CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Market Volatility & Trading Psychology: Why the best market measure of ‘Fear’ is correlation

A Bruising Week for Risk Traders

Last week delivered a bruising market for risk traders. Reduced liquidity at the top of the order book led to more exaggerated moves, sharp intraday swings, and vicious reversals. Traders had to stay extremely nimble and open-minded - many shifted towards a day-trading mindset, refraining from holding positions when they weren’t at the screens and able to react in real time.

Volatility Spikes and the VIX Index as a Fear Gauge

A major focal point was on the VIX. While markets became deeply oversold — especially in crypto - we saw a significant appetite to buy equity volatility. Trader’s dislike buying volatility through options because it’s costs money to hold the position, given the negative carry, and volatility is one of the most mean-reverting assets in global markets. So, the fact we saw strong demand for puts and protection against further drawdown speaks volumes, and many saw the VIX at 28% - and well above the 12-month average of 18% - as a sign of fear in the markets.

The VIX aside, another preferred gauge on equity market stress, one should focus on the correlations – not just within asset classes, but within the companies that make up the S&P500.

Why Correlations May be a Better ‘Fear Gauge’ Than the Vix

Correlations arguably provide the clearest measure of market fear. We’re not just talking about correlations across asset classes – as risky assets can rise together in a healthy bull market - e.g., S&P 500 rallying, volatility drifting lower, gold higher, crypto higher, etc.

What matters is the realised (and implied) correlations within the companies within an equity index.

During last week’s selloff, we saw strong downside alignment across assets:

- Nasdaq futures hit a 9.5% drawdownfrom the highs

- The VIX spiked to 28%

- Aggressive short-selling activity picked up notably in the AI plays and the lower quality equities.

- Credit spreads widened

- Gold came under pressure

- Bitcoin traded to a $80,497 – taking the max drawdown from the 6 October highs to 36%

Everything moved together — the classic signature of broad-based deleveraging.

The CBOE One-Month Correlation Index: A Key Market Fear Signal

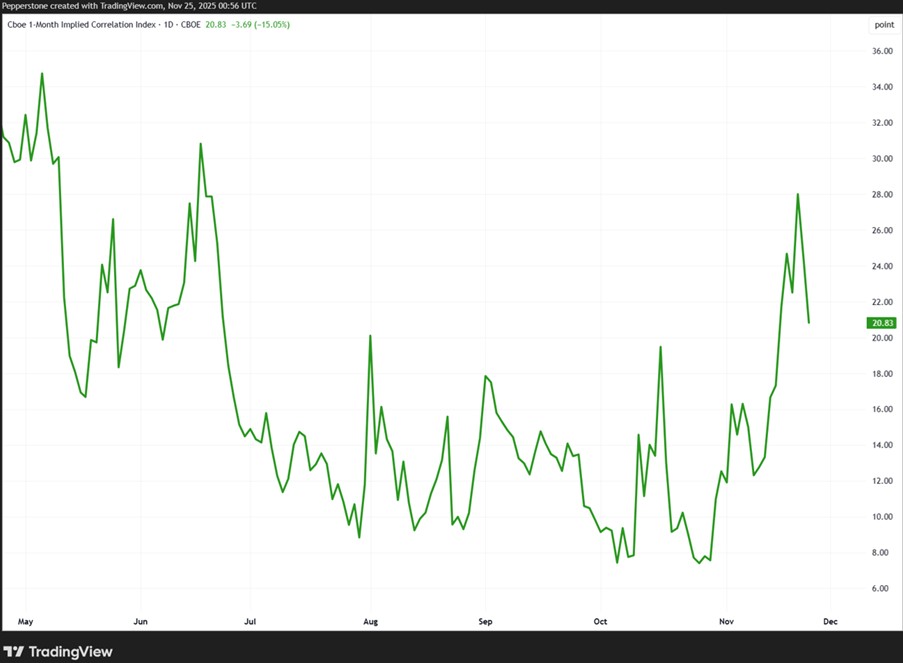

We can also see through this period that the CBOE One-Month Correlation Index, which measures the correlations among S&P 500 companies, rose from 7% to 32%. An impressive increase in the relationship between the 500 S&P500 constituents.

High correlation means:

- Stock-specific factors matter less, and equity moves as one

- Macro dominates

- Hedge funds de-risk

- Systematic players move in the same direction

This surge makes sense given concerns around:

- GPU depreciation impacting the hyperscalers future earnings

- A rapid increase in corporate debt issuanceto fund the AI infrastructure build out would increase net debt/cashflows, net debt/EBITDA to more concerning levels – with traders hedging risk through credit default swaps (CDS).

- A sharp reduction in market pricing for the Fed to cut rate in December.

- Overly extended positioning in the AI/semi space.

At one point, the probability of a December Fed cut fell to 35%, which fed the risk-off tone.

A Healthier Setup for the Week Ahead

Fast forward to now, and the landscape looks far more constructive:

- The markets implied probability for the Fed to cut in December has surged to 92%

- VIX has pulled back to 20%

- S&P500 equity correlation have dropped to ~20%

Lower correlations are bullish — they signal a return of stock picking, discretionary flows, and reduced macro stress. This is typically the kind of backdrop where a Santa Claus rally can begin to form.

Is AI Leadership Returning?

With correlations easing, leadership is starting to re-emerge:

- Alphabet is raising its hand as the market leader and rallying hard into new highs.

- Broadcom is ripping again

- AI sentiment appears to be turning, while traders offset this position staying overweight Healthcare names.

The question now: Is the AI trade back on?

If the correlations within S&P500 companies continue to fall, there’s a strong chance it will marry with a rally in the S&P500 and NAS100.

Bottom Line

For me, equity correlations remain the most important indicator of fear in the market. If they continue to retreat, the path of least resistance is for risk to stabilise and then rip higher. The bulls finally have a setup they can work with.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.