- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

What will take gold back to the $2000 mark and even the historical high?

As a result, we’ve seen funds flow into gold, with the price surging to $1,920. The questions traders ask are: will the price continue to tally to $2,000 and even reach the historical high of $2,070? What would be the catalyst to take it to the all-time high?

There are three main factors that all traders should factor in:

1.Positioning - scope for funds to increase gold positionings

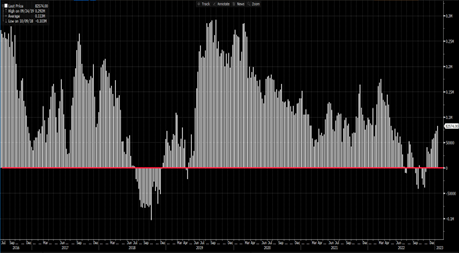

As a rough guide on sentiment, gold futures positions held by hedge funds have increasing since November 2022. As of January 10th, 2023, the net long positions have been increased to 82,574.00 contracts, from 4,000.00 contracts in November, according to the CoT report of managed money.

For the yellow metal to continue to rally to $2,000 and onto $2,070, we will need to see traders build positioning in the market. For context, when the gold price was at the $2,000 high in April 2022, or at its all-time high of $2,070, we saw a net position of 150,000.00 to 175,000.00 long contracts respectively held by leveraged funds.

Despite a solid rally from $1,620, positioning is still light, and this suggests that there is the potential for more long positions to be added to the futures market while the market has paired back bearish bets. But it is by no means overlooked- usually the sign for contrarian positions.

2. The weakening USD

The gold price is influenced by several factors, but one of the most important divers is the value of the USD which has an inverse relationship with gold. Recently, the market has shifted towards a strong bias to sell USDs, and we’ve seen a strong trend lower since late September. The question is whether the USD drawdown has further to go, which in theory should support further gold appreciation.

Another important consideration is real US interest rates-these are US treasuries adjusted for inflation expectations and represent the real cost of capital. As real yields rise, it reduces the relative attractiveness to hold gold, as gold doesn’t generate any yield. Based on this logic, the current trend of decreasing real rates (as shown below) has resulted in the gold price becoming relatively more attractive, which has contributed to gold appreciation.

Orange -XAUUSD (Inverted)

Blue – 5-year US real rates

As we see, gold has recently diverged from US real rates and trade at a premium to what could be considered fair value. In theory, the upside in gold could be limited, given its premium to real rates. To sustain its upward trend, real rates would need to decrease further to take the yellow metal to the next high.

3. China’s strong demand

China's increasing demand for gold is providing support for the price of the precious metal. According to CEIC data, China's gold reserves have been steadily increasing, reaching $117.235 billion in December 2022 from $111.650 bn in November 2022. This strong demand is driven by China's recovering economy and is expected to continue to grow. With the gold price currently near the $2000 mark, there is potential for further price appreciation.

Risk management

On the technical front, XAUUSD needs to close above the $1920 mark to confirm a continuation of the bullish trend – the price is holding above the 5-day EMA, for now, which has contained the rally since late December. A break of $1,920 would naturally increase the prospect of reaching $2,000. Conversely, support could be seen at $1851 (the 38.2% fib of the 23 Nov to 16 Jan move) Fundamentally, traders should pay close attention to moves in the USD, equity, and US real rates – as well as positioning they hold the key to a near-term test of $2,000

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.