- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The Week That Was – Themes

The moment that participants had spent most of the year waiting for finally occurred on Wednesday, with the FOMC delivering the first rate cut of the cycle, in aggressive fashion, reducing the target range for the fed funds rate to 4.75% - 5.00%.

This 50bp cut was contrary to my own forecast, and to consensus expectations, though was broadly in line with market pricing, with the OIS curve having discounted around a 60% chance of such a move, having undergone a significant dovish drift during the FOMC’s pre-meeting ‘blackout’ period.

Interestingly, the decision to plump for such an aggressive move was not a unanimous decision among voting members on the FOMC. Governor Bowman dissented in favour of a more modest 25bp move, the first dissent by a Governor in almost 2 decades. A 25bp move, in my mind, would’ve been the more appropriate one, considering that inflation remains above target, unemployment is not elevated to a worrying degree, and the economy has grown at a rate north of 2% in seven of the last eight quarters. Still, what I – or any other participant – thinks the Fed should do is immaterial, we must analyse and react only to what they will do.

The main driver not only of the 50bp cut, but also a relatively dovish dot plot, signalling a further 50bp of easing this year, followed by another 100bp next year, was seemingly the FOMC’s latest round of economic forecasts. The Committee’s median expectation is now for the unemployment rate to end the year at 4.4%, 0.4pp higher than foreseen in June, while headline inflation is seen 0.3pp lower at 2.3%, per the PCE gauge. Only time will tell whether placing such a huge amount of faith in forecasts which are notoriously inaccurate will prove wise, or folly.

In any case, the September ‘dot plot’ did provide a very useful gauge of how elevated monetary policy uncertainty remains, as we move into the most delicate point of the cycle – removing restriction. While the 2024 median dot points to a further 50bp of cuts this year, 9 of the 19 member FOMC placed their individual estimate above this median. Furthermore, while the most hawkish two on the Committee see just one more 25bp cut before 2024 is out, their most dovish colleague seeks a whopping 100bp further easing in the same period. It would seem that policymakers have as little idea as the rest of us as to a defined course of the speed at which rates will be cut, even if the direction of travel is now clearer than ever.

Thankfully, last week’s other G10 central bank decisions were substantially more straightforward.

On Threadneedle Street, the Bank of England’s Monetary Policy Committee voted 8-1 in favour of holding Bank Rate steady at 5.00%, taking a pause for breath having delivered this cycle’s first 25bp cut back in August. Only external MPC member Dhingra favoured a second straight rate reduction, though such a dissent is in line with her well-known uber-dovish stance. The MPC’s guidance was largely a ‘carbon copy’ of that issued previously, noting a need for policy to remain restrictive for ‘sufficiently long’ in order to stamp out persistent underlying price pressures within the UK economy, while also reiterating that policymakers shall follow a ‘meeting-by-meeting’ approach to future policy decisions.

