CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

I have been bullish equities the entire year. I remain a bull. At the same time, I’ve long said that that bullish stance does not mean that a pullback, or even a correction, can’t happen. It seems that is now what market participants find themselves in the midst of.

Something of a perfect storm appeared on the horizon last week, with first a more hawkish than expected BoJ, then a softer than expected US labour market report, barrelling into financial markets. Carry trades have unwound, bond bulls been emboldened, and risk assets slumped severely. The reaction has been rapid, violent, and extreme - to which, I say, fade the extremes.

These extremes are, perhaps, best epitomised by how the market’s view of the Fed policy outlook has violently gyrated over the last couple of sessions. As Chair Powell spoke on Wednesday, the OIS curve discounted around 75bp of easing by the end of the year, a pace which already looked rather punchy. Now, that same curve prices five cuts, or 125bp of easing, as a coin-flip. Market participants have had no luck accurately pricing the Fed policy path all year, and that luck is unlikely to have suddenly changed.

Of course, Friday’s jobs report was the main trigger for the aggressive dovish repricing. Yes, the report was soft, with just 114k jobs having been added in July, and unemployment rising to 4.3%. To this, I’d say participants should be more like policymakers – be data dependent, not data-point dependent. It is trends in data that matter, not one release on its own.

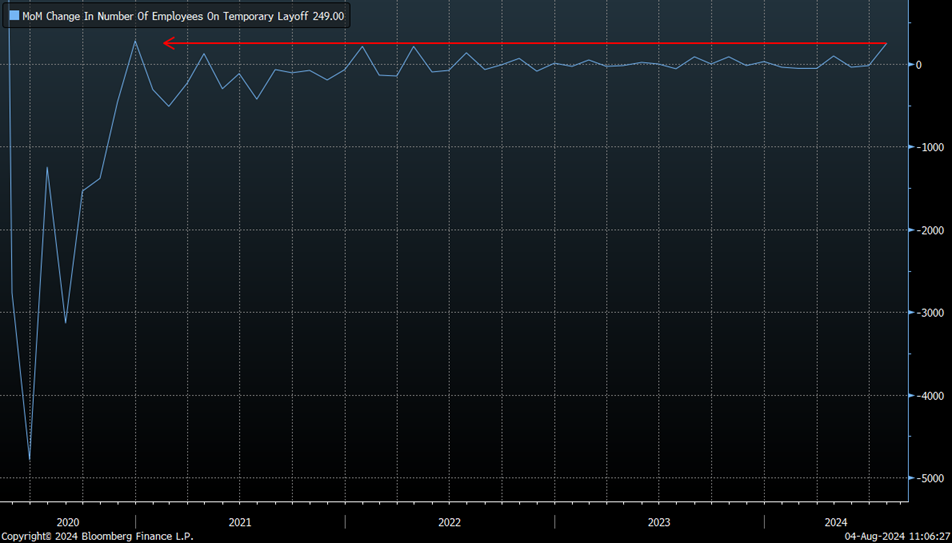

While job growth is clearly slowing, that is to be expected, and is in fact a characteristic of the ‘soft landing’ that many had called for, and that I continue to expect. Unemployment, meanwhile, rose almost entirely due to temporary layoffs surging due to the arrival of Hurricane Beryl, a surge that should be almost entirely reversed in the August report.

Let’s say, though, for a moment, that the jobs report is some ‘harbinger of doom’, and not just a bump in the road for the US economy. Handily, the FOMC have said for some time that any ‘unexpected’ labour market weakness would elicit a policy response. Even more handily, with the fed funds rate at 5.25% - 5.50%, and quantitative tightening still ongoing, there’s plenty in the Fed’s toolbox if such a policy response were to be required. While an aggressive easing, of the ilk markets currently price, seems unlikely at present, policymakers have the optionality to deliver it if they see fit, not wishing to fall over themselves on the last stretch of the victory lap, having already slain the inflationary beast earlier in the year.

This optionality, the so-called ‘Fed put’, has been one of the three key factors underpinning my equity bull case this year. I’ve said at length how the ‘put’ is both more flexible, and more forceful, than it has been before. That remains the case, and should, in the medium-term, once more provide participants with ample confidence to remain further out the risk curve.

The second part of my bull case has been solid earnings growth. As Q2 reporting season wraps up, with three quarters of the S&P 500 having reported, annual earnings growth is running at around 11.5%, its fastest clip since the last quarter of 2021. At the same time revenues have grown 5.3% on an annual basis, marking the 15th straight quarter of growth. From an earnings perspective, there is little to worry about.

