- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

US–Iran Tensions Trigger Oil Spike as Brent Crude Tests Breakout Levels

Summary

• Escalating US–Iran tensions have driven Brent and WTI crude more than 4% higher, marking the biggest daily move since October.

• Supply disruption risks through the Strait of Hormuz are now central to oil market pricing.

• Higher energy prices are lifting inflation expectations and could pressure global equities while supporting gold.

Markets Wrong-Footed by Escalating US–Iran Headlines Markets have been caught off guard by a sudden shift in the US–Iran narrative. Only weeks ago, headlines pointed toward constructive dialogue and the potential for a diplomatic breakthrough. That tone has changed materially.

Major news outlets, including Axios and CBS, are now reporting a meaningful probability of military escalation, with suggestions that a conflict could unfold within weeks and potentially last for an extended period. The market reaction has been swift and decisive.

Brent and WTI Crude Jump Over 4% as Breakout Levels Near

Energy markets have responded aggressively:

• WTI crude has surged above $65, pushing back into the trading range held since February.

• Brent crude has moved toward $71, testing the upper bound of its $67 to $70 consolidation range.

This marks the largest single-day move in crude since October and suggests traders are beginning to price in geopolitical risk premia.

From a technical perspective, Brent is attempting to break out of a multi-month range. A sustained move above $71 would open the door to a more volatile price regime, particularly if headlines intensify.

Strait of Hormuz: The Critical Supply Risk

The focal point of market concern is the Strait of Hormuz, arguably the most important energy shipping lane in the world.

• Roughly 21 million barrels of oil and oil equivalents pass through the Strait daily.

• That represents over 20 percent of global energy consumption flows. Reports overnight suggested temporary disruptions in the Strait, although a full closure remains unlikely. A sustained shutdown would provoke severe geopolitical consequences and likely draw in regional powers. However, markets do not need a full-blown closure to react. Even a temporary or partial disruption would materially tighten global supply and drive oil prices sharply higher. The risk premium now embedded in crude reflects this uncertainty.

Client Positioning and Betting Market Signals

Positioning data shows traders are leaning bullish:

• 71 percent of open Brent crude positions are currently long.

