CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Australia’s Market Outlook for 2025: What Traders Need to Know

National house values continue to rise, albeit at an ever-slower pace, with Brisbane and Perth outperforming (among the capital cities), with a divergent and weaker performance in Melbourne and Sydney.

Inflation is gradually falling towards the RBA’s target range, and while the central bank have expressed an increased appetite to cut the cash rate, the pace of disinflation – notably in services - is far stickier than the RBA and households would like.

The ASX200 in 2024 – It's all about the banks

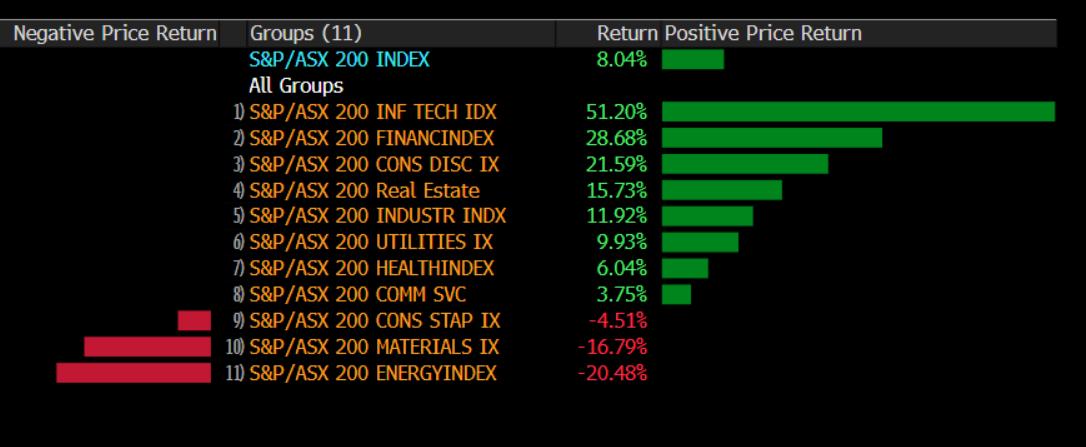

For Aussie equity traders, while we’ve seen strong gains in the ASX tech and consumer discretionary sectors, the domestic story of 2024 has been the incredible outperformance of the ASX200 banks (notably Westpac and CBA). With China’s growth concerns limiting the appeal to own resource equity plays with any conviction, domestic institutional funds have seen a scarcity of compelling liquid alternatives to protect against localised inflation and have subsequently piled into the banks.

At an index level, solid gains in the big banks throughout 2024 resulted in the ASX200 hitting a new ATH of 8514 (on 3 December), with bouts of higher index volatility proving to be short-lived.