_spx_v_2024-08-05_06-57-02.jpg)

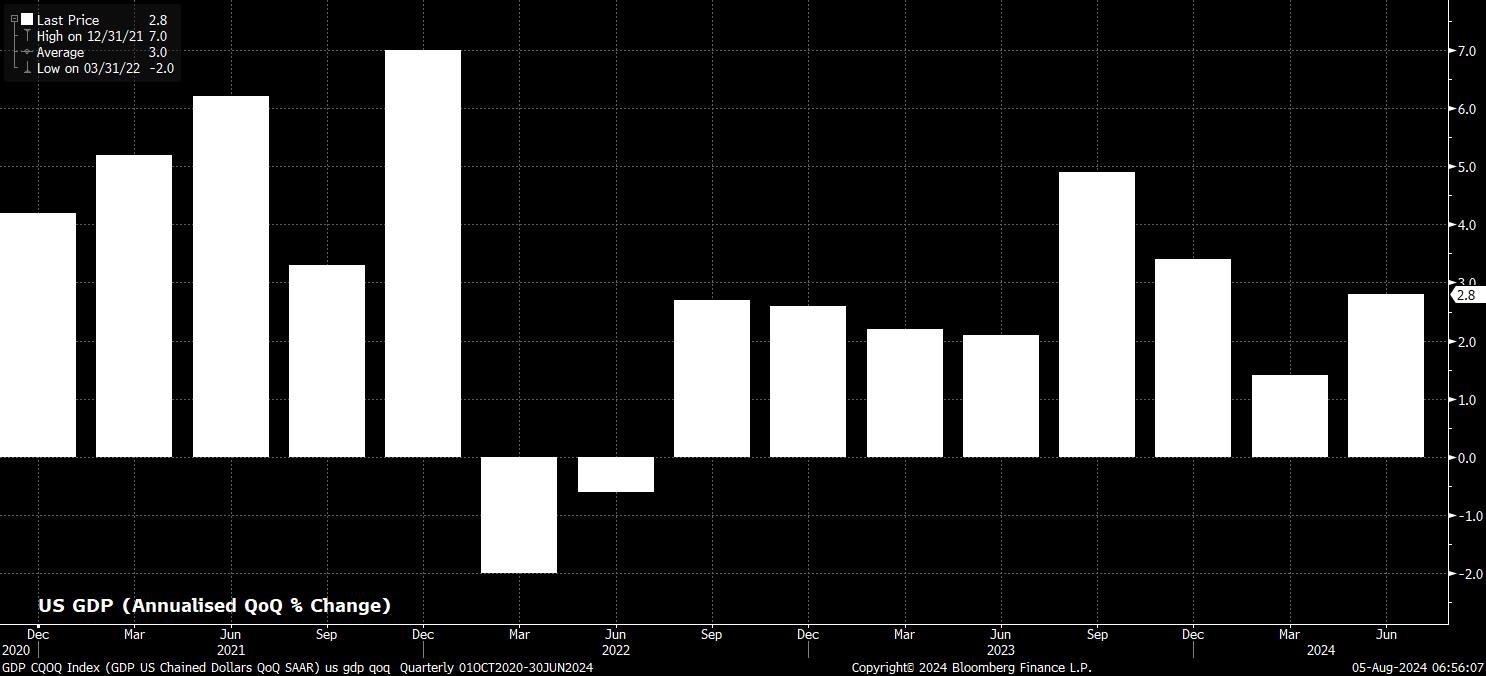

The third, and final, factor, underpinning equity sentiment, has been strong economic growth. Here, there also appears relatively little to worry about, with US GDP having grown by 2.8% on an annualised QoQ basis in the three months to June, marking the seventh quarter in the last eight where the economy has notched real GDP growth in excess of 2%.

Of course, last week’s soft ISM manufacturing PMI figure, at 46.8, has raised some concern over whether this pace of growth can be maintained. In the same way that one swallow doesn’t make a summer, and one soft jobs report doesn’t spell a labour market crunch, a single poor PMI print – with the survey being rather unreliable in any case – doesn’t spell ‘doom’ for the economy at large. Particularly, in an election year, with both sides of the political aisle committed to further fiscal loosening.

With the fundamental bull case seemingly intact, one must ask if there are more technical factors at play.

Here, it appears, that the answer is ‘yes’.

One of the biggest ‘trades du jour’ of 2024 has been the carry trade; an FX strategy whereby participants borrow in a low-yielding currency, to buy a higher-yielding one, pocketing the interest rate differential, or ‘carry’, as profit. By its very nature, a carry trade is fundamentally short volatility, as higher vol increases the potential that an adverse spot market move will wipe out any carry earned, and potentially more.

The JPY was, unsurprisingly, one of the most favoured funding currencies for these strategies. Over the last couple of weeks, not only has MoF intervention finally done the trick in stamping out the speculation that Kanda & Co. have been so perturbed by, but a more hawkish than expected July BoJ decision has seen vol ratchet higher, while also eroding a little more of the carry that could be earned in such positions.