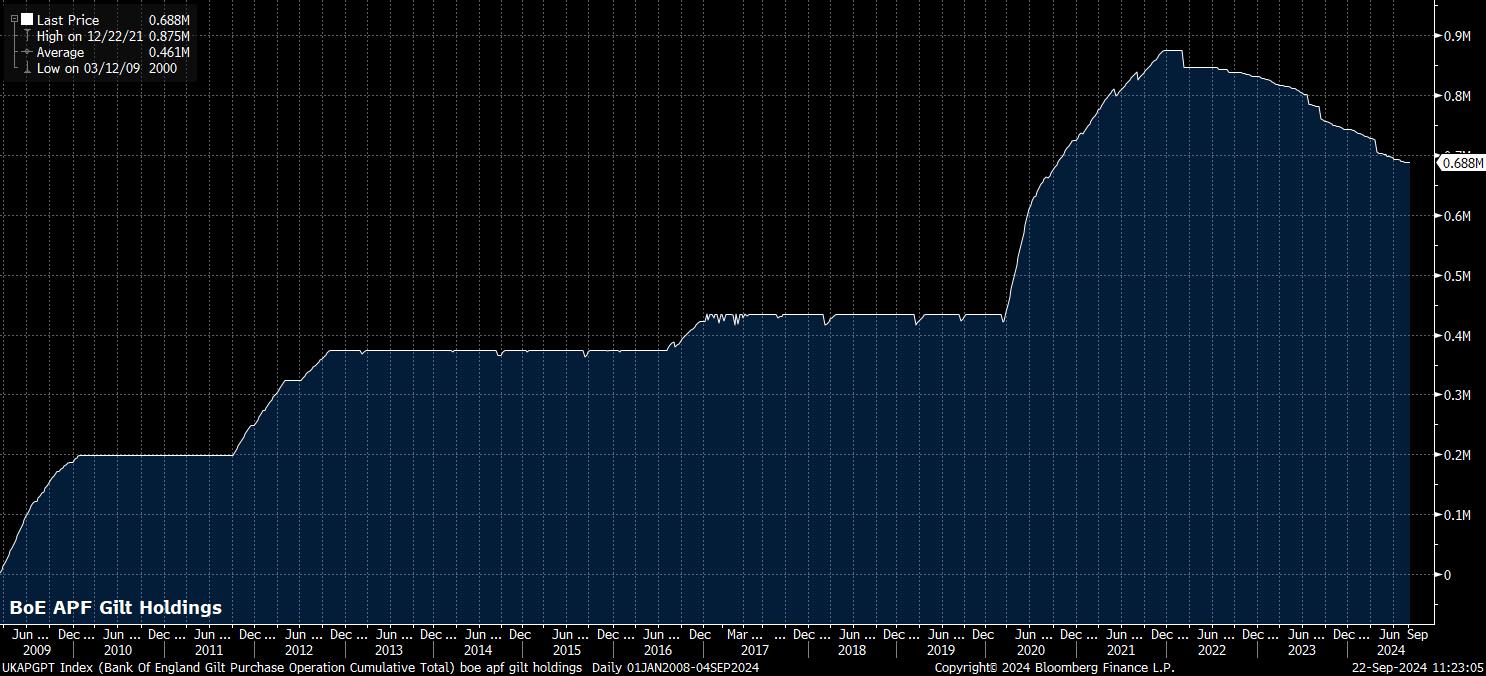

What was, perhaps, more interesting than the Bank Rate decision, was the MPC’s unanimous decision to maintain the pace of balance sheet run-off at £100bln over the next year. Given the sizeable increase in redemptions next year, this decision means that the BoE’s active gilt sales will fall from £50bln, to a paltry £13bln – albeit, news that is likely to be welcomed in HM Treasury given that fewer losses will now be crystallised, somewhat easing fiscal constraints ahead of October’s Budget.

That said, the decision to continue with QT at all could be considered a perplexing one. Not only are there increasing signs of funding stresses within the UK financial system, with usage of the BoE’s short-term repo facility surging week-by-week, but there is also now a situation where the two primary monetary policy levers – interest rates, and the balance sheet – are working against each other. Given that the Fed are likely to wrap up QT before year-end, it seems difficult to imagine that the BoE could plough on much into 2025 before having to wrap things up themselves.

Elsewhere, the Norges Bank held rates steady at 4.50%, as expected, while also flagging that “gradual reductions” are likely to take place from the first quarter of 2025. Such a stance was broadly in line with market expectations, and with the NOK OIS curve pricing a negligible 13bp of easing by year-end, such a statement caused little by way of significant vol.

The Bank of Japan also sprang little by way of surprise, holding the policy rate steady at 0.25%, as expected, in a unanimous vote. Nevertheless, the prospect of a further rate hike before year-end remains on the cards, with policymakers having raised their assessment of consumer spending, while also maintaining expectations for export price growth, seemingly signalling that recent market turmoil has not materially altered the BoJ’s plans to continue to raise rates.

Despite that, it seems the window to raise rates to a significant extent is closing rather rapidly, owing to domestic developments, but also to the FOMC having now embarked on their easing cycle. BoJ Governor Ueda struck a relatively dovish note at the press conference, stating that upside inflation risks have “eased”, giving the BoJ more room to “mull” policy shifts.

