- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Mexican Peso Depreciation: Internal and External Factors Renew Pressure on the MXN

This weakening adds to the volatility that has characterized the market since early August, following the release of U.S. employment data for July and the deleveraging partially induced by the Bank of Japan's (BOJ) stance—factors that have negatively impacted the Mexican currency.

The international economic context continues to be crucial in the peso's depreciation. The recent revision of figures by the U.S. Bureau of Labor Statistics revealed a faster-than-expected cooling of the labor market. This revision showed that, for the period ending in March 2024, there were 818,000 fewer jobs added than initially reported, averaging 68,000 fewer jobs per month. This data, alongside the July report indicating the creation of only 114,000 jobs—well below the expected 175,000—highlights the weakness of the U.S. labor market.

It is important to underscore the close economic relationship between Mexico and the United States, which means that any sign of weakness in the U.S. economy has a direct impact on Mexico's. With over 80% of Mexican exports directed northward, a slowdown in the U.S. labor market or economic activity can quickly translate into reduced demand for Mexican products, affecting key sectors such as manufacturing and automotive. As the saying goes, when the United States sneezes, Mexico catches a cold—a metaphor that illustrates the vulnerability of the Mexican economy to the economic fluctuations of its main trading partner.

On the domestic front, the Mexican economy has been facing its own challenges. Recent economic data has been less favorable than expected, as evidenced by a 3.9% year-on-year drop in retail sales in June 2024—the largest decline since December 2020. Additionally, consumer confidence has recently shown signs of weakening, standing at 46.9 points in July, marking the second decline of the year and reflecting contractions across all five main components of the index.

Tomorrow, the final figures for Mexico's economic growth are expected to be released, with anticipations pointing to a confirmation of 2.2% growth in 2024. This reaffirms a lower level of economic activity compared to previous years and underscores the slowdown of the Mexican economy, which has also been a key factor in the peso's depreciation.

Political uncertainty in Mexico has also played a decisive role in the current weakness of the currency. Recently, attention has focused on a potential judicial reform proposed by the current administration, which has raised concerns among investors and contributed to market volatility. The proposal to elect Supreme Court justices through popular vote and the creation of an independent body to oversee the integrity of the judiciary have been contentious issues that have added pressure on the peso.

The political landscape in the United States also poses a risk factor for the Mexican currency. Although the chances of Donald Trump's return have been mitigated, the potential for his comeback has not been entirely ruled out. This adverse scenario, previously identified as a significant risk for the peso, remains a source of uncertainty.

USD/MXN Technical Analysis: Positive Trend Strengthens After Breaking Key Level

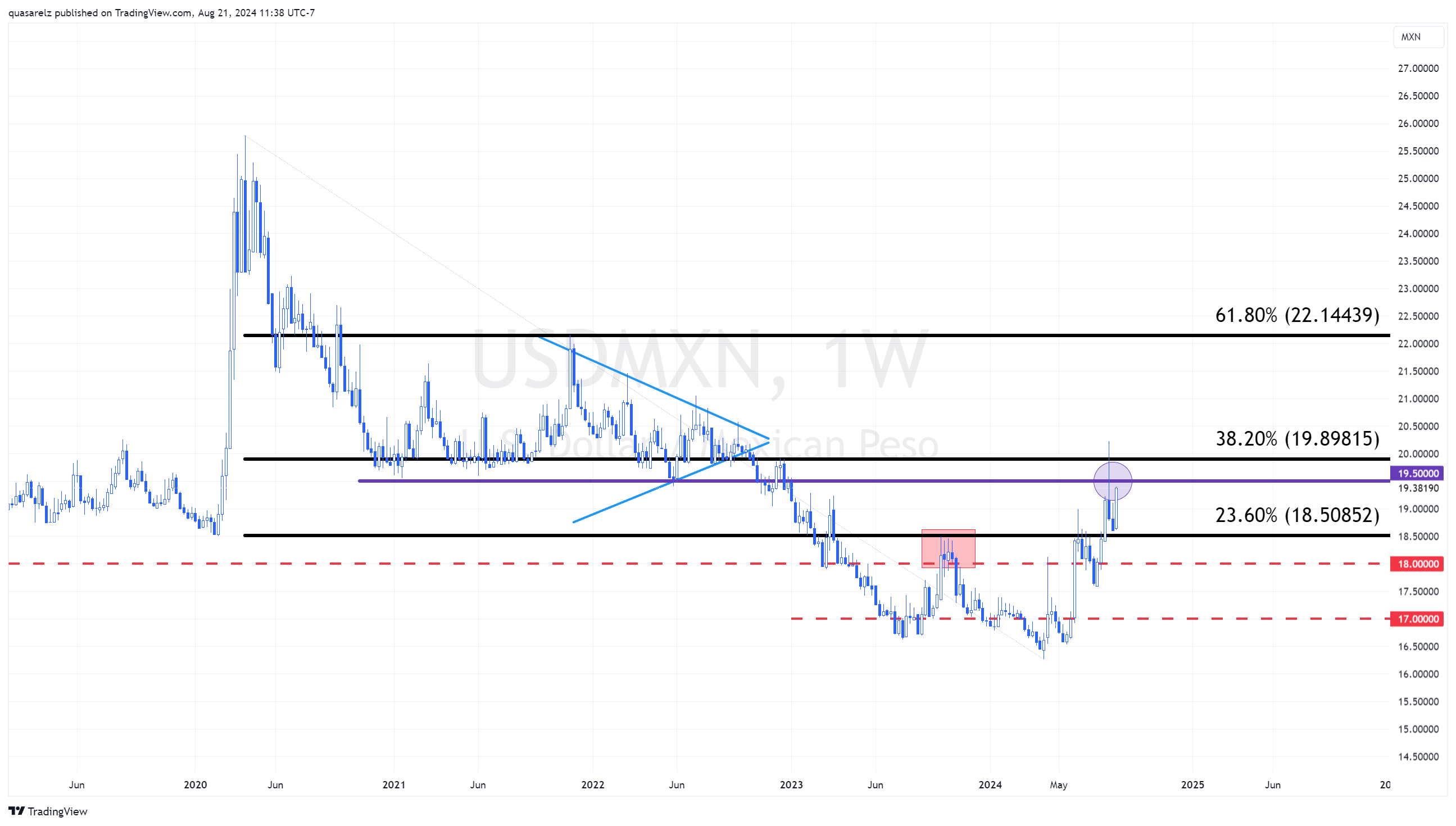

The USD/MXN pair continues to exhibit a positive structure, confirming its strength by breaking through the 23.60% Fibonacci retracement level at 18.5 pesos per dollar, calculated from the 2020 highs. This level, which acted as a key support under the polarity principle, has provided a solid foundation for the recent rebound observed in the pair.

After finding support at 18.5, the USD/MXN has resumed its upward trajectory, swiftly approaching the next critical resistance levels. The first of these is at 19.5 pesos per dollar. Further up, the 38.20% Fibonacci retracement, located near the crucial psychological level of 20 pesos per dollar, presents an additional significant barrier. This level has previously proven to be substantial resistance following the turmoil caused by July's Non-Farm Payrolls (NFP) data and the unwinding of carry trade positions in Japanese yen (JPY). Notably, the 20 pesos per dollar level is critical given that it served as an important support during 2021 and 2022.

The behavior of the USD/MXN in the coming days will be pivotal in determining whether the pair can maintain its positive momentum and overcome these resistance levels, potentially paving the way for further gains in the medium term.

Conclusion

In this environment of uncertainty and volatility, both domestically and internationally, the Mexican peso will continue to face significant challenges, with the primary path of least resistance remaining upward.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.