spread betting is a leveraged product, meaning that you can access the market by putting down only a fraction of the total cost of your position. This means you can maximise your exposure while minimising the capital required upfront. Let’s dive deep into it with the following scenario:

If a trader wanted to invest in Facebook shares in the traditional way, they would need to pay the full share price upfront. However, with spread betting, they might only need to commit, say, 20% of the total value as a deposit. This is known as initial margin, and would result in a leverage ratio of 5:1.

It’s important to remember that the profit or loss is still based on the full value of the position. So while leverage magnifies potential profits, it equally amplifies potential losses.

Margin

Leveraged trading involves maintaining a certain amount of money in your account to keep positions open. This is known as margin, and the reason why leveraged trading is often called 'trading on margin'.

There are two key types of margin in spread betting:

- Deposit margin: This is the amount needed to open a position and is typically represented as a percentage of the total trade.

- Maintenance margin: This is the amount required in your account to help you withstand reasonable losses on your position. If losses accumulate beyond the initial deposit amount, additional funds may be required. Then a margin call is issued, prompting you to add funds to avoid position closure.

Example

Let’s say a trader wants to speculate £10 per point on the FTSE 100 at 7,500, leveraging at a ratio of 20:1. Their position size would be (£10 x 7500) £75,000, necessitating a margin of (5% of £75,000) £3,750. It's imperative to always maintain at least 5% of the total value of the position in their account to sustain the position.

Margin rates in spread betting vary across markets. For example, spread trading shares might entail a 5% margin, whereas forex trading might require 20% of the trade size. Check out our guide on how to spread bet on forex to learn more.

_on_a_blue_grid_background-min.jpg)

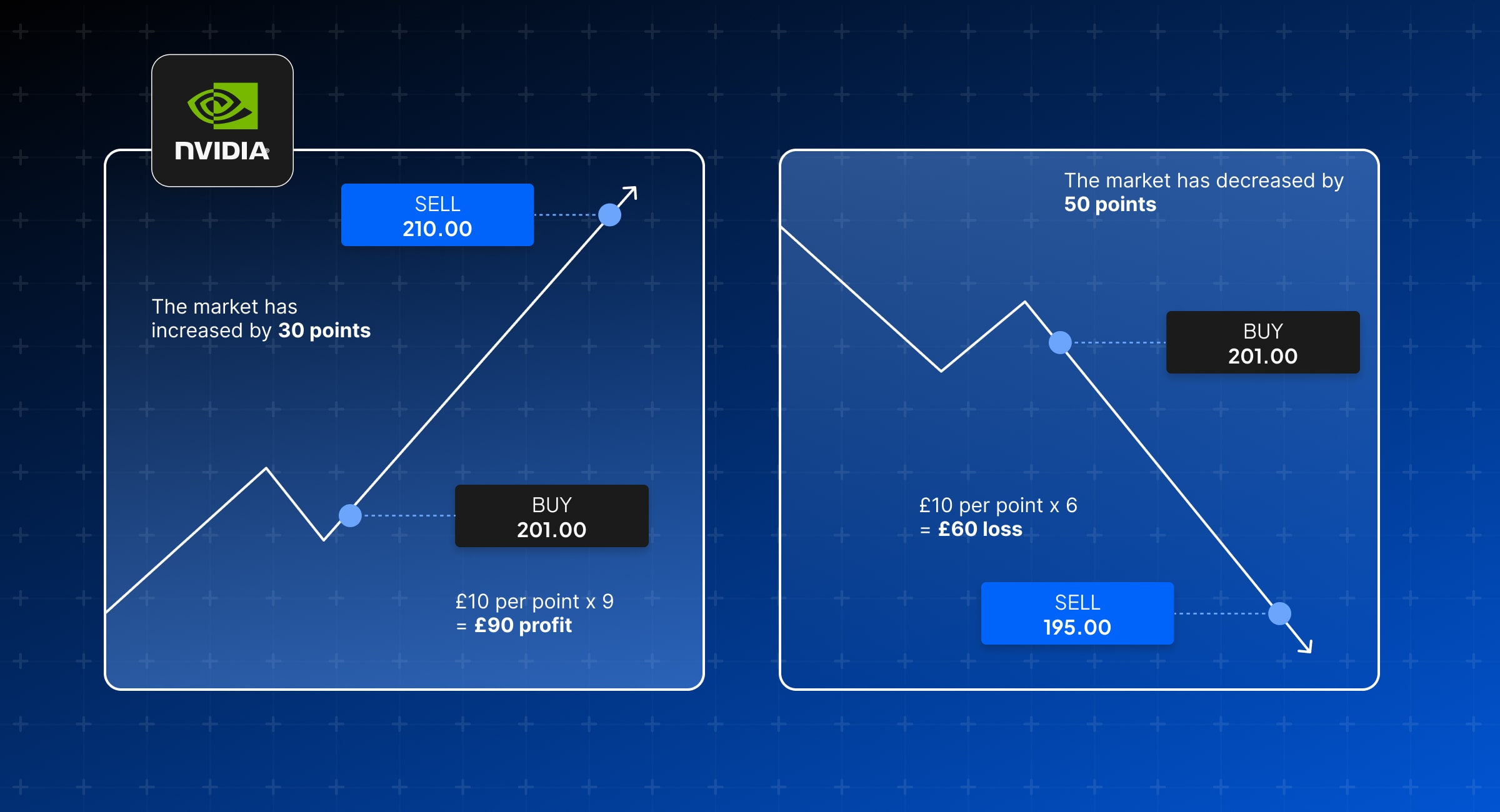

What is an example of a spread bet?

