CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Trader’s Week Ahead: Markets React to US-China Progress & CPI Data

This same constructive outlook is also true of Bitcoin, where we see the price taken to $105k on Sunday before increased supply kicked in - a further squeeze higher in the S&P500 or NAS100 futures through Asia, could see price push towards the ATHs of $109k soon enough.

Despite the fundamentals hardly screaming out for long positions, Brent crude rallied 4% last week, and I take the view that a daily close above $65.22 could see a further push into $68 and the top of the recent range.

Read S&P500 outlook: Bulls in control as the 200-day moving average in sight

The USD index (DXY) closed a touch above the neckline of the inverse head and shoulders pattern on Thursday and Friday, but needs to kick to confirm the reversal set-up, which could target the 103 level. Early signs from interbank FX trade favour USD longs, certainly vs CHF, JPY and EUR, and we head into US core CPI and retail sales with the wind at the back of the USD.

Gold may face some downside pressure early through Asia, with eyes on Friday’s low of $3274.

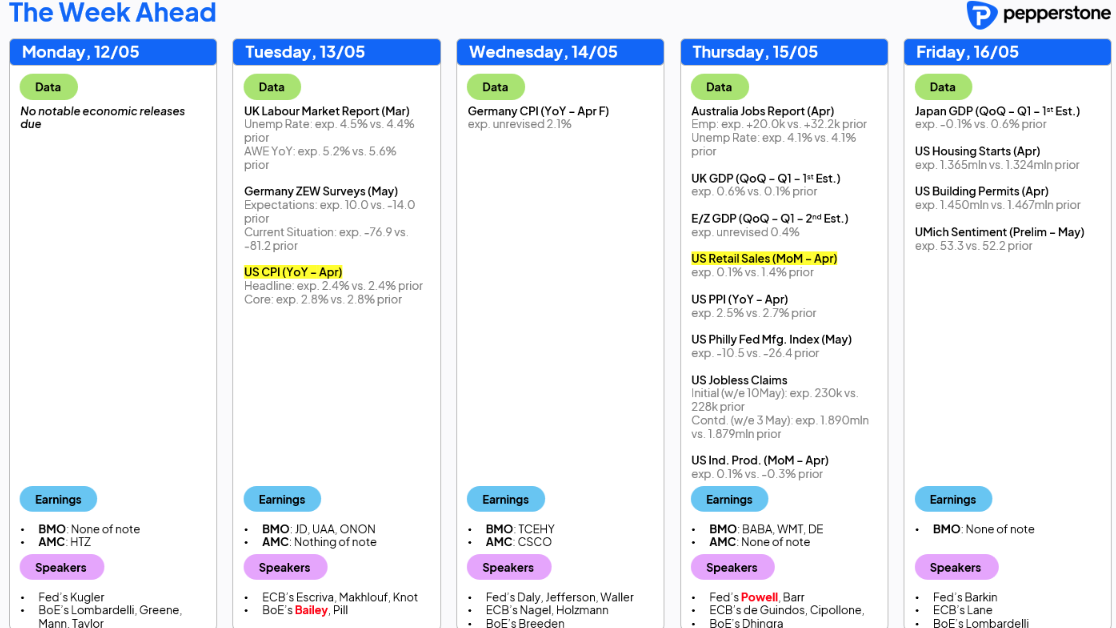

Assessing The Key Event Risks for the Week Ahead

Headlines on tariffs will remain a constant input that drives market sentiment, with the initial reaction to the weekend US-China talks predictably encouraging, with both the China and US camps remarking that substantial progress was made, achieving a consensus and establishing a consultation mechanism for trade and economic issues. While this was always the likely outcome, it does represent an important step forward in the dialogue process and is obviously constructive, and we now look for the necessary substance and whether the two countries will take the tangible step towards the speculated US import tariff rates of 60% (from 145%).

We can be assured of further dialogue between the two camps, and headline risk/noise, but markets will have a low tolerance for inaction – market players want the tariff rates taken down to 60% swiftly and in one action (over a staggered approach). Let’s see, because the lower Bessent goes on China tariffs, the lower the scope for removing income taxes on a broad array of US taxpayers.