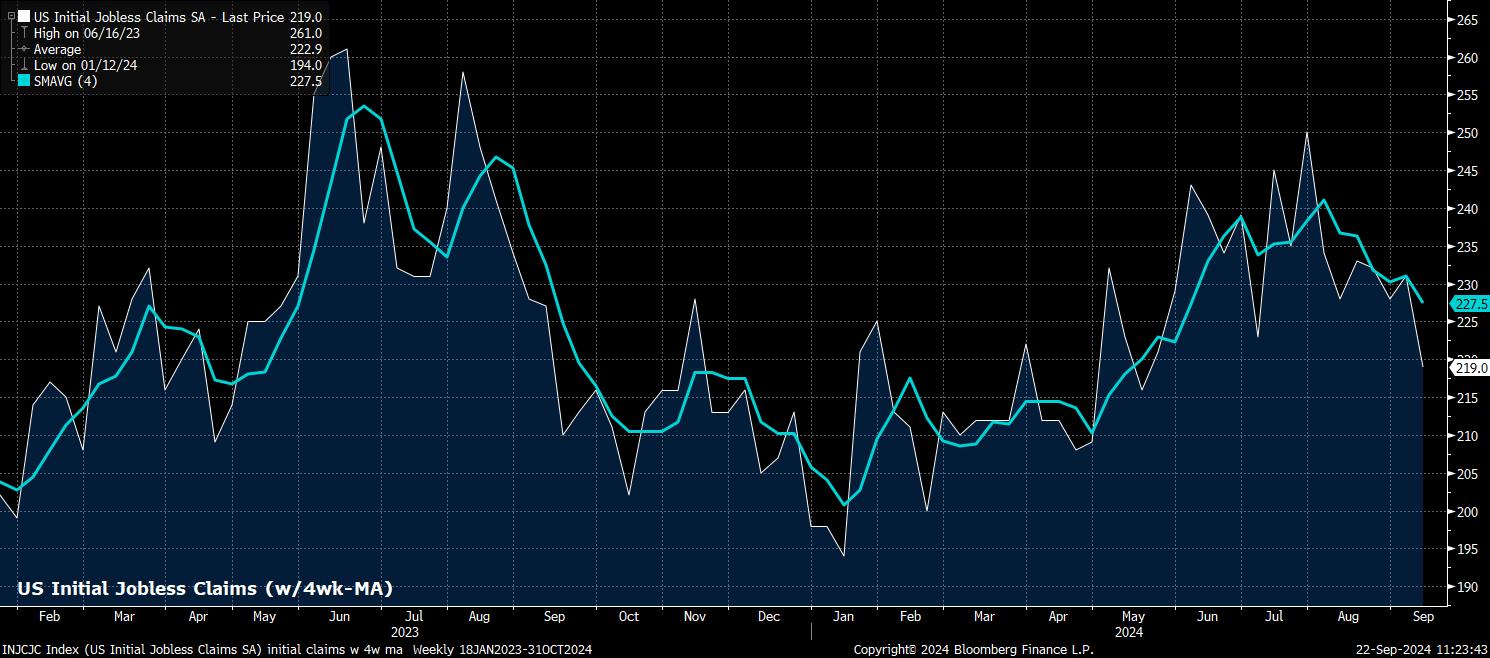

Away from the world of central banking, last week’s economic data once again bore out the theme of US economic outperformance. Retail sales rose a better-than-expected 0.1% MoM in August, while industrial production rose 0.8% MoM in the same period, quadruple the pace that consensus had expected. Meanwhile, on the labour market, initial jobless claims fell to a four-month low 219k in the week to 14th September, coinciding with the nonfarm payrolls survey period, while continuing claims also fell considerably, to 1.829mln. Once more, for those at the back, data of this ilk doesn’t scream “we need a 50bp cut!”.

Elsewhere, data was somewhat more mixed. The Australian economy continued to add jobs at a healthy clip in August, with net employment having risen by +47.5k, building on the +58.2k jobs added in July, though unemployment held steady at 4.2%.

