- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Supreme Court Tariff Ruling Could Trigger Market Volatility as Traders Brace for IEEPA Decision

Here’s what traders need to know.

A High-Stakes Legal Battle Over Tariff Authority

One of the key market focus points right now revolves around the U.S. Supreme Court’s review of the Trump administration’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs under claims of national emergency.

These tariffs — implemented under “reciprocal” and “fentanyl-related” measures — have generated around $90 billion in revenue for the U.S. Treasury since their introduction, representing over half of all tariffs collected since April. By year-end, that figure is expected to climb toward $140 billion.

At the heart of the case lies a simple but critical legal question: Did President Trump have the legal authority to impose these tariffs under claims of national emergency and without Congressional approval?

What the Betting Markets Are Pricing as the High Probability Outcome

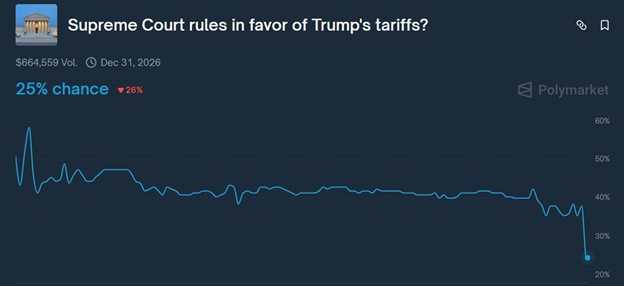

After hearing oral arguments from Trump’s legal team and those against the use of IEEPA tariff and the questions posed by the justices within the court, traders now see an increased probability that the Supreme Court will rule against Trump’s use of IEEPA tariffs—either striking them down entirely or in part. Prediction platform Polymarket currently assigns a 75% probability to a partial or full reversal.

The timing of the decision remains a major uncertainty. Most analysts expect a ruling between mid-December and late January, though an earlier or later outcome remains possible. For traders, this makes it exceptionally difficult to price risk for a specific date, amplifying the potential for volatility.

The Range of Possible Outcomes

There are several plausible rulings the Court could deliver:

- Full approval of Trump’s IEEPA tariffs:

This would maintain the status quo and cement executive authority to use IEEPA for trade policy. Markets would likely interpret this as continuity and stability. - Partial or full invalidation (most likely scenario):

The Court could strike down all or part of the tariffs, which would have both short-term and potentially far-reaching legal, economic, and market consequences. - Remand to the International Court of Trade:

The justices could send the case back with guidance for reinterpretation, effectively delaying a final decision. - Jurisdictional dismissal:

The Court could rule that it should never have taken the case, though this outcome is considered low probability.

Refunds, Deficits, and Policy Reactions

If the Supreme Court invalidates the IEEPA tariffs, U.S. businesses that paid those levies will file claims for refunds to the government seeking partial or full refunds. The claims process is expected to be slow, complex, and businesses will need to follow a protocol which is obviously still not known to quantify those claims.

Companies with heavy import exposure would stand to benefit the most, potentially realizing a one-time earnings boost.

There could be an impact on US deficit projections due to the lost revenue from the strike of IEEPA. While inflation expectations could also fall, which would offset the potential sell-off seen in US Treasuries from the higher projected deficits

That said, the Trump administration is almost certainly set to could pursue alternative legal routes on trade tariffs should the IEEPA ruling go against him. These channels require Congressional approval but could be pushed through quickly if the administration is ready to roll these out quickly.

These alternatives include:

- Section 122, which allows for tariffs of up to 15% for 150 days on certain imports.

- Section 338, which permits tariffs of up to 50% on nations discriminating against U.S. exports.

Market Implications and Volatility Risk

The potential removal of IEEPA tariffs would temporarily strip the Trump administration of a key negotiating tool used to pressure major trading partners such as China and Canada. Markets may respond with sharp moves across currencies, equities, and commodities, as investors reassess the balance of trade risks.

That said, the threat of substituting the now-reductant IEEPA tariffs with Section 122 or 338 tariffs would likely see other countries refrain from altering their import rates on the US.

If the US is not prepared and in a dynamic position to roll out tariffs under Section 122 or 338 that could be a different proposition that would run a higher risk of a trade escalation.

While refund-eligible companies could experience a near-term outperformance in the equity, the prospect that the process could be glacial and convoluted may limit the impact.

Traders may view the temporary reduction in the U.S. effective tariff rate as disinflationary, lowering inflation expectations. However, this could be offset by higher fiscal deficit projections and a modest positive uplift to expected growth.

An increased dispersion of market views as the impact of the decision on economics and markets could result in reduced liquidity, further amplifying price swings and volatility, across global risk assets.

The Bottom Line

The Supreme Court’s IEEPA tariff ruling could represent a short-term blow to Trump’s economic plans – but while it could be seen as one of more consequential policy events into 2026, there are offsets that suggest the fallout could be well contained. We just don’t know, and the uncertainty and lack of visibility to price risk around an outcome could result in higher volatility.

With no clear date for a decision and multiple potential outcomes, pricing risk remains a challenge. For traders, staying nimble, data-driven, and volatility-aware will be essential as this legal and market saga unfolds.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.