- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Metatrader, one of the most popular platforms, is currently unavailable on the App Store

How Metaquotes delivered one of the top trading platforms

History

Metaquotes, a Company based in Cyprus, are the founders of the Metatrader 4 (MT4) and Metatrader 5 (MT5) electronic trading platforms. Metaquotes launched their first platform in 2002 but the popularity of the product really took off in 2005 with the launch of the enhanced MT4 platform.

Metatrader 4 and its rise in popularity

The MT4 platform grew in popularity due to its charting package, array of indicators, and the number of Expert Advisor (EA’s) that were on offer. This demand resulted in a large number of brokers adopting the platform from 2007 onwards.

The Metatrader 4 programming language is known as MQL4. It is used to develop scripts, bespoke technical indicators, and Expert Advisors.

These tools are extremely popular with technical traders who utilise them to enhance their trading experience and capabilities.

Metatrader trade 5 and the future

MT5 was launched in 2009. Although it has grown in popularity, it still lags behind MT4 for the number of global users.

MT5 runs on a faster 64-bit multi-thread platform compared to the 32-bit mono-thread MT4. This allows for quicker backtesting for EA’s.* The new programming language is known as MQL5.

While the MT4 platform is predominantly focused on the foreign exchange market, MT5 is regarded as a multi asset trading platform allowing trading on FX, stocks, indices, cryptocurrencies, futures, and the metal market. It also allows for direct trading from 11 global exchanges around the world such as the London Stock Exchange and the US NASDAQ. This is made possible by the Metaquotes Gateway API.

Other enhancements are twenty-one timeframes compared to MT4s nine, thirty-eight built-in indicators compared to MT4s thirty, and more drawing tools and objects. There is also the DOM functionality (Depth of Market) allowing traders to see where bids (buy) and offers (sell) are placed in the market.

*Backtesting being the capability of testing the profitability of a trading system using past data

Figure 1 Metaquotes

What is the difference between an Indicator, an Expert Advisor, and a Trading Bot (Robot)

Although they are all written in either MQL4 or MQL5 languages, there are some fundamental differences between the three.

An indicator is intended as a graphical display to help a trader define certain aspects of a product. This is using past data and mathematical calculations. For example, it could provide an ‘indication’ that the product is overbought or oversold.

Aside from samples, there are no built-in Expert Advisors available on Metaquotes platforms. EAs are built by coders and programmers using the MQL4 or MQL5 language. An EA is built using a combination of indicators and algorithms with Yes and No scenarios. These can be extremely complex scripts. The end function is to ‘advise’ a trader to a selling or buying opportunity.

Although EA’s and trading bots are often regarded as the same product, an EA advises the trader what to do whereas the trading bot executes the trade automatically. The trading bot will run the account, opening trades and setting stopand take profit orders, regardless of the results. The real beauty of a trading bot is the ability to execute trades, 24 hours a day, during market hours.

MQL Community

The MQL5 community offers traders the ability to chat and ask questions via the 1000’s of thread topics. This could be a basic subject like how to withdraw funds from your platform to more complex matters regarding writing scripts for an Expert Advisor.

We have already discussed the fact that it can take years to gain the knowledge to become a proficient coder. In the MQL community you can review and purchase products from the Marketplace.

If you are looking for something a little more bespoke, you can hire a freelancer who will develop and implement your trading strategy for a price.

In the Signals area you can automatically copy a provider’s trades for a monthly set fee. Filter by their portability, reliability, followers and if they are algo based. You can also review the trading history and statistics.

Apple pulling the plug on Metatrader 4 and 5

It all sounds so good. So, why did Apple take the product off the App Store on Friday the 23rd of September?

While there has been much speculation as to why Apple removed the popular trading apps from its store, there has been no official statement from either Metaquotes or Apple. Traders are hopeful that they will see the apps again soon.

How does this ban affect traders

With Metaquotes platforms reported to dominate over 50% or the retail market share, this is clearly not good news. Although traders who have already downloaded the app will still be able to execute trades as before, they will not receive updates, an issue that could affect future functionality.