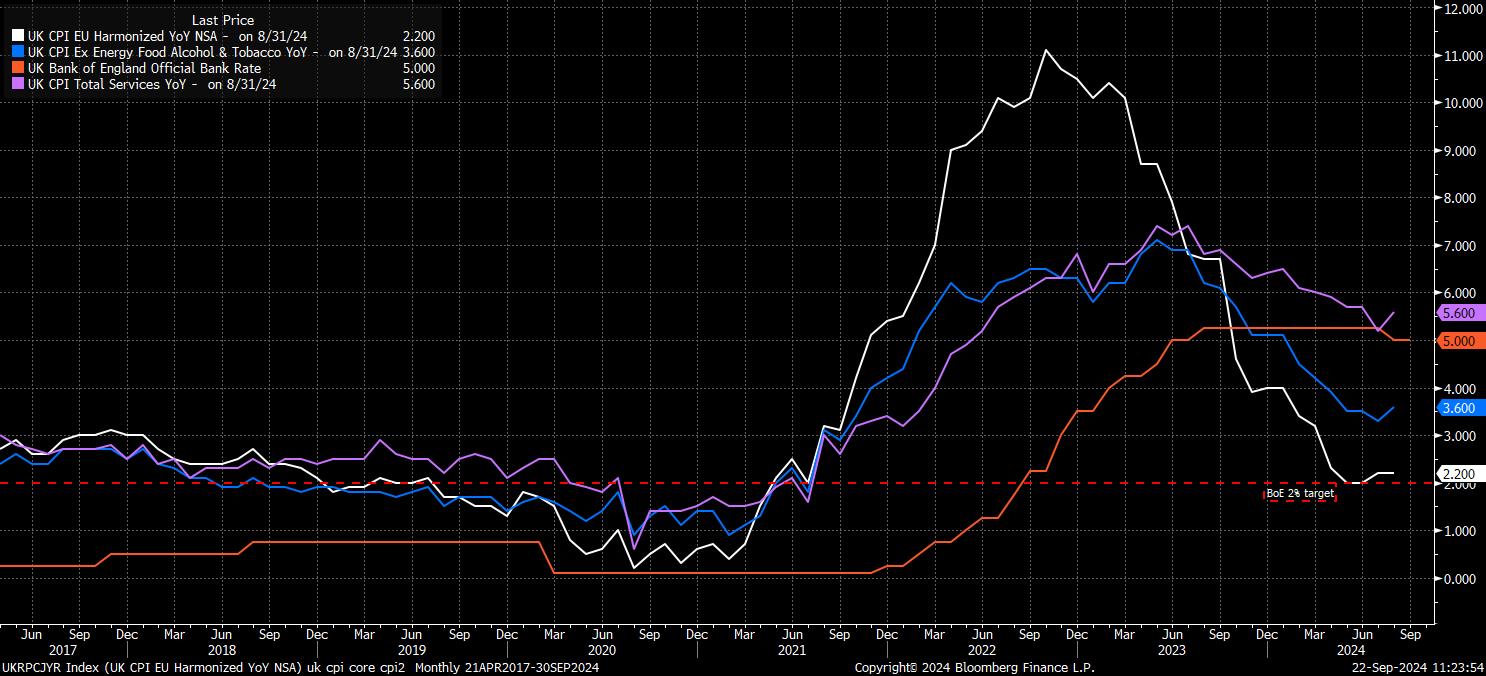

Economic news closer to home was less positive, however. Here in the UK, headline CPI rose by 2.2% YoY in August, unchanged from the pace seen in July. More worryingly, core CPI rose by 3.6% YoY, 0.3pp quicker than the pace seen in July, while services CPI rose by 5.6% YoY, 0.4pp above the rate seen a month prior. While statistical base effects contributed significantly to these increases, and both metrics were still below the BoE’s forecasts, policymakers will be seeking significant further disinflationary progress, particularly in services prices, before having the confidence to deliver another Bank Rate cut, which I still have pencilled in for November.

The Week That Was – Markets

Despite the host of moving parts that last week brought, the story for financial markets was a relatively simple one – a risk-on rally in equities, a broadly softer USD, firmer gold prices, and a sell-off at the long-end of the Treasury curve.

I should note, however, that the bulk of these moves only came towards the back end of the week, after the dust had settled after the FOMC’s decision on Wednesday. While conditions over said decision were incredibly choppy, and most participants probably suffered from whiplash as a result, a clearer market bias became evident as calmer heads subsequently prevailed.

As noted, equities continued to gain ground, with the S&P 500 notching back-to-back weekly gains, and rising to fresh record highs.

While I may, at this point, be sounding like something of a broken record, my three-pronged bull case of strong economic growth, solid earnings growth, and a forceful Fed put, remains firmly intact. This should see the path of least resistance continue to lead to the upside, and result in dips continuing to be seen as buying opportunities, with investors still having the confidence to remain further out the risk curve. That ‘Fed put’, incidentally, became even stronger this week, as we now know it’s strike price! Unemployment north of 4.4% likely sees the FOMC chuck a 50bp cut our way once more, while 25bp moves at every meeting is the base case in the meantime. Either way, the policy outlook is providing an increasing strong fillip for risk appetite.

