- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The discourse over Fed policy has become convoluted, and frankly rather messy, in recent weeks, not at all helped by President Trump ranting away about the need for lower rates at every possible opportunity.

Hence, let’s try to simplify things.

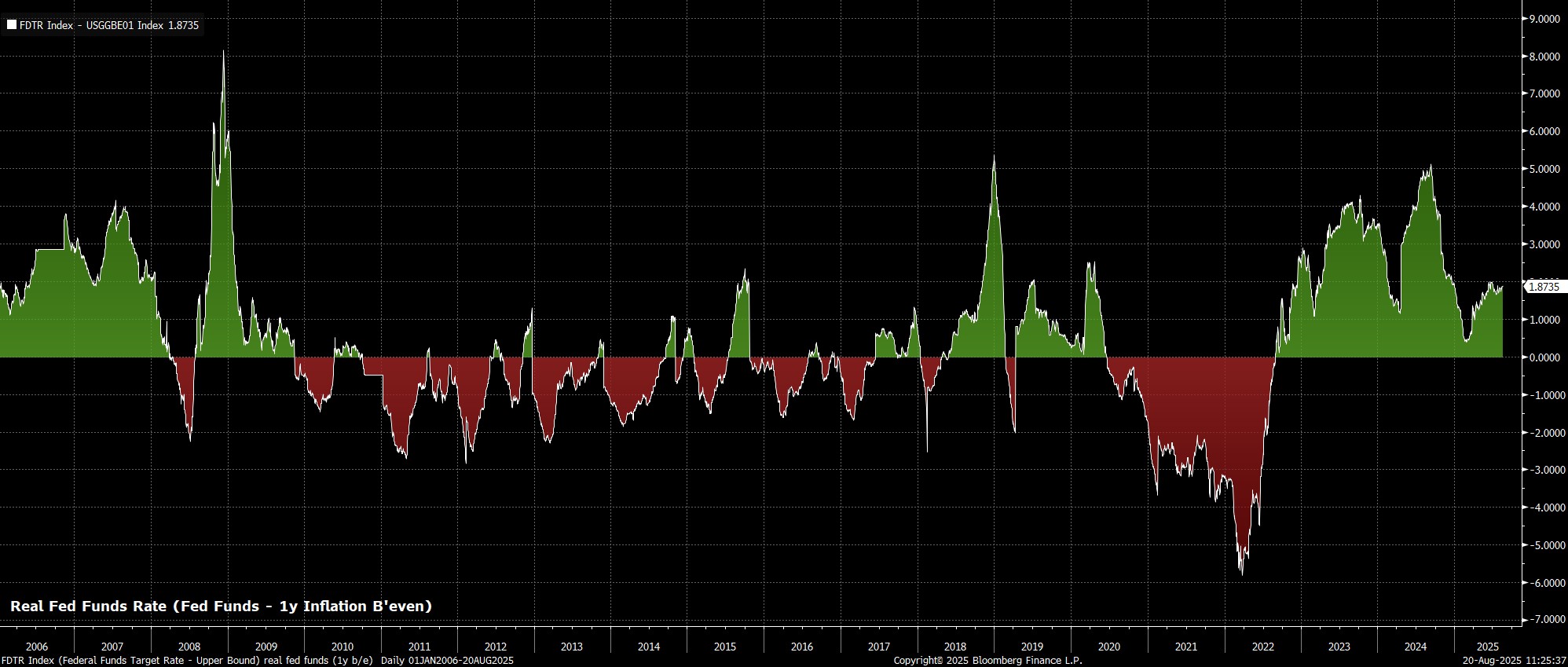

Firstly, the current stance of policy isn’t really that restrictive. The real fed funds rate – using Chair Powell’s preferred deflator of the 1-year inflation breakeven – is running at less than 2%, well off the near-5% levels seen at the back end of last year.

