- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

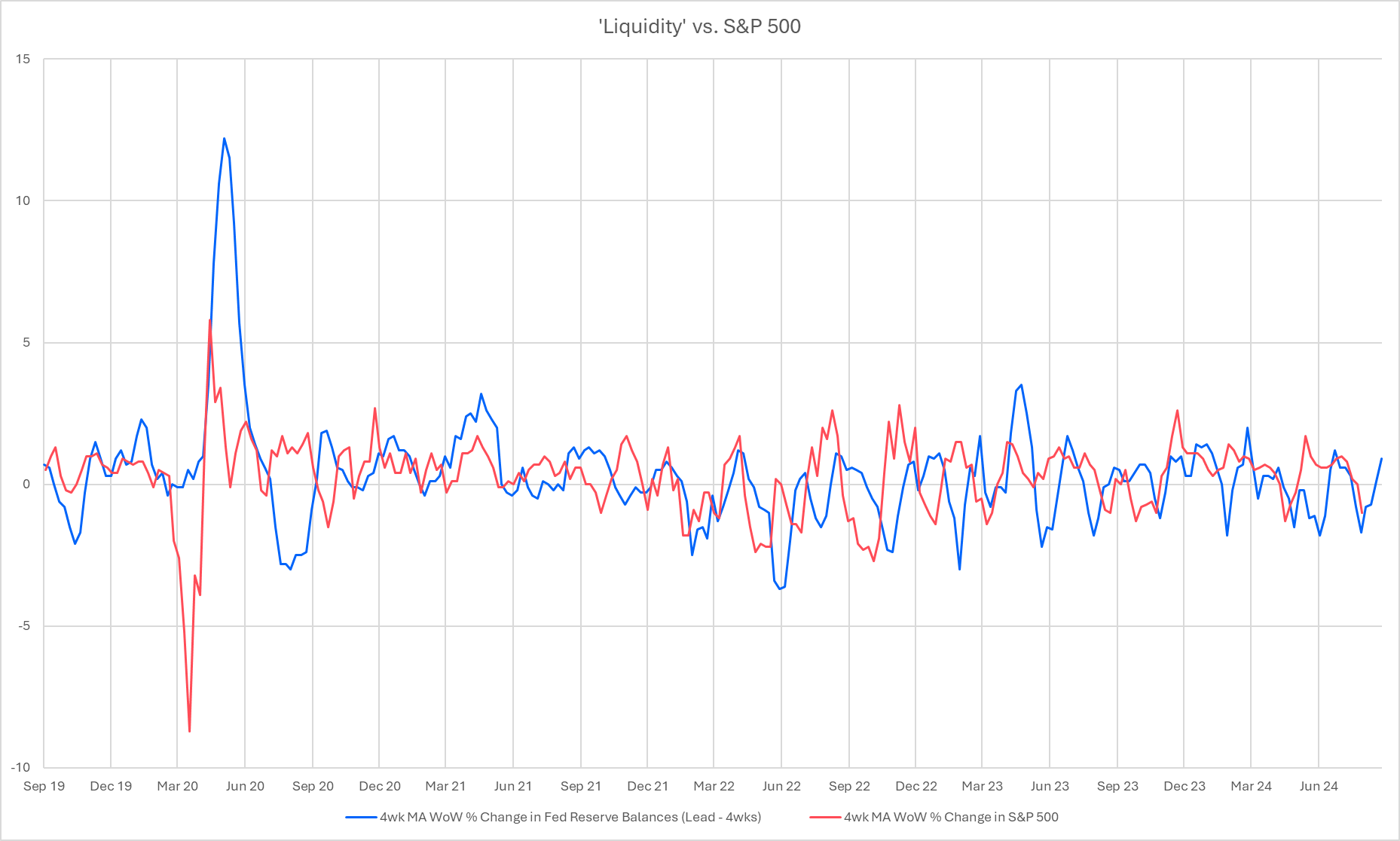

Since the GFC, and even more so since the pandemic, changes in central bank liquidity have shown a strong tendency to drive price changes in global equities, as the below chart shows.

The logic here is relatively straightforward – central banks injecting liquidity, either by lower overnight interest rates, or by virtue of stimulative balance sheet policies, ‘creates’ money within the financial system, which must then find its way of being put to use. More often than not, that use case is found in the stock market.

Here, there may well be some good news for equity bulls, after the sell-off that has marred the early days of August.

Not only was that sell-off unfounded from a fundamental perspective – see my note yesterday, with both earnings and economic growth both remaining solid – it was also likely exacerbated by thinner than usual trading volumes, given the time of year.

In any case, Fed reserve balances – a proxy for liquidity – have begun to rise once more over the last couple of weeks, potentially posing a tailwind to equities, when the current bout of turbulence dies down. In this respect, the upcoming July retail sales print, on 15th Aug, may well be the most important data to watch, given the ‘growth scare’ narrative that appears to be gaining traction in some quarters. Despite, that is, Q2 GDP growth of 2.8% annl. QoQ, and the Atlanta Fed’s GDPNow metric forecasting 2.5% growth in the three months to September.

Taking a further step back, and looking ahead to the remainder of the year, the liquidity backdrop is likely to become increasingly supportive, on a global level. A 25bp Fed cut in September is a near-certainty, with more aggressive 50bp moves likely off the table for now, though further reductions will follow as Powell & Co. normalise policy through the remainder of this year, and next. A similar, likely gradual, pace of cuts will also be followed by other G10 central banks – excluding the BoJ – as policymakers obtain greater confidence that inflation is sustainably returning towards the 2% target.

There is also the issue of central bank balance sheets. As rates continue to decline, it becomes increasingly likely that balance sheet run-off, or quantitative tightening programmes, will come to an end. It would be rather odd to ease policy with rates, while simultaneously tightening policy via the balance sheet.

The BoE are likely the first to adjust plans here, probably bringing active gilt sales to an end at the September MPC meeting, amid increasing signs of tighter financing conditions for UK banks, and as usage of the BoE’s S/T repo facility hits fresh records on a weekly basis. Other G10 central banks are also likely to closely examine balance sheet plans as rates continue to normalise.

Lastly, there is the central bank ‘put’ to be considered. As has been discussed at some length, were economic conditions to warrant it, with the battle against inflation now – effectively – won, policymakers have both the ability, and the will, to deliver sizeable support if needed. Say, in the event of unexpected labour market weakness, or an exogeneous growth shock. This, if it were to occur, would provide a further liquidity injection.

In short, while central banks would be wise to stand firm amid the current market sell-off, which by most reasonable metrics is overdone, not only does the fundamental equity bull case remain intact, but liquidity could provide a further fillip to any would-be dip buyers.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.