Web based and Google play still available

Metatrader 4 and Metatrader 5 apps are still available to download to android phones from Google Play. Most traders use the web-based platforms for free from their dedicated broker. There have been no reported issues, to date, and this option is still readily available.

However, with traders eager to keep an open eye on the market while on the move, will there be an exodus to other trading platforms?

Before talking about alternatives, it’s worth mentioning that we have created an FAQ section located here that addresses the different questions that traders have on the subject. For those looking for quicker access, you can start using the MetaTrader 5 Webtrader (optimized for mobile) by clicking on the following link. We also created a tutorial video to help you with all aspects of the Webtrader.

Alternative platforms at Pepperstone – cTrader and Trading View

Pepperstone offers two alternatives.

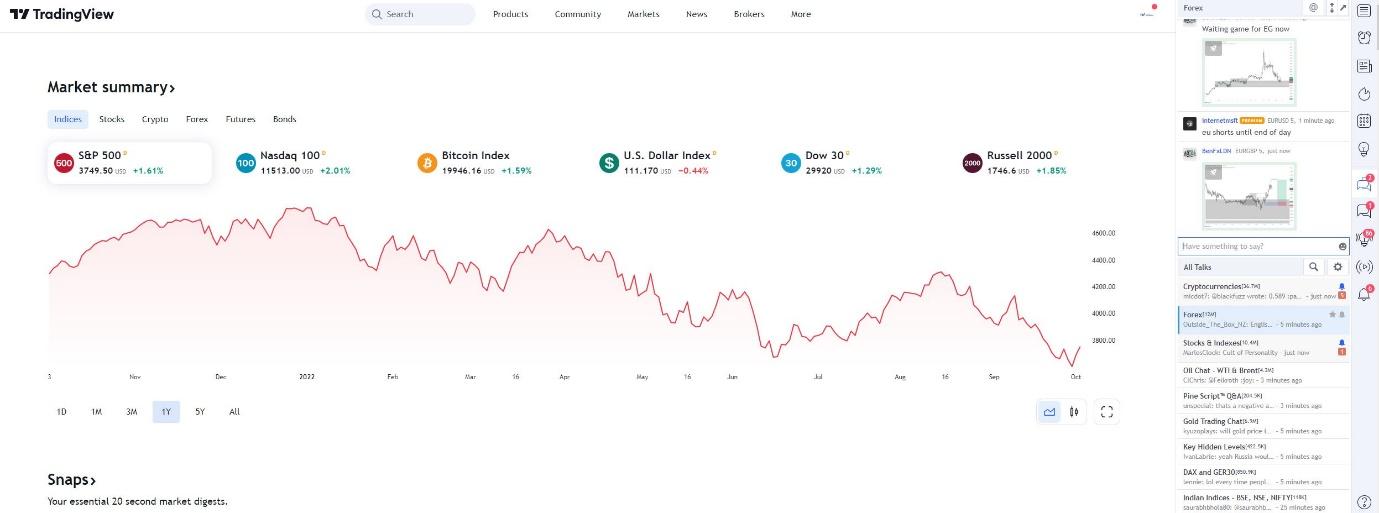

With TradingView offering an impressive charting platform and a growing social trading network, you may decide that connecting through your Pepperstone Razor account is the move for you.

Perhaps you like the Metaquotes capability to use EA’s and custom indicators. TradingView Pine Script is a great alternative with 100’s of free and customisable indicators.

Beyond advanced charting and a capable platform, TradingView is available as a standalone app on mobile devices.

To find out more information about connecting to TradingView, click here.

Figure 2 TradingView

cTrader is an intuitive and easy-to-use platform with advanced trading capabilities such as fast entry and execution and coding customisation, as well as plenty of education and analysis to help you make better trading decisions.

cTrader uses the popular C# code for programming. There is also the capability to use cBots for fully automated trading robots.

cTrader also makes it easy for traders on the go to trade the markets by offering its own app for mobile devices.

To find out more information about trading through cTrader, click here.

Figure 3 Pepperstone cTrader

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.