- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Only in the rare event that the RBA really wanted to inject great uncertainty as to its future policy path would they go down the route of shocking the market – but, as history has shown when the markets implied pricing of an outcome is above 90%, and the bank haven’t guided expectations away from such highly convicted levels, then they always meet the market.

Could the RBA cut by 50bp?

There is a loose debate that the RBA could cut by 50bp on Tuesday – in fact, for a short period of time today, the Aussie swaps market had priced a 12% chance of a 50bp cut. However, the strong May household spending data (+0.9% m/m / 4.2% y/y) has subsequently seen that small premium for an outsized cut being removed.

In essence, the RBA could feasibly choose to pull out the big guns and cut by 50bp, but that would need to be carefully explained to the markets as to why the urgency to front-load the cuts, when a 50bp cut has traditionally only been pulled in times of panicked markets.

The move in the AUD to be driven by the tone of the RBA’s statement

Given the current rates pricing, a 25bp cut in isolation – if realised - shouldn’t move the AUD or the AUS200 to any great extent, and so layering into AUD shorts in anticipation of a rate cut seems a low-impact tactical trade.

The movement in the AUD will therefore likely come in response to the tone of the RBA’s statement and shortly after from Gov Bullock’s press conference. It’s here where we assess the urgency expressed to take the cash rate to a ‘neutral’ policy setting – neutral being the equilibrium policy setting, which is neither stimulatory nor restrictive for the unfolding economics.

How quickly will the RBA cut to a neutral setting?

In February, the RBA made it known that they saw the neutral rate at 2.90%, although in the May Statement on Monetary policy, its projections for the trough cash rate were slightly higher at 3.2%.

Having already cut the cash rate from 4.35% to 3.85%, to get to 2.90% would imply the RBA have another 3 to 4 rate cuts to get take policy to a neutral setting – how quickly they go about lowering the cash rate and how efficiently they articulate this to the market is what the AUD and AUS200 will feed off.

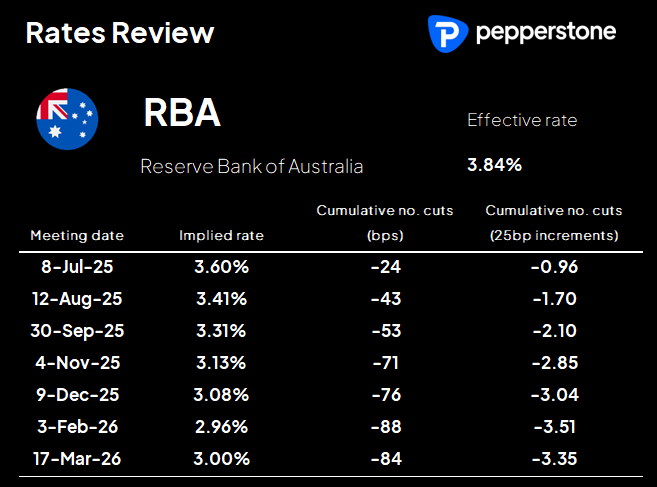

Looking further out along the Aussie swaps curve and the central expectations for each respective meeting out till March 2026, we see a further 50bp of cuts implied by December, with the cash rate expected to trough at around 3% going into 2026.

As the RBA await the all-important Q2 CPI print (due 30 July), it’s hard to see the RBA offering strong implicit forward guidance on how quickly they want to get to neutral – they remain somewhat data dependent and reactive - and while growth in the private sector remains anemic, yet wages remain elevated at 3.4% y/y and the labour market is still tight, its seems unlikely that traders get the hard definition they want.

AUD positioning under review

Positioning is also a key factor when considering the extent of any move in the AUD in response to a major announcement. As it stands, both leveraged and retail accounts hold a small net long position in the AUD, while real money accounts are small short. Not a huge amount to get excited about, or that offers a clear skew for a directional move in response to the news.

So, in essence, given the current market pricing in the rates market, and while all roads lead to a 25bp cut, the question for those looking for a tactical trade or even managing the risk of holding AUD exposures over the RBA meeting, we consider whether the statement and Gov Bullock’s presser offers the degree of urgency to get to 3% more quickly than what is priced…..if we don’t get it perhaps we could see a short bout of AUD upside.

We also consider that once the dust settles on the RBA meeting, AUDUSD will then soon revert to taking its direction and steer from the S&P500, HK50, copper and/or the CNH (Chinese yuan). When trading a view on RBA policy, doing so against the cross rates and removing the USD exposure is often the cleaner play.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.