- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

As has been noted on many an occasion, this year is one where more voters than ever before will head to the polls across the world. In total, 2024 will see elections in at least 64 countries, as well as the European Union, with almost half of the global population set to exercise their democratic right.

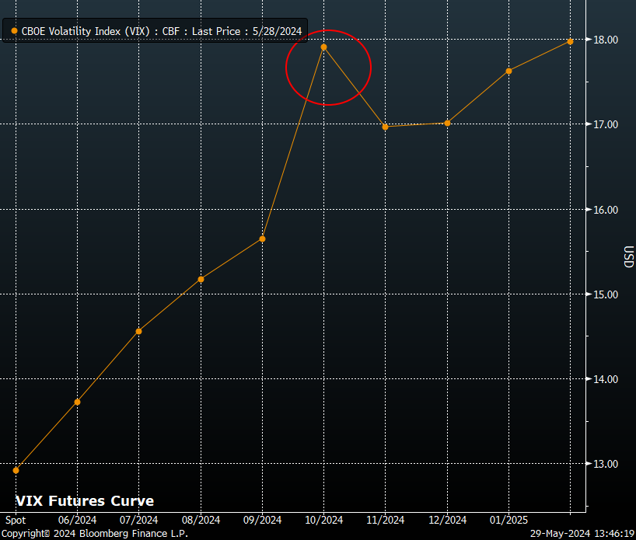

Of course, the most significant election, on a global scale at least, will be the US presidential election in November. Though it remains rather too early for this to be a tradeable event at the present juncture, particularly with policy detail still rather thin on the ground, markets are braced for higher volatility around election time.

As the above shows, the VIX futures curve has a rather notable ‘kink’ higher around the October expiry, implying markets pricing a higher level of vol in the run-up to the 5th November vote.

What is, perhaps, more interesting however, is that there is no such pricing for elevated vol around the November VIX expiry, suggesting that markets are not pricing the risk of a prolonged post-election process, akin to that seen in 2020, where the result was not known for some days after polls closed, and was then subject to various legal challenges at both a state and national level. With it impossible to rule out a repeat situation, perhaps markets are under-pricing the risk of the election result not being immediately known.

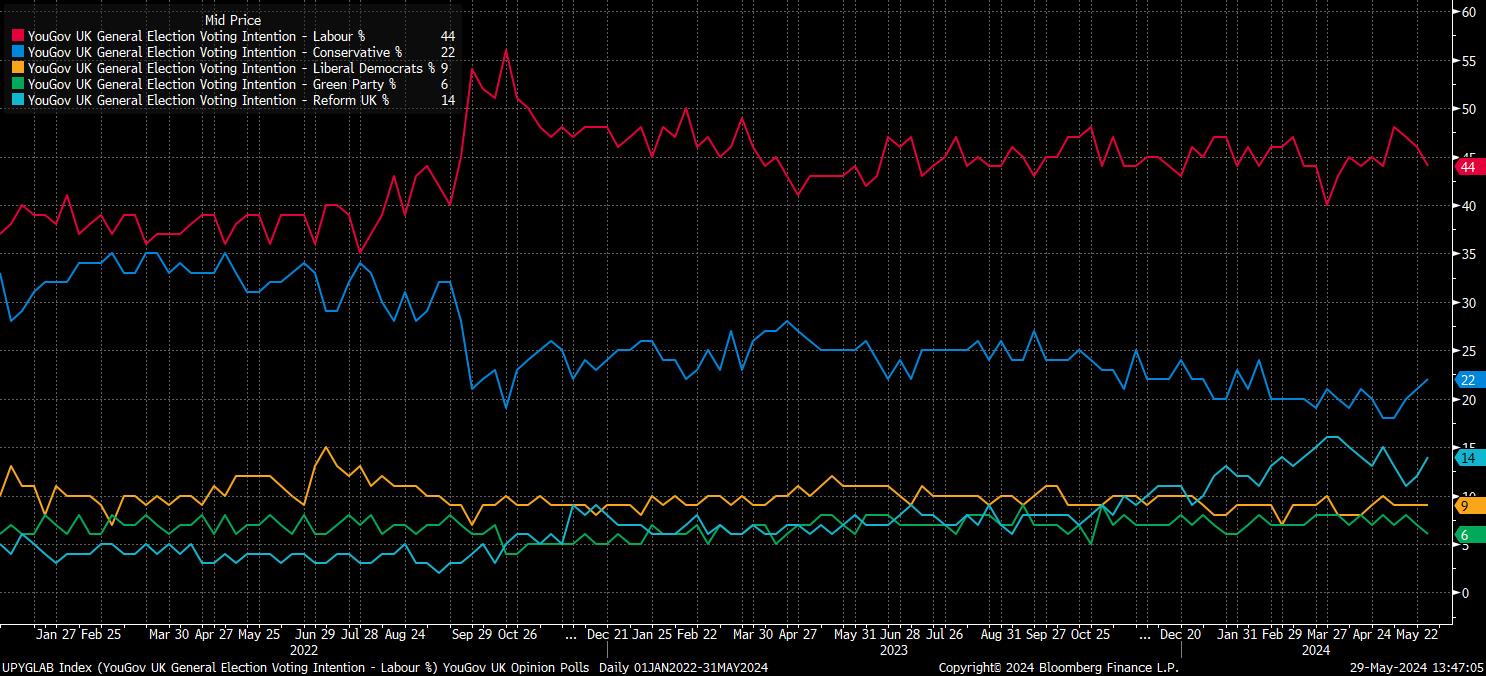

In any case, before then, there is the small matter of the UK general election to grapple with even if, as polls currently suggest, a Labour majority may be something of a foregone conclusion come early-July.