The subsequent carry unwind has been violent, with USDJPY as much as 20 (yes, twenty) big figures off the highs seen last month; it’s ironic how the MoF don’t mind speculation when it moves the market in their favour. Such a move, however, has seen short JPY positioning lighten up significantly, likely limiting the scope for the carry unwind to progress further.

_2024-08-05_06-55-51.jpg)

In many ways, the carry trade had also morphed into a momentum trade, a strategy that had also proved profitable this year in the equity space, and in commodities such as gold which enjoyed a relentless run higher. Its subsequent unwind, then, could perhaps have been expected to cause cross-asset ructions, and a surge in cross-asset volatility.

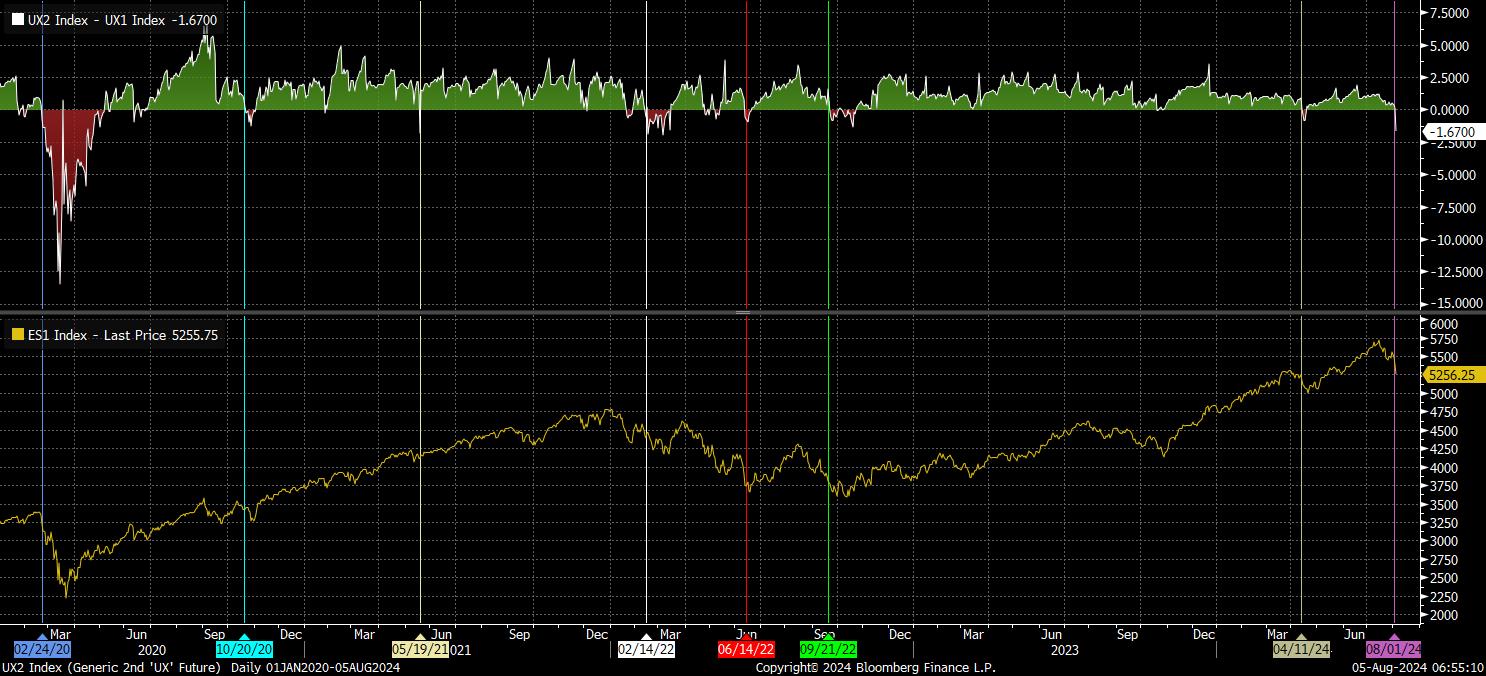

Sticking with volatility, though, an interesting phenomenon has occurred – the VIX curve has inverted, with the front VIX contract now trading higher than the second month. The rise in near-term vol is to be expected, given the typical inverse correlation with the underling equity index, though prior front-second inversions have coincided with the low being printed in said index.

In short, markets have endured some extreme moves of late, moves which have likely been exacerbated by the typically thinner-than-usual liquidity seen at this time of the year. These moves, however, appear overdone, and out-of-line with underlying macroeconomic fundamentals, and the monetary policy backdrop.

The path of least resistance, over the medium-term, continues to lead higher for equities, though may prove a more turbulent one than seen year-to-date. In FX, the USD should rebound as Fed pricing pares back from its current extreme levels, towards a considerably more realistic path. Treasuries will likely also retrace recent gains as a result, though the bias here remains towards a steeper curve, with the move to a more flexible interpretation of the 2% inflation target having not been abandoned.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.