On the equity side, US earnings will dissipate in frequency, although Walmart’s Q126 Earnings (released premarket on Thursday) will be well-watched, and have the potential to move the dial.

With macro markets now comfortable with the idea that we’re all watching the incoming US hard economic data, and that data will take time to crack – if at all – however, if we’re going to listen to any of the US corporates on the tariff impact, it’s the US retailers. Walmart is a bellwether in this regard, although, as we heard on its investor day (on 9 April), around two-thirds of its products are assembled and produced in the US, which cushions the effects of tariffs. The market will still be sensitive to Walmart's outlook and guidance and how it's managing tariffs, and as such, we see the implied move (from options pricing) for the day of earnings set at -/+5.3% - a premium to the 4.8% average move recorded in the past 8 quarterly earnings reports.

Can Nvidia Run Hot(er) Despite the AI Diffusion Ruling?

We also hear the conclusion to the AI Diffusion ruling (due on Thursday). The recent speculation is that Trump will scrap Biden’s chip export rules and look to replace them with a new ruling on chip controls. Investors expect the new controls to be simplified, and no more onerous than the Biden-era controls. Whether the Diffusion Day findings impacts Nvidia, and the US AI plays is a factor to watch, but the real test for the AI-giant falls on its Q126 earnings report on 28 May - where for the first time in recent memory there is real debate if they’ll miss the consensus expectations on revenue for $43.22b – a 9.9% increase from Q425.

Nvidia has rallied a lazy 34% from the April lows, but the real kicker awaits on the 28 April – if they can beat and raise, we could feasibly be looking at this former market darling showing full leadership once again. Many in the investment world have this name on their buy list, but are holding off until they clear the earnings hurdle, subsequently reacting with increased conviction should this major overhang be removed. If Nvidia can kick this week into and above $125, then NAS100 futures should break above the 200- and 100-day MA and the 26 March swing high of 20,045.

Trading the HK50 - Eyes on Tencent and Alibaba

Another focus this week is on the HK50 index, which has fully closed the gap seen on 7 April and the 61.8 fibo of the 23% drawdown seen from March to April. I am skewed for further upside, where a closing break above 23k would increase my bullish conviction, while conversely looking to reassess and potentially reverse that view on a move below 22,589. With both Tencent and Alibaba reporting earnings through the week, when two of the three biggest index weights report earnings, the HK50 has the potential to see increased volatility at an index level.

Traders Set to Navigate US CPI and Retail Sales

On the US economic data risk, US CPI, PPI and retail sales could move markets and pose risk to positioning. US core CPI is seen as the marquee event risk, although it feels too early to expect the anticipated tariff price lift to play into this CPI release, with the US forward inflation swaps market pricing the price lift from July and building towards 3.60% by November. That said, with markets concerned about a future stagflation state, there could still be a high sensitivity to inflation and retail sales data.

Simplistically, a US core CPI print that shows progress in April, with the year-on-year clip coming in below 2.7% should reinvigorate the prospect for a cut at the July FOMC meeting, an outcome implied at 68%. Should the US core CPI come in above 3% y/y, and the USD should find solid buyers, with equity unlikely to take to that kindly. Again, the US retail sales print could also impact – those positioned long of US equity would want to see both a weaker CPI print and a hotter retail sales release. USD longs would be looking for hotter numbers in both data points, albeit not so hot on the inflation outcome that it promotes a sharp pick up in volatility, which could see the USD rollover vs the CHF and JPY. There is also a strong line-up of Fed speakers, but I’d say it’s still too early for them to offer anything new that we haven’t recently heard.

Key Event Risk Outside of the US

The UK data flow will get a strong focus from GBP traders, with the wages/employment report and Q1 GDP due through the week, although the numbers would need to be sufficiently weak to bring a June cut (from the MPC) onto the table.

In Australia, we get consumer and business confidence, Q1 wages and the April employment report. A 25bp cut in the May RBA meeting is seen as a done deal, but the data could see rates/swaps trader’s massage expectations for policy action in the July RBA meeting, where there is a 56% implied chance of a 25bp cut here. Further out and after the May cut, traders see 3 more 25bp cuts by December.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.