- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

WHERE WE STAND – Right then, back to the grindstone we go, with only four months of the year left to run; how 2025 has just flown by.

I said in my last note that I hoped markets would behave themselves while I was gone. Mercifully, for the most part, they did – stocks hardly budged all week, trade in the G10 FX complex can at best be described as turgid, while the Treasury curve continued to steepen. In fact, the only move of note was that seen in gold, with spot bullion now just $30-odd off printing a fresh record high, which I’d expect to see sooner rather than later.

Sadly, the same cannot be said in terms of external market actors during my brief hiatus. Not only did we have President Trump trying to fire Fed Governor Cook, France also appears to have descended into yet another political shambles, while here in the UK Chancellor Reeves has put tax-hiking fanatic Torsten Bell in charge of Budget preparations. That’s before even getting to Fed Chair Powell, who used his Jackson Hole address to firmly open the door to a September cut, which now feels like a hell of a long time ago indeed.

Those remarks, though, with Powell noting that the shifting balance of risks “may warrant adjusting our policy stance” have significantly changed the debate around the Fed outlook.

The question is now not whether or not the FOMC will cut in September, but whether the 25bp cut they deliver will be a hawkish one (i.e. a ‘one and done’ move), or a dovish one (i.e. resuming the journey back towards neutral that paused at the start of the year). Friday’s jobs report will be the key determinant as to which of those paths we follow, with the employment side of the dual mandate now taking precedence over inflation, as Powell himself now takes the view that tariffs will likely lead to a ‘one-time shift in the price level’, as opposed to more persistent inflationary pressures. Incoming inflation figures, frankly, don’t matter much to the Fed for now, as the lack of market reaction to Friday’s PCE report proved.

I must admit that I’m not quite as blasé as Powell appears to be regarding the risk of sticky inflation within the US economy, but given that I don’t have a seat on the FOMC, what I think they should be doing with policy doesn’t really matter. What matters, is what they are doing with policy, and the base case on that front must now be that we get 2x 25bp cuts before the year is out, probably in September and December.

My overall market biases, however, are broadly unchanged, with most of the developments over the last week or so actually serving to reinforce those views.

I remain an equity bull, as both economic growth (Q2 GDP growth was revised up to 3.3% annl. QoQ last week) and earnings growth remain impressive, and as an overall calmer tone continues to prevail on the trade front, as participants now seem relatively content with an average tariff rate of 15ish%. While my bull case is not predicated on a looser monetary policy stance, a more dovish Fed delivering rate cuts will not only help the rally along, but also provide something of a ‘comfort blanket’ to the bulls, with the ‘Fed put’ now back in play once again. It’s a strong ‘put’ at that, with the fed funds rate not only 150bp above neutral, but also 400-odd bp above the effective lower bound. The path of least resistance continues to lead higher, with dips standing as buying opportunities.

Elsewhere, curve steepening remains my preferred play not only in the Treasury complex, but in DM Govvies across the board, with Gilts again most susceptible to weakness at the long-end, as the market continues to need no excuse whatsoever to pounce on signs of fiscal incompetence ahead of the autumn Budget.

For Treasuries, in particular, though, while a heavily consensus view, steepeners are a trade I’m happy to stick with for the time being – not only are the FOMC embarking on an easing cycle that runs the risk of inflation expectations un-anchoring from the 2% target, but policy independence also continues to be eroded at a rate of knots, as the ongoing saga over Governor Cook’s future well-evidences.

That erosion of Fed independence, and generally dim view that the Trump Admin continue to take to economic orthodoxy, should pose further headwinds to the greenback, if and when the FX space awakens from its summer slumber that is. The EUR is the most likely beneficiary here, not because the eurozone economy is booming, but simply as it’s the largest alternative bloc in which capital can find a suitable home.

Of course, gold is another such suitable home, with the latest moves against Gov Cook seeing bullion regain its lustre last week, and finally break out to the upside of the recent trading range, notching back-to-back weekly gains. A new record high seems a question of ‘when’ and not ‘if’ now, with a break north of $3,500/oz likely to encourage further buying interest from momentum traders, all the while physical demand remains underpinned as well.

All in all, then, a lot of noise over the last week, but not much to move the needle in the grand scheme of things. Something tells me I might be re-using that phrase a few more times before the year is out!