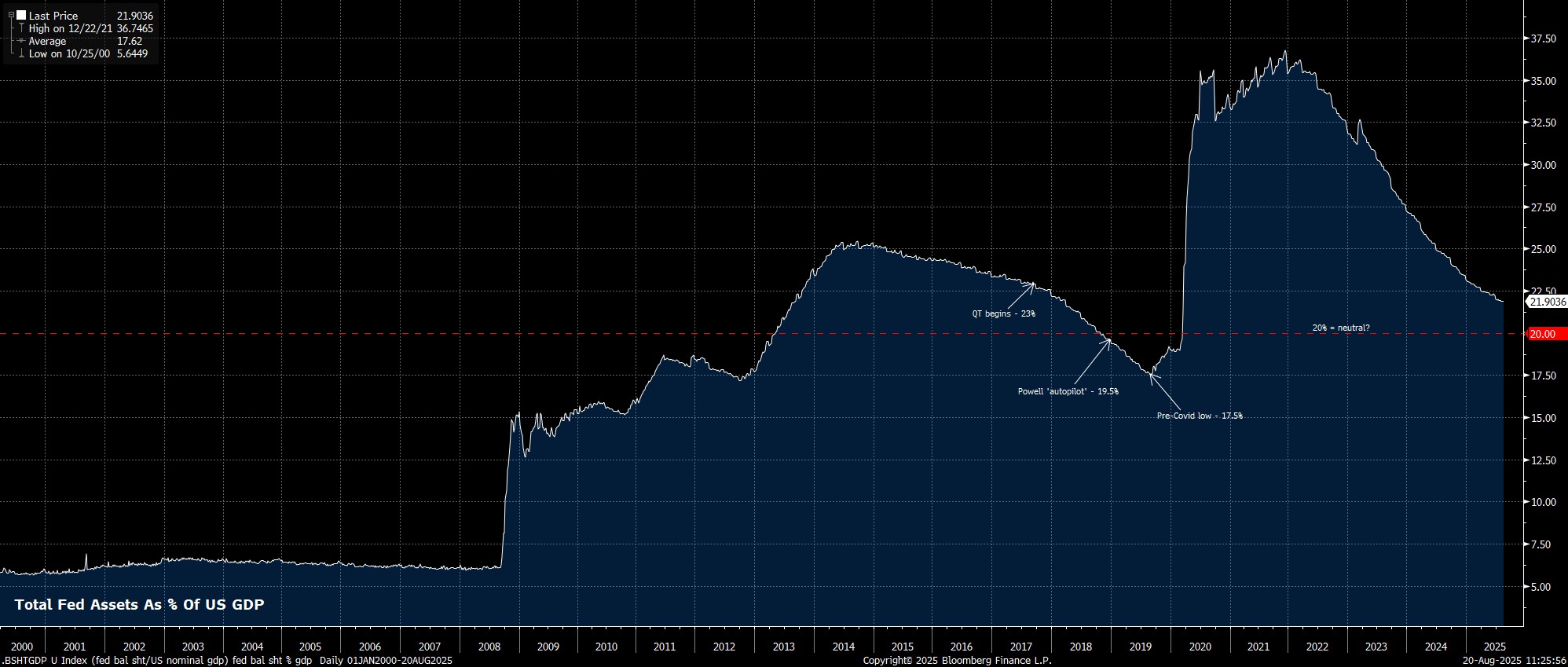

Secondly, balance sheet policy isn’t especially restrictive either. The Fed’s total asset stock currently stands a little under 22% of GDP, comfortably above the 20% region beneath which I’d consider things to be ‘tight’, and well above the lows that the balance sheet reached relative to the size of the economy pre-covid.

Next, let’s consider how far the Fed stand from their dual mandate goals, of stable prices and maximum employment. For ease, we will interpret those as inflation at 2%, and unemployment under 4.5%, a decent proxy for ‘full employment’.