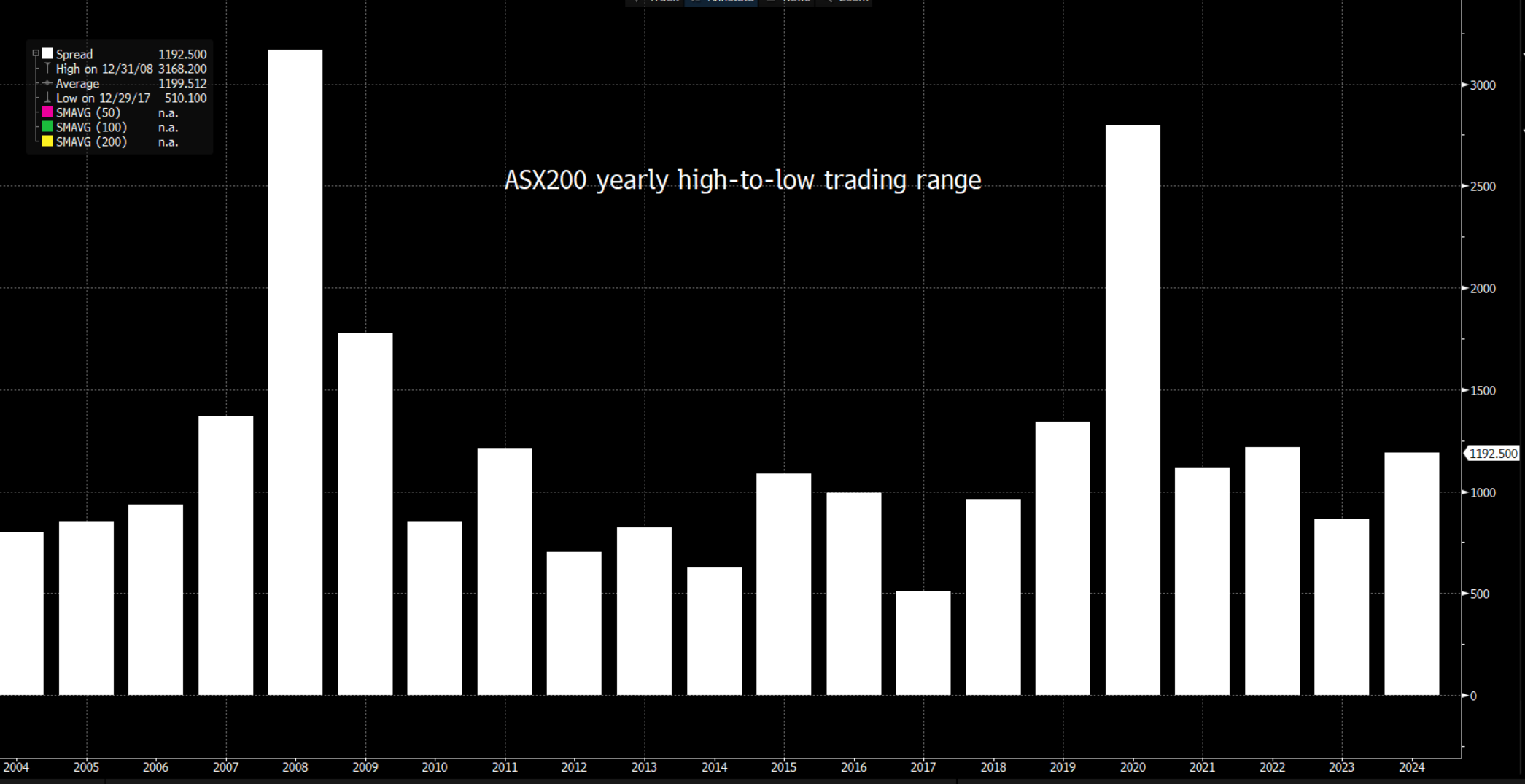

To quantify the volatility regime in domestic equity, we’ve seen the ASX200 VIX index average 11.6% in 2024 - below the 5-year average implied volatility of 14.8%. The ASX200 has tracked a 1192-point range in 2024 (see above), very much in line with the 20-year average of 1199 points, with an average daily high-low trading range of 67-points, modestly lower than the 5-year daily average range of 77-points.

Many will say that the 8.1% YTD gain (13.2% on a total return basis) for the ASX200 is 'unremarkable', notably when compared to the YTD gains seen in US and Asian equity indices. However, we need to consider that the ASX200 is a value/higher income equity index, and while the Aussie index has certainly underperformed, an 8% return is still above the long run yearly average return. And, given the poor performance of the ASX200 materials sector, and the expected returns at the start of the year, the YTD performance is not a bad outcome.

An unremarkable year for the AUD

One can also say it’s been an unremarkable year for the AUD on both a return and volatility basis. AUDUSD sits -8.2% YTD and despite the spot rate near the YTD lows, it has held a meagre 743 pip range (0.6942 to 0.6199) throughout the year – the second lowest yearly high-to-low range in the past 20 years.

The RBA may be one of the few major central banks who have not altered its policy setting in 2024, but the AUDUSD has been impacted predominantly by external factors: China growth concerns, impending tariffs increases and US economic exceptionalism. That is unlikely to change too intently in 2025.

A more eventful year ahead for Aussie markets?

With elevated valuations, and a low visibility on earnings growth, 2025 will likely be a year of low correlation within ASX200 equity, and higher volatility; A positive backdrop for active managers, and stock pickers. Banks remain a must-watch, where we consider the role of China and how they execute on policy, as the rollout has could have a significant impact on the ASX200 materials and energy plays, as well as the AUD.

As we look ahead into 2025, I’ve listed some pertinent questions that are front of mind.

- Where to for the US growth, inflation and Fed policy? Regardless of the domestic news flow, volatility in the AUD and ASX200 will remain heavily influenced by US economic growth, Fed policy and also Trump’s actions.

- With the ASX200 valued at a lofty 18x forward earnings, will investors continue to pay up for an ‘expensive’ market, and should we get a re-rating, where does the earnings growth come from in 2025?

- Will the Australian Federal Election bring increased volatility to Aussie markets? Traditionally, Australian elections have been low vol events, but with fiscal policy and government spending accounting for c.70% of Australia’s GDP and employment growth, a minority government could usher in a more conservative fiscal program which could impact the perception of future economic activity.

- Therefore, are consensus expectations for Australia’s GDP to rise above 2% by Q3 25, driven by a rebound in household consumption, too optimistic?

- Where too for the Australian labour market and notably private sector job creation? Economists see the unemployment rate (currently at 3.9%) rising to 4.5% by Q325, with a rise above 5% seen as unlikely given forecasts for net migration and further deficit spending.

- Where to for Australian (and US) inflation? While economists believe the Australian inflation rate is skewed lower in 1H25, there is a widely held view that annualised CPI could rise back above 3% in Q325 and Q425. If proved correct, a reversal in the disinflationary trend would have clear implications for RBA policy and market volatility.

- Navigating tariff headlines - How will tariff risk seen from Q125, either directly or indirectly, impact Aussie equity? China is the major known unknown - Can China exceed expectations for its stimulus plans in the March NPC meeting and get Chinese equities, commodities and ASX200 materials plays firing up?

- If China can get the party started, could the large-cap ASX materials provide domestic institutional funds a liquid alternative to rotate their exposure away from the banks?

- With the ASX200 energy sector falling 21% in 2024 (the 3rd worst yearly performance in 20 years), could 2025 be a better year for the energy equity bulls, or will the short sellers continue to see this as a primary sector to focus on?

- A big Aus Q4 CPI due on 29 January – While we look for the outcome of the December employment report (due 16 Jan), the markets currently imply a 66% chance that the RBA cut in February, but it's the Q4 inflation print that should hold the keys as to whether the RBA cut rates on 18 February or hold off.

- The RBA may well cut rates in February or May, but it’s the expected extent of cuts in the cycle that is most important – are the markets correct to assume that any easing cycle will be a shallow (at best), with potentially three 25bp cuts expected over the coming 12 months?

- How will ASX banks fare on impending RBA action/inaction? At a simplistic level, if the RBA don’t cut rates, then investors may express a greater concern on reduced demand for credit and a potential increase in bad and doubtful debts. If the RBA do cut, then lower variable rates will need to be offset by higher volumes or net interest margins will decline further.

- Where to for the AUD? One would expect the AUD to trade lower should the PBoC devalue the yuan to offset tariffs. However, China’s stimulus implementation (from March onwards), the potential for a trough in European growth and changes in the US economy could all offset potential headwinds from a CNY devaluation. What does 2025 hold for Aussie equity, AUS200 index and AUD traders?

It promises to be another fascinating year, and for traders who are agnostic in their directional bias and trade from both the long and short side, it’s time to put Australia back on the radar.

Good luck to all

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.