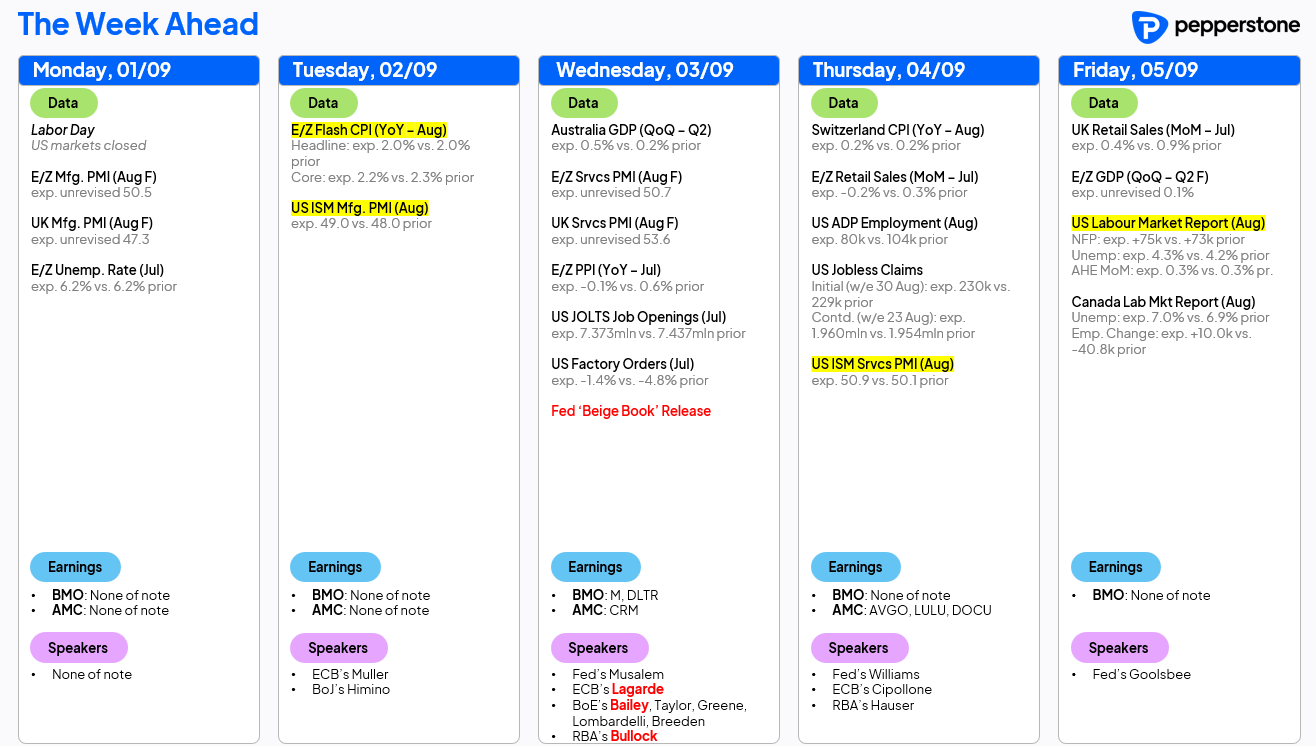

LOOK AHEAD – This week’s docket is heavily skewed towards US releases, somewhat ironically given that our American friends are out today for Labor Day.

In any case, as noted earlier on, Friday’s jobs report stands as the calendar highlight, with headline nonfarm payrolls seen rising by 75k in August, and unemployment set to have ticked modestly higher to 4.3%. A 50bp September cut seems highly unlikely, given the inflation backdrop, so the report is more likely to determine the framing of the 25bp reduction that is delivered – in short, the softer the jobs report the more dovish the cut that is delivered. It’s not only NFP in focus this week, though, with the latest round of ISM PMI surveys also due, in addition to the July JOLTS job openings data, and the Fed’s ‘Beige Book’ of anecdotal economic evidence.

Elsewhere, things are a little more subdued as participants return from their summer breaks. The latest eurozone CPI figures are set to show headline inflation having remained at the 2% target last month, reaffirming the base case that the ECB’s easing cycle is now at an end, with Lagarde & Co set to stand pat at next week’s policy meeting.

Here in the UK, pre-Budget speculation seems to have gone into overdrive, though we still don’t have a date for the speech itself. Given the timings around the OBR’s forecast collation, we’re now looking at mid-November at the earliest for Reeves to deliver the Budget – the ‘Winter is Coming’ headlines write themselves at this stage. Besides that, monetary policy will be in focus this week, with five BoE speakers, including Governor Bailey, on Wednesday, as the policy outlook remains somewhat murky given the hotter-than-expected July CPI figures.

Besides that, trade and geopolitical headlines will be keenly watched as and when they crop up, while this week’s corporate earnings slate is rather light, with Broadcom (AVGO) the only report of note, and Q2 earnings season – for all intents and purposes – now being at an end.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.