- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Traders’ Weekly Playbook: Nvidia, Treasury Auctions, and USD Direction

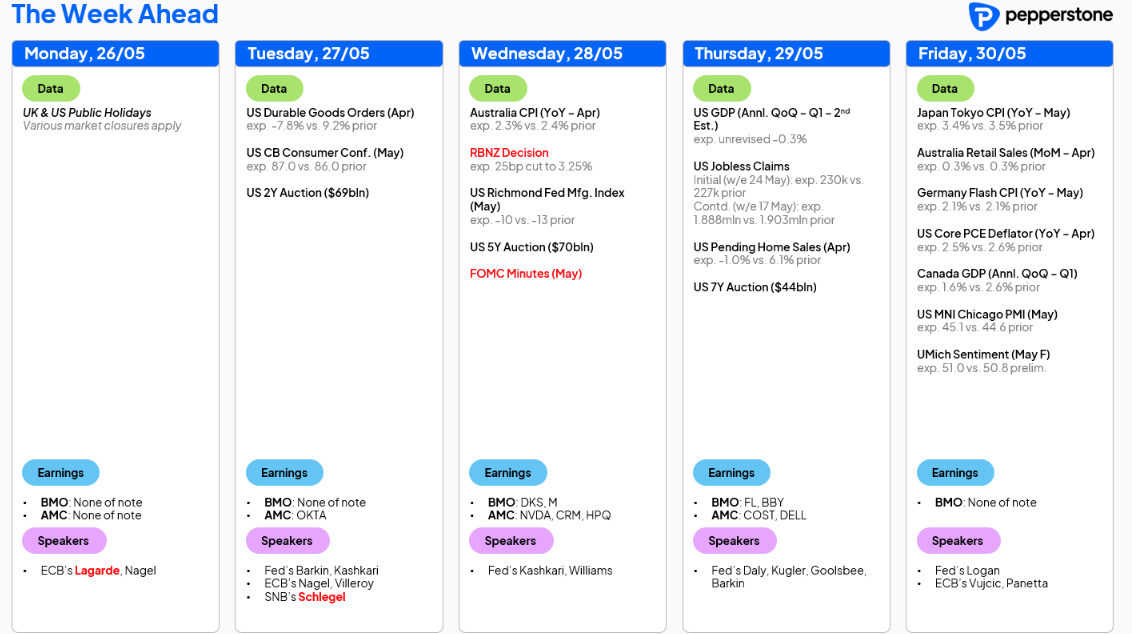

We also navigate month-end portfolio rebalancing flows, the May FOMC meeting minutes and another heavy dose of Fed speakers, which can largely be ignored, as the prospect of learning any new intel is low.

Bond markets take centre stage

The core focus once again falls on the US, Japanese, European and UK bond and inflation markets – not just because the fixed income space offers the cleanest guide on how the collective view Trump’s ‘big, beautiful bill’ and its read-through to future deficits and the subsequent future level of coupon issuance and funding requirement.

Modelling the impact of the reconciliation bill is no easy task, because among other factors, we’re yet to see the tweaks put in place by Senators, but scenario testing involves making assumptions of future GDP reads, the offset of tariff revenue, and the interest rate demanded to lend to the US government.

What seems clear from the reconciliation bill that was passed through the House last week and will soon be debated in the Senate is that Trump and Bessent have shifted tactics, swiveling hard from fiscal conservatism and reduced spending to an outright pro-growth policy stance.

This approach involves increasing the fiscal deficit by around 0.4 ppt of GDP each year over the next 10 years, married with an increased push for deregulation in Q3, with the exchange rate expected to do much of the heavy lifting to close the imbalances. If it isn’t already, it is fast becoming a consensus view that the USD is on the path to a multi-year decline, notably vs those countries that run persistently high current account surpluses with the US.

The gold market is clearly articulating the argument of a structural USD bear market, as is Bitcoin.

US Treasury auctions to play a role in shaping market sentiment

With the US Treasury market front of mind, we note the level of govt bond issuance due out this week - while many outside of the macro/fixed income space typically pay little attention to the frequent govt bond actions, and the takedown and demand seen from various entities, this week that dynamic could change.

The US Treasury Department is set to issue $183b in 2-, 5- and 7-year Treasuries. While Japan will be hoping for far better demand than Tuesday's 20-year JGB auction, when they issue Y500b in 40-year JGBs. The UK DMO will issue around 4b in paper through the week.

The ‘big, beautiful bill’ to increase the deficit and Treasury interest expenses

The central focus for macro players will fall on the US Treasury issuance, and one suspects the demand for US Treasury issuance across these tenors will be solid enough and be well absorbed by the private market. The concerns of late have centred on the move in yield at the long end of the Treasury curve and the rise in term premium - so the maturities on auction through this week won’t necessarily tell us a huge amount of demand for longer-term debt, with the next US 10yr bond auction not scheduled until 9 July, (30yr auction on 10 July), which falls a number of days after the proposed deadline to pass the Senate’s version of Trump’s budget and tax plan.

That said, solid demand in the auctions this week could help settle and calm market anxiety levels that have recently seen the Treasury buyers go missing. US Treasury yields moving lower on strong demand at the respective auctions would be positive for US equity risk and the USD. Conversely, if the demand remains poor – notably from foreign entities - and results in higher bond yields then the concerns on the US debt dynamics would see the USD and US equity trade lower and push more capital into gold.

Yet another Trump tariff U-turn

We also consider the breaking news that Trump has agreed to push back the start date on the 50% tariff rate on EU imports from 1 June to 9 July. This is no random date, with the new implementation date falling on the same day as the deadline for the 90-day pause on most reciprocal tariffs.

The consensus view was always that the 50% tariffs wouldn’t hold for long anyhow and would have most likely been reduced towards 20% shortly after 1 June - but this action today simply highlights that while tariffs will be helpful in keeping the US deficit in check, they are also a primary negotiation tool, where the initial gambit has been swiftly reduced.

Nvidia’s Q126 earnings set to impact

Nvidia’s Q126 earnings on Wednesday (after-market) will be closely monitored and could be a risk for US tech/semis as well as to the NAS100 and SPX500 futures. Options pricing implies a -/+6.8% move in Nvidia's share price on the day of earnings, which if realised would be lower than the 8.5% move seen in the past 8 quarters – but a -/+7% move for any company with a $3t market cap is still a healthy level of movement and enough to get broad markets pumping after hours. Investors see earnings as the remaining major overhang holding them back from buying the stock…subsequently, a solid beat and raise, with guidance that margins are set to rise over the coming quarters should be enough to remove the earnings overhang and get the stock pumping.

Trading Views

It could be a week that if you get the call right for the direction for US 10-year Treasury yields then you will likely get the direction right for US equity, the USD and gold. The reason for the move also matters, but simplistically, an upside break of 4.6% (in the 10yr) would likely take the SPX500 down through the 200-day MA and put more credence to the pronounced wedge pattern in play. Nvidia will be a core influence on the US equity tape into and post-earnings.

Over the medium term, the USD looks destined for lower levels, and the moves of late have been seen against the Asian high current account currencies – TWD, KRW, SGD, and JPY, with USDCNH at the lowest levels since November. EURUSD was never overly concerned by the 50% tariff threat, but the news today has the spot rate eyeing a move this week into 1.1400. Watch AUDUSD as it pushes into range highs and traders are on notice for a possible break out of 0.6515.

The set-up in gold is clearly bullish and the bulls will need to find a further 4% for new ATHs to play out…. Lower UST yields this week may perversely be a gold negative, although it depends on whether that is driven by increased demand or due to negative growth factors.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.