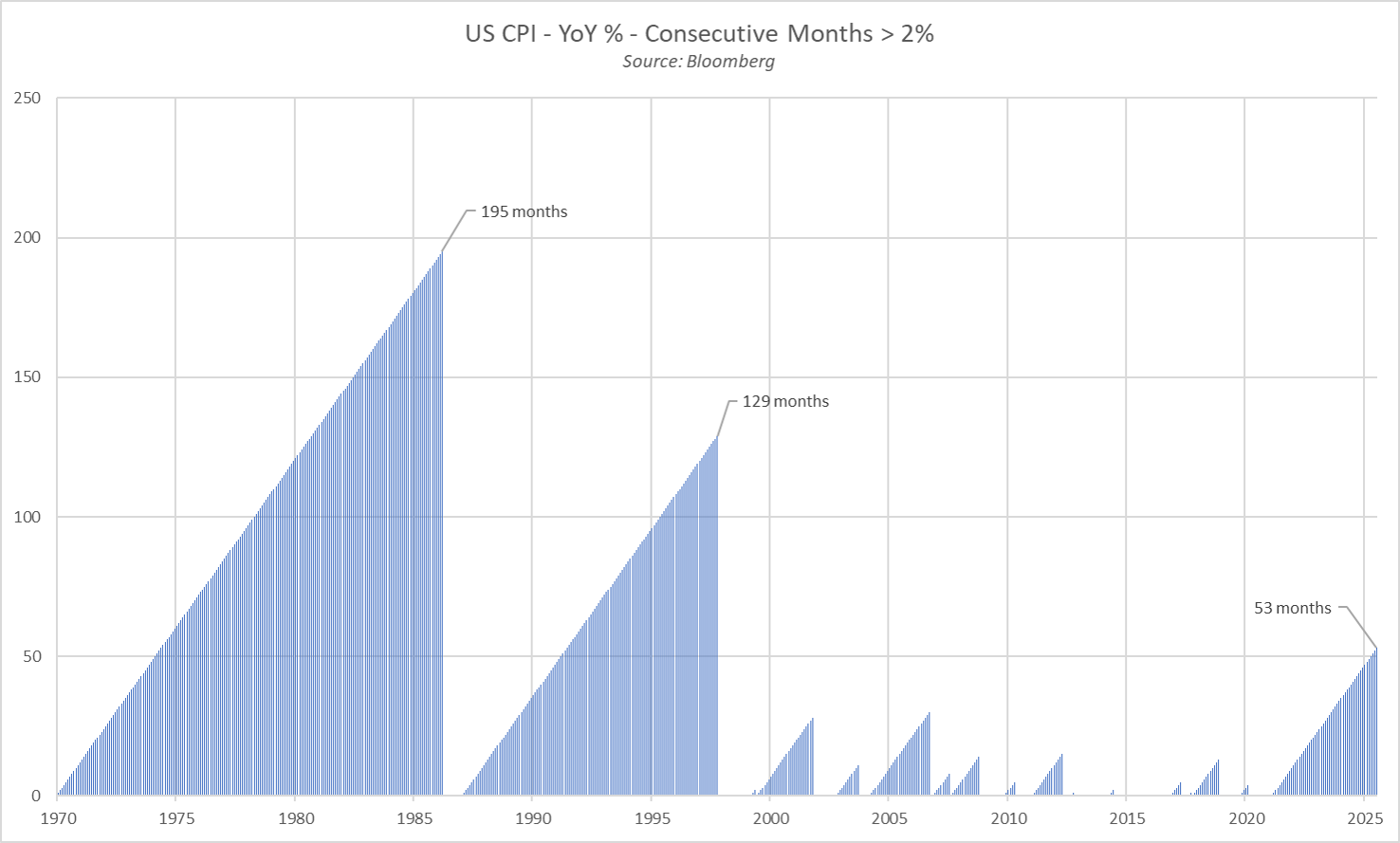

On inflation, headline CPI remains north of the 2% target, as it has done for the last 53 months in a row, with this marking the third longest such stretch in the last five decades. The last time that headline CPI was below the Fed’s 2% was in February 2021, a time when the world looked very different to how it does now.