Let's delve into a scenario using the Nvidia stock. A trader anticipates an increase in Nvidia's stock value, due to an upcoming product launch. To capitalise on this, they decide to spread bet on Nvidia shares.

Currently, the bid-offer spread for Nvidia sits at 200.50 - 201.00.

The trader places a bet of £10 per point at the offer price of 201.00.

There are two potential outcomes:

Outcome 1 - Nvidia's stock price rises:

Suppose Nvidia's stock increases to 210.00 - 210.50, and you sell at the bid price of 210.00. This is a 9-point increase from your entry level. With each point being worth £10, you’d make a total profit of £90 (£10 x 9).

Outcome 2 - Nvidia's stock price declines:

If Nvidia's stock drops to 195.00 - 195.50, and you sell at the bid price of 195.00. This reflects a 6-point decrease from your entry, and you will suffer a loss. With each point valued at £10, your loss amounts to £60 (£10 x 6).

In spread betting, a trader's gains or losses hinge on the variance between the entry point and the closing price, multiplied by their stake.

Benefits of spread betting

- Pay no tax on your profits: As spread betting is classified as gambling in the UK for tax purposes, there is no capital gains tax (CGT) or stamp duty to pay. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

- Maximise your exposure with leverage: Get full exposure with just a small initial deposit, which can amplify your profits – but also your losses

- Seize short-term opportunities: As you’re not buying shares outright you can enter and exit thousands of markets quickly, often from a single platform.

- Hedge your risk: Placing a short spread bet on an asset's falling price could potentially offset losses in shares you already own.

- Go short or long: Since you can bet on both bear (falling) and bull (rising) markets, you can potentially profit from price movements in either direction, regardless of market trends.

- Access out-of-hours trading: Take advantage of global market movements and news events. For instance, with Pepperstone you can spread bet around the clock2 on many key US shares.

Risks of spread betting

- Leverage: Leverage can be a double-edged sword since it magnifies both profits and losses. Without a firm grasp of how it works, you could accidentally overexpose yourself and receive margin calls that demand more capital or result in liquidation of positions. Understanding the full value of the position you’re about to open is paramount to avoid unpleasant surprises.

- Variable costs: During market turbulence or major events, spread betting providers may need to widen their spreads, triggering stop-loss orders prematurely if they’re too close to the market price. Additionally, spread betting is not designed for long-term trading, so holding cash positions for extended periods can lead to overnight financing fees building up.

- Overtrading: Maintaining too many leveraged positions in spread betting can significantly magnify the risks. It’s vital to maintain discipline, stick to a clear strategy, avoid emotional decision making and set stop orders.

Managing risk in spread betting

While leveraged products inherently contain risks, you can manage them with the following tools:

- Stop-loss orders: These can automatically close out a trade once the market hits a predetermined price level. However, during periods of increased market volatility, there is a possibility that the trade may close at a less favourable price than anticipated. This is known as slippage.

- Alerts: Some providers, such as Pepperstone, enable you to set alerts to receive notification if a market reaches your specified level. This gives you the freedom to decide how to act in the moment.

- Negative balance protection: FCA protections mean your account balance can never go below zero.

- Education: Trading is a journey, and everybody can keep developing their skills. Pepperstone offers education for all levels of traders, including webinars, market analysis and our range of trading guides.

Spread betting platforms

At Pepperstone, you can spread bet on a range of markets through several innovative trading platforms with lightning-fast execution speed.

- Webtrader: Our native platform delivers secure and streamlined trading with razor-sharp spreads, industry-leading liquidity, efficient execution and of course our award-winning client support. Trade seamlessly between desktop and our intuitive mobile app.

- TradingView: You can link your Pepperstone trading account directly to TradingView. The platform offers powerful charting tools, real-time market data and access to the largest social trading network in the world.

- MetaTrader 4: The most popular platform among traders worldwide provides access to live quotes, real-time charts, extensive news updates, and detailed analytics. MetaTrader 4 also offers a variety of order management tools, technical indicators, and expert advisors, making it ideal for both beginners and experienced traders.

- MetaTrader 5: The advanced version of MetaTrader 4, delivering exceptional performance and precision. It provides quicker processing times, supports position hedging, and offers a range of advanced pending order functions. It also comes equipped with various tools and indicators to enhance your spread betting strategies.