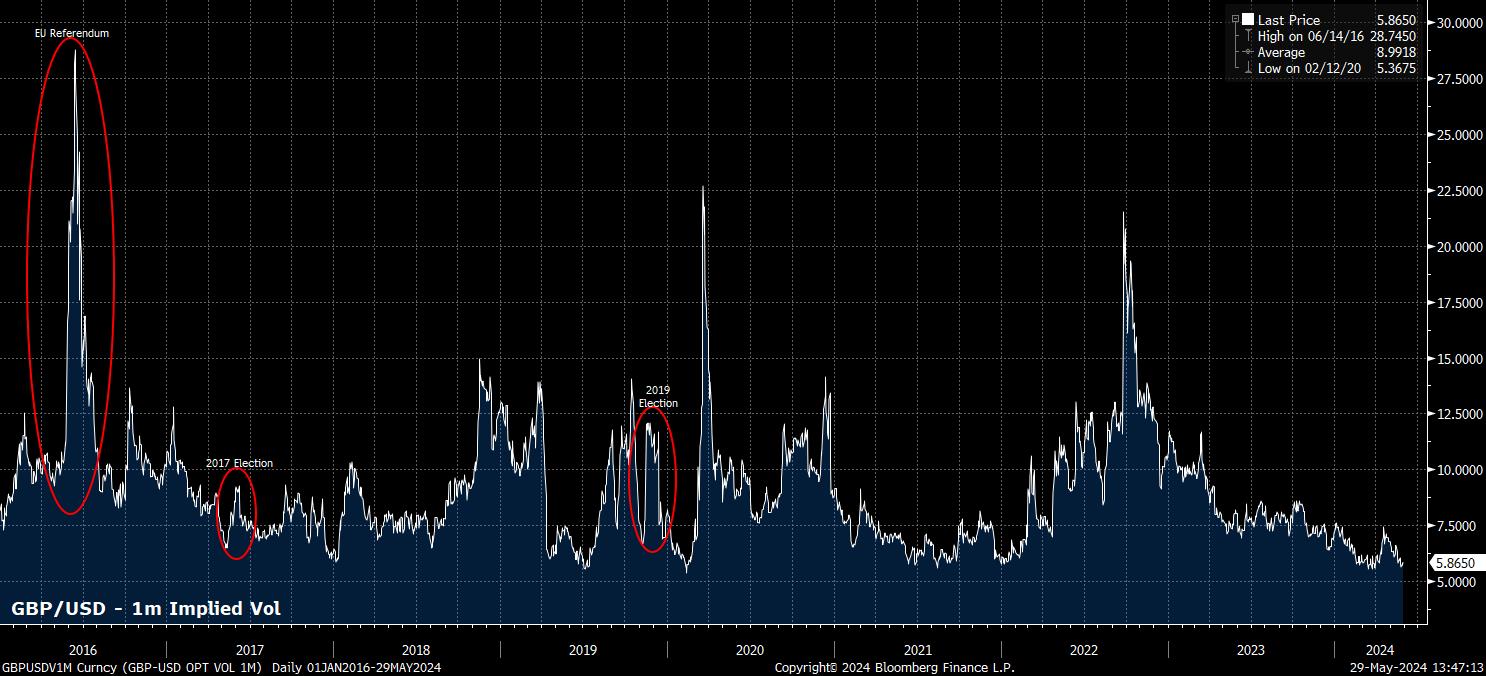

Though the result may well appear to be a ‘done deal’, even at this early stage, some increase in vol does seem likely as polling day nears, particularly as participants hedge the two primary GBP tail risk scenarios – the upside risk of a surprise Tory majority, and the downside risk of a hung parliament.

Albeit not a predictor of the future, a look at recent elections suggests that any rise in GBP vols does tend to be rather short-lived around polling day. The current landscape would suggest that similar may pan out once more, particularly with fiscal headroom so limited, and differences in fiscal policy between the major parties next to non-existent.

Of course, it is not just these two polls which will be in focus. This week, South Africa votes in a general election, while in early-June results from the Indian election – the largest in world history – will be released. Furthermore, this weekend sees Mexicans head to the polls, while voting will also soon get underway in the next EU Parliament election, the first such election since the UK left the bloc.

Naturally, this begs the question as to how – or indeed if – one should adapt their trading style around significant political events.

Of course, nothing in these columns should be taken as advice. However, there are two important considerations when it comes to political events impacting financial markets. The first is the likely increase in volatility, as noted above, which obviously has significant implications in terms of risk management, given the elevated potential for much greater short-term market moves, as election-related headlines drop.

Secondly, at a broader level, in terms of interpreting election results, the most important consideration is how the outcome compares to what markets had discounted in advance of the poll. This potential divergence is where both trading opportunity, and risk, may present itself, hence the importance of paying attention to opinion polling in the run up to an election, in order to gauge shifting market expectations.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.