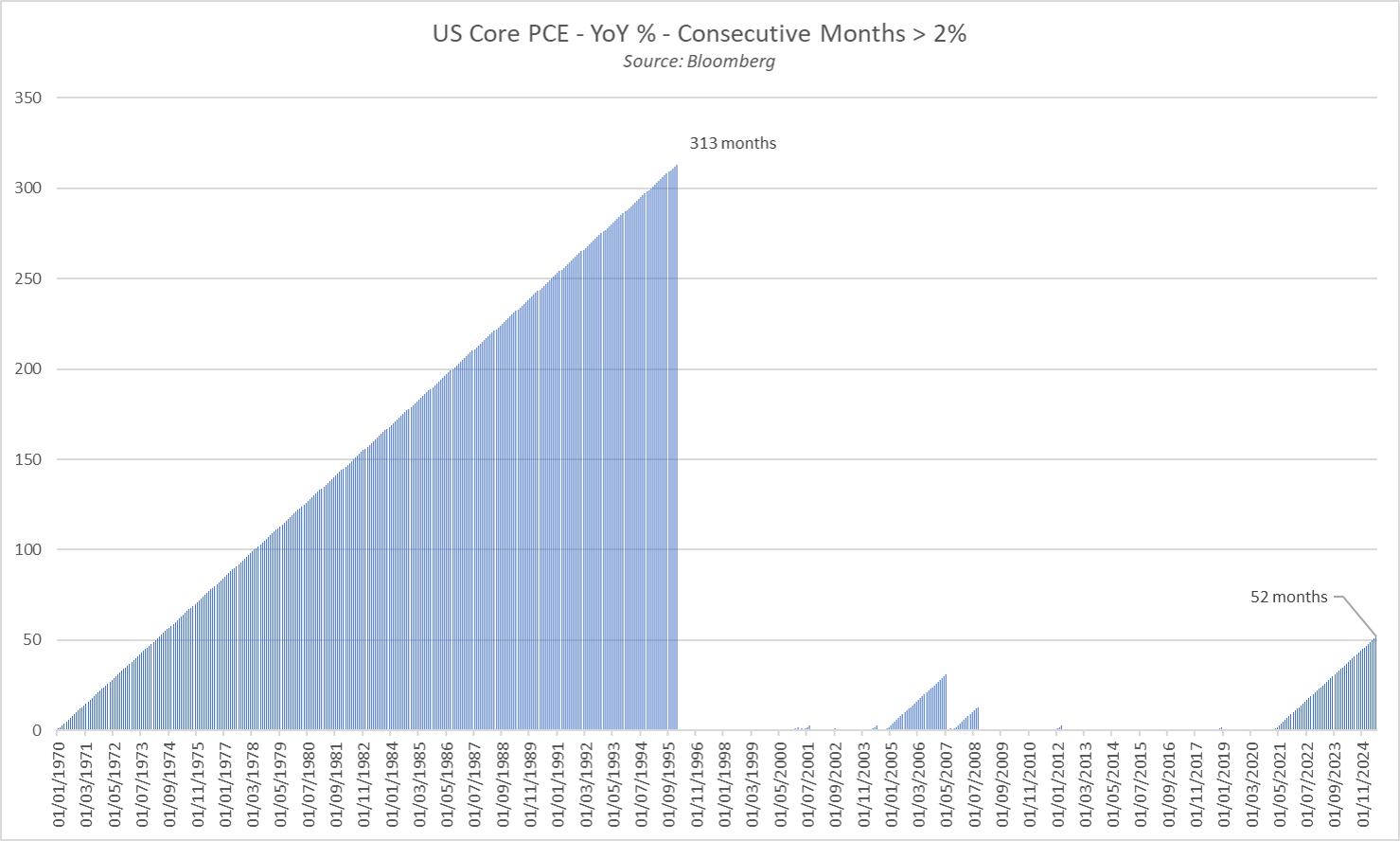

Using the Fed’s preferred gauge of price pressures, the core CPE deflator, paints an uglier picture, with the index having run north of the 2% aim for 52 months running, ahead of the July report due at the end of the month, which marks the second longest stretch since the start of the 70s.