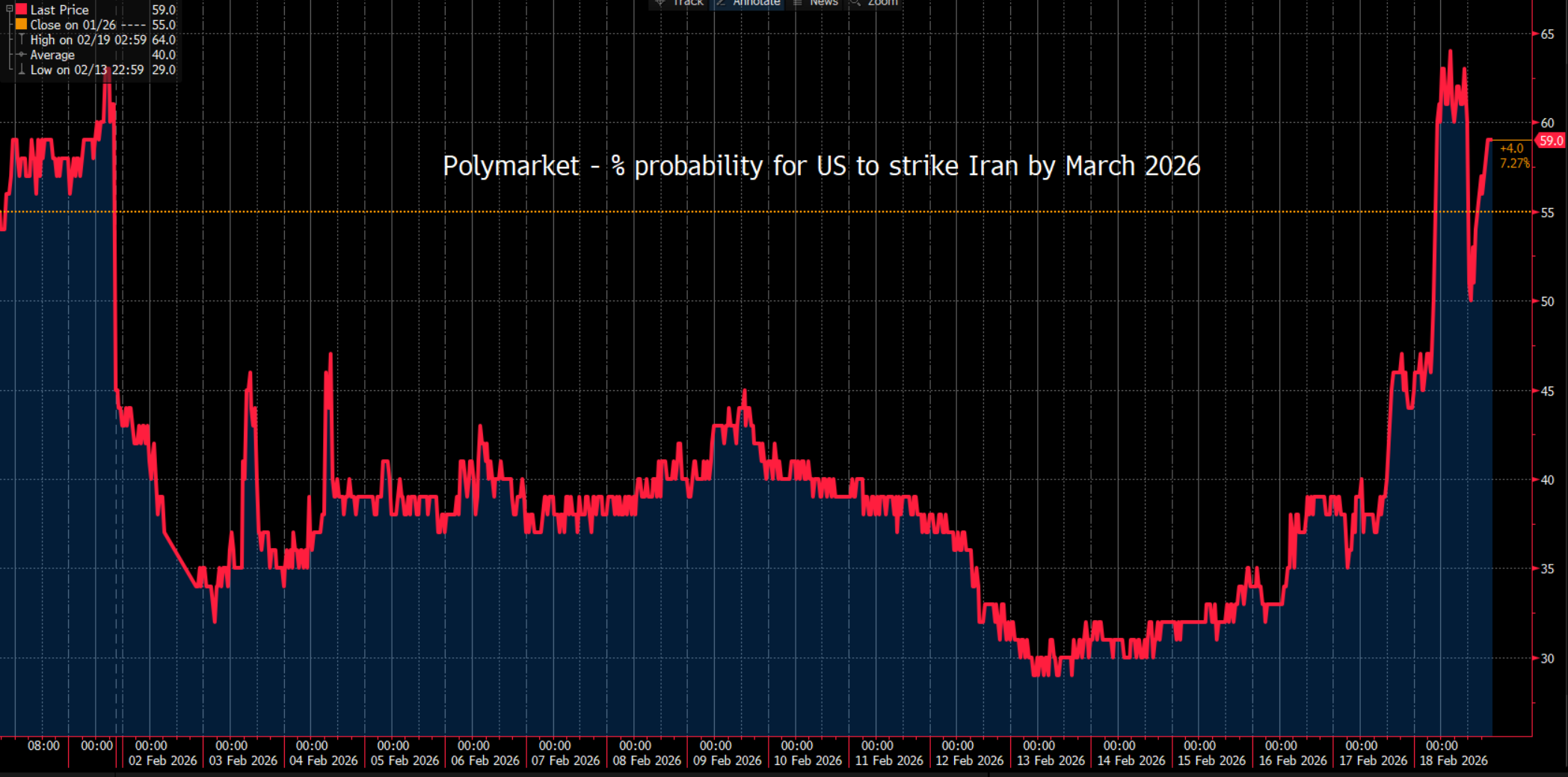

Meanwhile, betting markets such as Polymarket show rising probabilities of military action:

• Odds of a US strike on Iran by the end of March have risen from around 30 percent to 57%, having briefly touched 65%.

While prediction markets are not perfect forecasting tools, they reflect shifting sentiment. The market now assigns a greater-than-even probability to some form of military escalation.

Inflation Expectations and Global Market Implications

The energy spike is already feeding into broader markets:

• Inflation expectations, as priced in bond markets, are ticking higher.

• Energy equities are outperforming.

• Energy-importing nations may face short-term underperformance as terms of trade deteriorate.

If crude continues higher, second-round effects could include:

• Rising gasoline and natural gas prices

• Upward pressure on global CPI expectations

• Increased volatility in bond yields

• Marginal pressure on equity valuations

Gold, Equities and Cross-Asset Impact

Should Brent Crude break decisively higher, cross-asset implications become increasingly important.

• Gold could be propelled back toward the 5,100 level as geopolitical hedging demand rises.

• Equities may face moderate downside pressure, particularly in rate-sensitive sectors.

• Defensive and energy-linked assets are likely to outperform in the short term.

At this stage, the difficulty for traders lies in pricing military escalation, a domain outside traditional economic modelling. Markets struggle when probabilities cannot be reliably quantified.

That uncertainty itself fuels volatility.

Volatility Set to Rise as Risk Becomes Harder to Price

The key variable remains the evolution of headlines. If escalation appears imminent and supply disruptions become credible, Brent could enter a higher volatility regime quickly.

Conversely, signs of diplomatic re-engagement could see the geopolitical premium unwind just as rapidly.

For now, traders are closely monitoring:

• Brent crude

• WTI crude

• Natural gas

• Gasoline futures

• Gold

The next directional move in energy will likely be driven less by technicals and more by geopolitical developments.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.