- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Walmart (WMT) Q4 26 Earnings Preview: How Consumer Segmentation & AI Fuel Its $1T Market Cap

.jpg)

This Thursday (February 19), Walmart (WMT) is set to release its Q4 26 earnings before the U.S. market opens. The report is not only a bellwether for the U.S. retail sector but also the first performance review under new CEO John Furner.

In the current environment of repricing “high-valuation defensive assets,” the report matters far beyond a single quarter’s earnings—it serves as a milestone assessment of the company’s valuation logic.

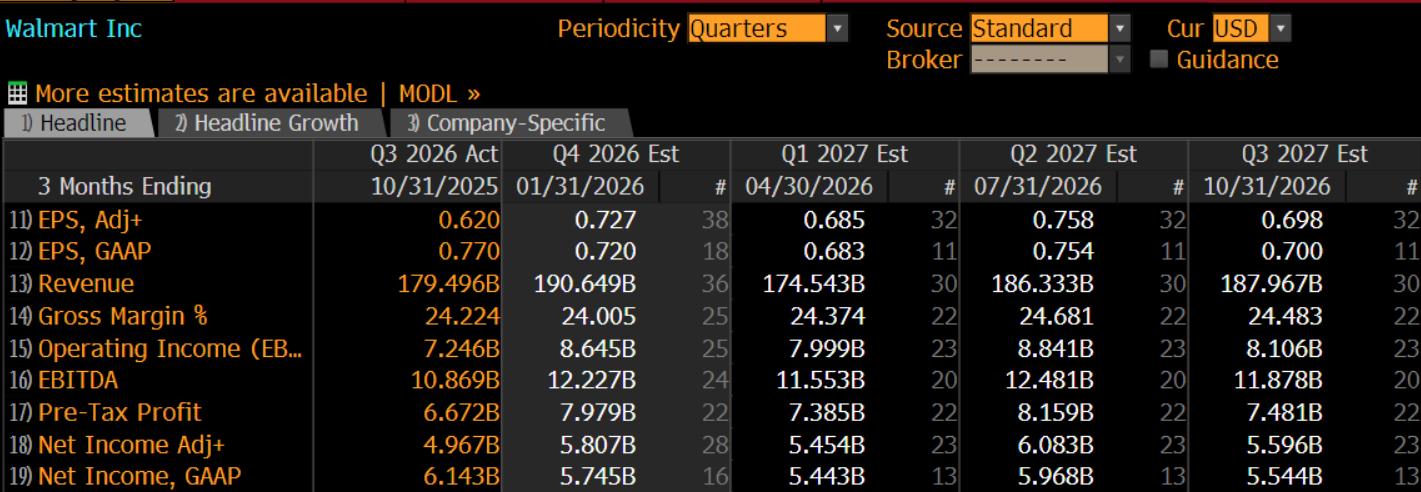

After a relatively weak Q3, Wall Street expectations for Q4 have rebounded. Consensus forecasts call for adjusted EPS of around $0.73, up from $0.62 in Q3; revenues are expected to exceed $190.6 billion, up roughly 6.2% QoQ; and adjusted net income is projected at around $5.8 billion, representing nearly 17% quarterly growth.

Notably, even though U.S. retail sales in December were flat MoM and broader consumer data showed no clear improvement, Walmart’s stock has risen roughly 20% YTD and surpassed a $1 trillion market cap in early February, becoming the first consumer staples company to enter the trillion-dollar club.

Beyond the raw financials, the key question for traders is which specific advantages have allowed Walmart to “outperform against the trend,” and whether these are temporary tailwinds or durable drivers sufficient to support its current valuation.

Behind the Trillion-Dollar Market Cap: Consumer Segmentation and AI Transformation

Walmart’s current valuation premium rests on two clear pillars: differentiated consumer demand and AI-driven efficiency gains.

On the demand side, U.S. consumption is showing a clear “K-shaped” split. In a high-interest-rate, income-segmented environment, one group—price-sensitive shoppers—relies heavily on low-cost channels, while high-income consumers maintain spending resilience in membership and premium categories. Walmart serves both ends of this spectrum.

The “Everyday Low Price” strategy strengthens foot traffic in groceries and daily necessities and can even increase market share during periods of consumer pressure. Sam’s Club, meanwhile, provides stable support for profits through high-margin membership revenue and strong renewal rates.

This cross-income penetration gives Walmart a structural advantage for “share-driven growth” even when overall demand softens, rather than relying purely on cyclical recovery.

On the supply side, AI and digital investments are materially improving cost structures. In recent years, Walmart has accelerated the adoption of generative AI and big data applications and partnered with tech companies like OpenAI to enhance personalized recommendations, inventory management, and dynamic pricing. Efficiency gains are already reflected in improved inventory turnover, optimized expense ratios, and higher online conversion rates.

The market’s willingness to assign Walmart a premium over traditional retail essentially reflects a bet on the sustainability of these efficiency gains. In other words, Walmart’s valuation logic is shifting from a “low price + scale” model to a “data + efficiency” platform approach.

As U.S. tech giants face scrutiny over monetization, and traders grow cautious on high-growth narratives, capital is reassessing traditional leaders that can leverage AI for efficiency while maintaining stable cash flow and defensive characteristics.

This marginal shift in risk appetite has transformed Walmart from a pure consumer stock into a defensive asset with a “tech efficiency premium,” directly contributing to its strong stock performance.

Key Earnings Focus: Growth Sustainability & AI Efficiency

In this report, the market will focus on metrics tied to consumer segmentation and AI transformation. Traders care more about the structure and sustainability of growth than single-quarter earnings.

Specifically, U.S. domestic operations—Walmart’s profit core—will be scrutinized for same-store sales growth, a direct indicator of consumer demand. Improvements in discretionary categories beyond groceries would suggest continued demand resilience; otherwise, it could indicate further concentration of spending toward essentials.

Meanwhile, performance in emerging markets and online channels, along with expense control and inventory management, will signal whether operational efficiency can continue to improve over the coming quarters. The real question is whether market share gains translate into margin expansion, rather than mere top-line growth.

Management commentary on AI investment payback periods, Walmart Connect advertising growth, and automated logistics during the earnings call will also influence market confidence in the sustainability of efficiency gains. Communications from the new CEO regarding growth strategy and capital allocation could sway sentiment in the short term.

Risk Considerations: Valuation, Competition & Global Exposure

Although Walmart is seen as a beneficiary of consumer segmentation and AI transformation, with relatively predictable fundamentals and support from advertising growth, dividends, and buybacks, risks remain.

Its forward P/E of nearly 47x is high for the traditional retail sector, implying that the market is already pricing in substantial growth. The current stock price assumes that efficiency improvements and profit expansion will progress simultaneously. In a slowing economic environment, if earnings or guidance fall short, valuation volatility could increase significantly.

Competitive dynamics cannot be ignored. Walmart continues to compete with online platforms like Amazon. If its digital and AI leadership fails to translate into sustained market share gains, the “tech-enabled retail” narrative could lose strength.

Additionally, international operations remain sensitive to trade policies and currency fluctuations. Tariff changes or exchange-rate swings could impact profitability in markets such as China, India, and Latin America.

Overall, Walmart’s milestone of crossing a $1 trillion market cap reflects not only its own transformation achievements but also a broader repricing of consumer segmentation and efficiency gains. The February 19 earnings report will be a key reference point for evaluating whether this high-valuation logic can continue.

In the short term, traders will focus on EPS delivery and AI investment returns, while in the medium to long term, stock support will hinge on the sustainability of efficiency gains.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.