- cTrader: cTrader features a user-friendly interface that includes customisable presets and detachable charts for a personalized experience. It also supports advanced order execution capabilities, and, for those looking to automate their spread betting strategies, custom coding using the C# programming language.

How to get started with spread betting

- Open a spread betting account

Pepperstone offers all the tools you need to start spread betting effectively, including a demo account to help you practice risk free. Opening a live account can take a matter of minutes: after providing the necessary details and completing the verification process, you can fund your account and start trading straight away. - Choose your market

Pepperstone gives you access to a broad range of spread betting instruments, including FX, indices, equities, commodities, and more, plus research tools and analytical updates to help you identify opportunities. - Open the deal ticket

With spread betting, you can speculate on price movements by choosing either a ‘buy’ or ‘sell’ position on an underlying market. You can choose your order type and bet size and set key parameters such as stop-losses and take-profits. When you’re ready, you can open your trade. - Monitor your spread bets

Track all of your open positions in real time using our top-tier trading platforms. You have the flexibility to close your trades whenever you like.

Interested in spread betting with Pepperstone? Open an account with us today.

Spread betting FAQs

How do I make a profit by spread betting?

Spread betting involves speculating on market movements, with gains or losses depending on the accuracy of those predictions. As a leveraged product, losses can exceed the initial deposit, highlighting the importance of sensible risk management and trading only with disposable funds.

Although it is possible to achieve your spread betting goals, it requires dedication, education, and disciplined risk management to maintain profitability, while understanding that losses are also possible.

What can I spread bet on?

Pepperstone provides spread betting on 1,200+ instruments, catering to a diverse range of trading preferences and strategies.

- Stocks: Bet on major global stocks such as Apple, Microsoft and Nvidia, with many key US shares available around the clock.

- Indices: We offer spread betting on major indices such as the US500 (S&P 500), UK100 (FTSE 100) and US Tech 100 (NASDAQ)

- Forex: Deal on major pairings like EUR/USD or GBP/JPY, along with a range of minor and exotic pairs.

- Commodities: Precious metals like gold and silver, energies like oil and natural gas, and agricultural products like wheat and coffee.

Is spread betting tax free in the UK?

Yes. In the UK, spread betting is tax-free from both stamp duty and capital gains tax (CGT). Typically, traders face levies on profits made from buying and selling shares, but these taxes do not apply to spread betting. It's important to note, however, that tax regulations are dynamic and subject to change. For more information on the latest changes to Capital Gains Tax and how spread betting may benefit UK traders facing a capital gains tax (CGT) increase, refer to Pepperstone's latest guide.

How can I hedge with spread betting?

The process of hedging with spread betting entails opening a spread bet that yields profits if an existing open position (or portfolio) incurs losses.

When employing hedging strategies through spread betting, a trader will initiate a position that counteracts potential adverse price movements in an existing position. This could involve trading the same asset in the opposite direction or opting for an asset with a divergent trajectory compared to their current trade.

For instance, let's say a trader holds shares in Tesla within their investment portfolio. If they anticipate a temporary downturn, the trader might contemplate selling their shares, risking the loss of their position in the company.

Alternatively, rather than divesting their shares, the trader could initiate a short spread bet on Tesla. Consequently, should Tesla’s stock price decline, the loss in the trader's portfolio could be offset by the gains from their spread bet. This approach allows a trader to hedge against potential losses while maintaining their position in the company.

What is a spread bet example?

Imagine that ABC stock is currently priced at £201.50. A spread-betting firm offers a fixed spread and quotes the bid/ask prices at £200/£203 for traders interested in trading.

A trader, anticipating that the stock's price will drop below £200, decides to sell at the bid price of £200. They wager £20 for every point the stock declines below their selling price of £200.

Should ABC's price drop to a bid/ask of £185/£188, the trader can exit the trade with a profit calculated as (£200 - £188) x £20 = £240. Conversely, if the stock price rises to £212/£215 and the trader opts to close the trade, they would incur a loss of (£200 - £215) x £20 = -£300.

Further, if the spread betting provider requires a 20% margin, the trader will need to deposit 20% of the initial position's value. The position's value is determined by multiplying the stake per point by the stock's bid price: (£20 * £200 = £4,000). Therefore, the trader needs to deposit 20% of this value, which amounts to £4,000 x 20% = £800, into their account to cover the bet.

Which is better, CFD trading or spread betting?

The answer to this question depends on your strategy and priorities. Contracts for difference (CFDs) and spread bets are both financial instruments used for speculating on the price movements of various assets without owning the underlying, but they contain some subtle differences.

Spread betting involves wagering on the anticipated movement of a market's value, whereas a CFD is a contract that entails exchanging the variation in an asset's price between the opening and closing times of the contract.

Both spread betting and CFDs are derivative financial instruments that utilise leverage.

1In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change

2For exact timings, please refer to the instrument specification within the trading terminal. 24-hour trading 5 days of the week on select US stocks only.

*In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.