Concurrently, that same policy outlook is posing headwinds for the greenback, as the FOMC plot a much faster course back to neutral than G10 peers, such as the BoE and ECB, who are taking a more ‘slow and steady’ approach to removing policy restriction.

The greenback, as a result, slipped to fresh YTD lows at 100.20 this week, with most other G10s benefitting – cable rose north of 1.33 for the first time since March 2022, the EUR notched its best week in a month, while the Aussie chalked up back-to-back weekly gains, on its way north of the 68 figure once more.

_d_2024-09-22_11-24-10.jpg)

A softening dollar once more proved to be a boon for gold, with the yellow metal again finding its shine, despite the long-end of the Treasury curve continuing to sell-off. Of course, the FOMC signalling policymakers being in something of a rush to get back to neutral will also have provided a tailwind to the zero-yielding asset.

Gold, in my view, remains a momentum trade at its core, having moved out of line with its traditional fundamental drivers for much of the year so far. As such, the yellow metal rising north of $2,600/oz last week for the first time, closing at a record high on Friday, is only likely to bring more buyers to the table.

_sp_2024-09-22_11-24-39.jpg)

All that said, it was the moves seen across the Treasury curve last week that piqued my interest the most.

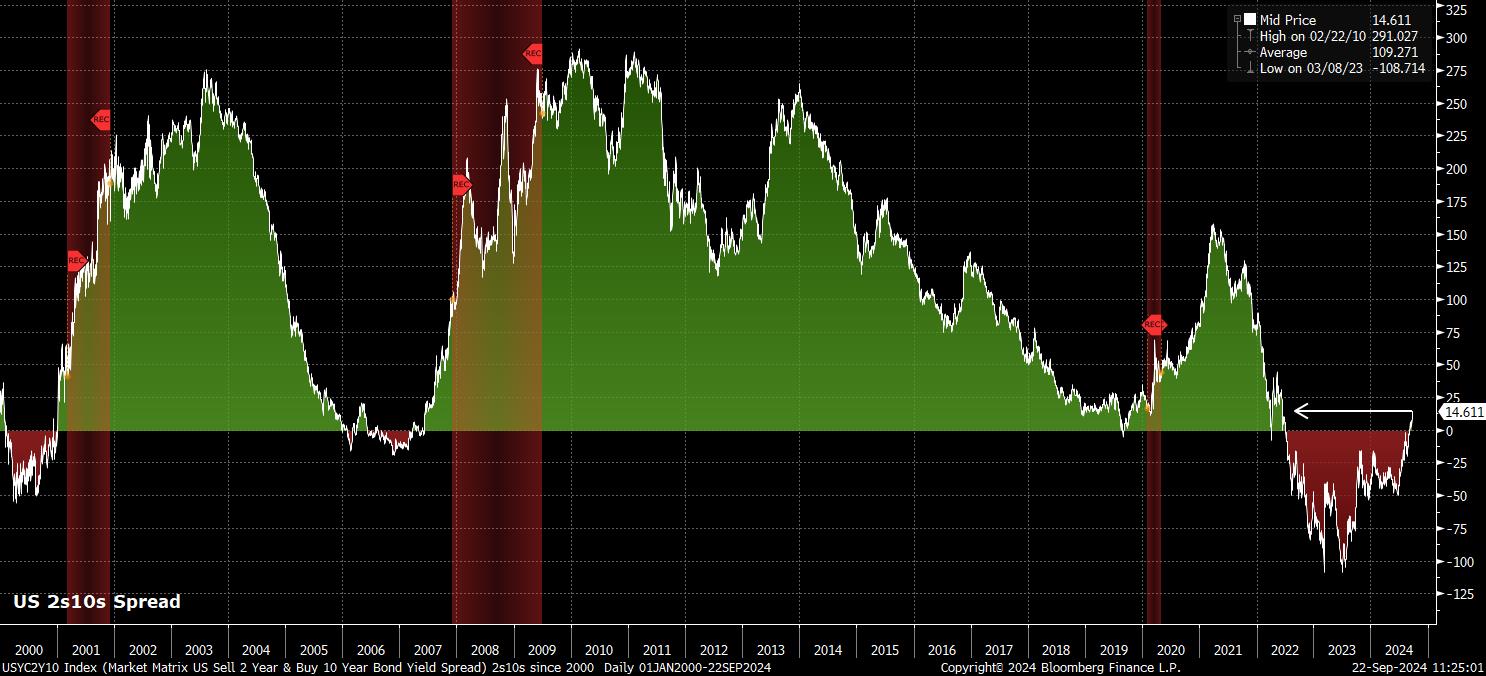

The front-end was as near as makes no difference unchanged before, and in the aftermath of, the FOMC decision, with the market having seemingly already accurately discounted both the likelihood of a 50bp cut, and the path that the FOMC would plot back towards neutral. The long-end, however, saw a notable sell-off, with 10s & 30s rising around 10bp apiece on a yield basis, as the latter rose north of 4% once more.

This selling at the long-end of the curve suggests a concern among participants that the Fed is not behind, but might actually be ahead of the curve – easing policy too substantially, and too quickly, into an economy that remains strong, and where inflationary pressures continue to bubble away. I would imagine that this, plus the substantial bear steepening seen last week, is causing some degree of consternation among FOMC policymakers.

Interestingly, the current historical Fed parallels are rather grim. The last two 50bp kick-offs to an easing cycle came in 2007, and 2001. Meanwhile, the last time that Treasuries sold-off after a 50bp cut was back in 2008. Let’s hope, for all our sakes, history shan’t repeat itself.

The Week Ahead

Turning to the week ahead, where a lighter data docket awaits, albeit one that still has a handful of events for traders to digest, and navigate. Of course, end-of-month and end-of-quarter flows may also have some impact, particularly towards the tail end of the week.