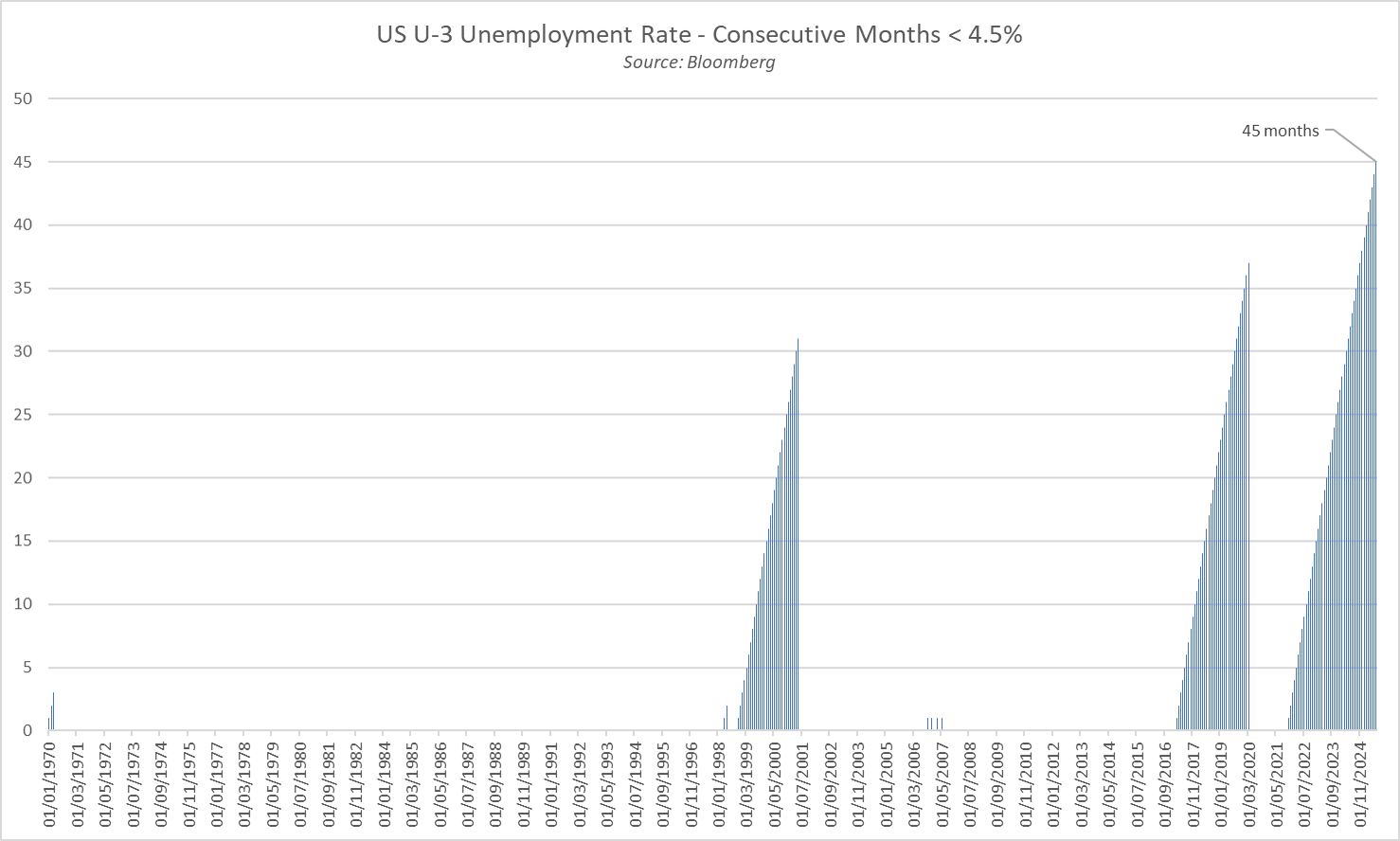

Turning to the labour market, while the pace of nonfarm payrolls growth has slowed, the breakeven payrolls pace has also slowed substantially, primarily by virtue of the labour force expanding at a much more sluggish rate, owing to the effects of increased immigration enforcement. Unemployment, meanwhile, has been north of the aforementioned 4.5% mark – a decent enough proxy for full employment – for 45 months in a row, the longest streak since at least 1970.

Taking all this into account, I’d argue that incoming data firmly reinforces the view of the majority of FOMC members that the inflation side of the dual mandate remains further from being achieved than the employment side of the mandate. I would also argue that, given the numerous upside price risks which remain on the outlook, the inflation side of the mandate will likely also take longer to achieve the Fed’s goal than the employment part, which is already hitting target.

Hence, this all helps to reinforce the ‘wait and see’ approach that has become the hallmark of monetary policy this year. As Chair Powell has noted on numerous occasions, the US economy remains in a ‘good place’, which in turn allows the FOMC to remain in their present ‘well-positioned’ policy stance, assessing incoming developments before, eventually, resuming the journey back towards a more neutral setting of the fed funds rate.

I’d expect that this is a message Powell will reinforce in his keynote address at the Jackson Hole Symposium on Friday, likely disappointing numerous doves in the market, who have bumped up the odds on a September cut to as high as 85%. My base case remains that the Fed cut just once this year, in December.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.