- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The Daily Fix: An ugly night, but it could have been far worse

But there's been movement and the commodity space has it in spades. The reflation trade has been called into question and tech has been the defensive play. JPY buyers have also been out of force and again re-enforces my view that the JPY remains one of the most attractive currencies around.

Without pressing too deeply into US politics, the passing of RDG has increased the perception that we won’t see fiscal stimulus this side of November – not a great vision for the future if we do end up getting a split Congress in November. EU banks were taken down in a big way, with the EU Stoxx banking sector losing 6.3% and where the daily chart suggests risks of a move into the floor seen between March and May. News that several banks were allegedly involved in illicit transfers for some two decades are at the heart of that move, while a 5bp decline in EU 5y inflation swaps will never help bank equity either.

Renewed focus on lockdown restrictions both in the UK, which have been deemed to be at a ‘critical’ point and around Europe haven’t helped either. The FTSE and EU equity markets have been sold aggressively, with the DAX (-4.4%) having a 3.8 z-score move – that said, our calls for the open (if it were to happen now) are looking somewhat constructive and this obviously reflects the late-session rally in US stocks. My play on the GER40 is to wait for a move through 12,576 and I’ll be holding for 12,200 and the 200-day MA.

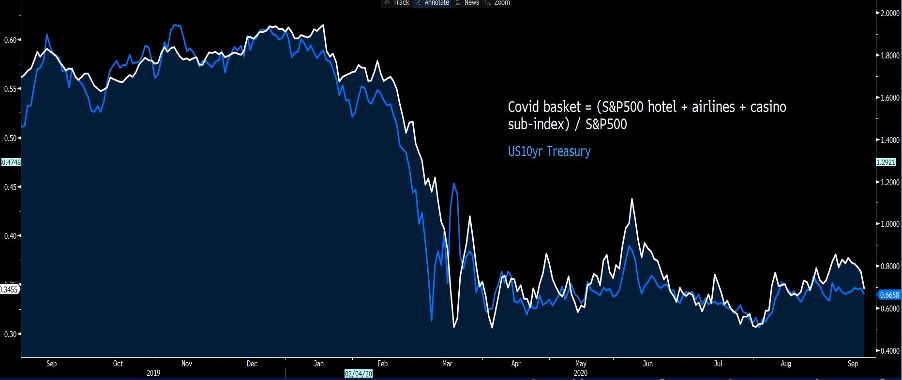

Comments from the former Food and Drug Administration Commissioner, Scott Gottlieb, that he expects the US to see out “at least one more cycle” won’t have helped sentiment either. If I look at a simple Covid-19 thematic basket (S&P 500 hotels, airlines and casino’s) and look at this relative to the broader S&P 500, there has been a sharp underperformance, which seems to have become a solid guide for where 10-year US Treasuries are headed. COVID concerns have impacted the reflation trade, then it’s not hard to see why there's been good buying in the long-end of the Treasury curve.

(Source: Bloomberg)

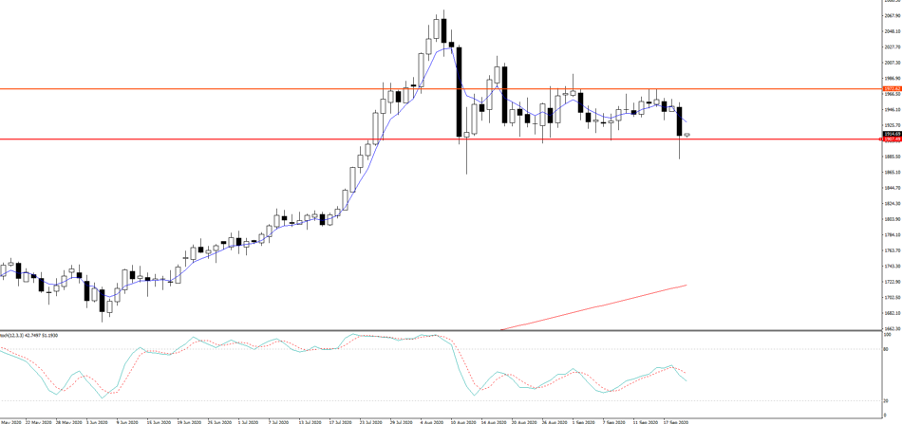

We’ve also inflation expectations falling quite sharply and therefore yields have moved 4bp higher in 5yr real Treasuries. There's little doubt this has promoted short covering in the USD, where relative real rates matter for exchange rates. So the combination of a stronger USD and higher real yields has hit gold 2%. That said, gold has bounced off the session low of 1882 and held 1900 and the August range low with some determination. For gold bears, a close through 1900 seems important, after the break of the 50-day MA. I still want to see a break of 1973 to turn more bullish on the metal.

Silver has again fared worse, falling 7.6%, while crude has lost 3.6% as global economics are called into question. Copper and iron ore futures falling on a similar theme.

On the docket today and by way of event risk, the only consideration from a data perspective is RBA’s Guy Debelle speech at 10:30 AEST. This could lay out framework for any policy initiatives the RBA could utilise if needed going forward. I don’t expect it to be a vol event, but it’s always prudent to watch AUD exposures around this point.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.