From a macro perspective, the latest round of ‘flash’ PMI surveys are probably the highlight, even if the data seems likely to tell a familiar story. That story, of course, is one of a continued divergence between the resilient services sector, and the struggling manufacturing industry, though the solid performance of the former should be enough to keep the various composite output gauges north of the 50 mark once more, which of course represents the boundary between expansion (above), and contraction (below). The surveys will also be interrogated for any anecdotal commentary on employment, and price pressures, particularly with the latter continuing to bubble away in most DM economies.

Elsewhere, the latest German IFO survey will be parsed for similar insights, though the data is likely to be in keeping with the broader theme of releases from Europe’s economic engine room of late. In a word – terrible.

The final read on third quarter US GDP is likely to be anything but, with the economy set to have grown by a solid 2.9% on an annualised QoQ basis, just 0.1pp below the 2nd estimate released last month. This week’s most notable US release, though, will be Friday’s core PCE figures – the Fed’s preferred inflation gauge – which are likely to show inflation having risen 0.1pp to 2.7% YoY in August; further validation for Bowman’s dissent in favour of just a 25bp cut, and likely further fuel on the fire for bond bears.

Speaking of the Fed, Fedspeak returns with a vengeance this week, as a whole host of policymakers make remarks now that the ‘blackout’ period has concluded. Thursday’s comments from Chair Powell, dissenter Bowman, and NY Fed President Williams will be of most interest to participants.

Elsewhere in the monetary policy world, this week also sees some second-tier G10 policy announcements. While the RBA are set to keep all policy settings unchanged, both the Riksbank and SNB are set to deliver 25bp rate cuts – all three of these moves are already fully discounted by market participants.

Earnings are, of course, not a huge feature of the docket this week, with Q3 earnings season not getting underway for another couple of weeks, with the banks starting to report on 11th October. Nevertheless, Jefferies (JEF) earnings will be used as a useful barometer of where other bank earnings may print upon their release, while Micron (MU) will be closely watched by those tracking the chip sector, and Costco (COST) remain a useful bellwether stock.

Lastly, geopolitical developments will remain on the radar, albeit with most headlines seeming to provide much more ‘noise’ than ‘signal’ at the moment. Market attention, though, will still focus on the Middle East, particularly after last week’s pager incidents, and after weekend reports of heavy fire being exchanged between Israel and Hezbollah. For now, however, participants are likely to stick with a ‘buy the rumour, sell the fact’ strategy when it comes to trading geopolitical risk.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.