- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

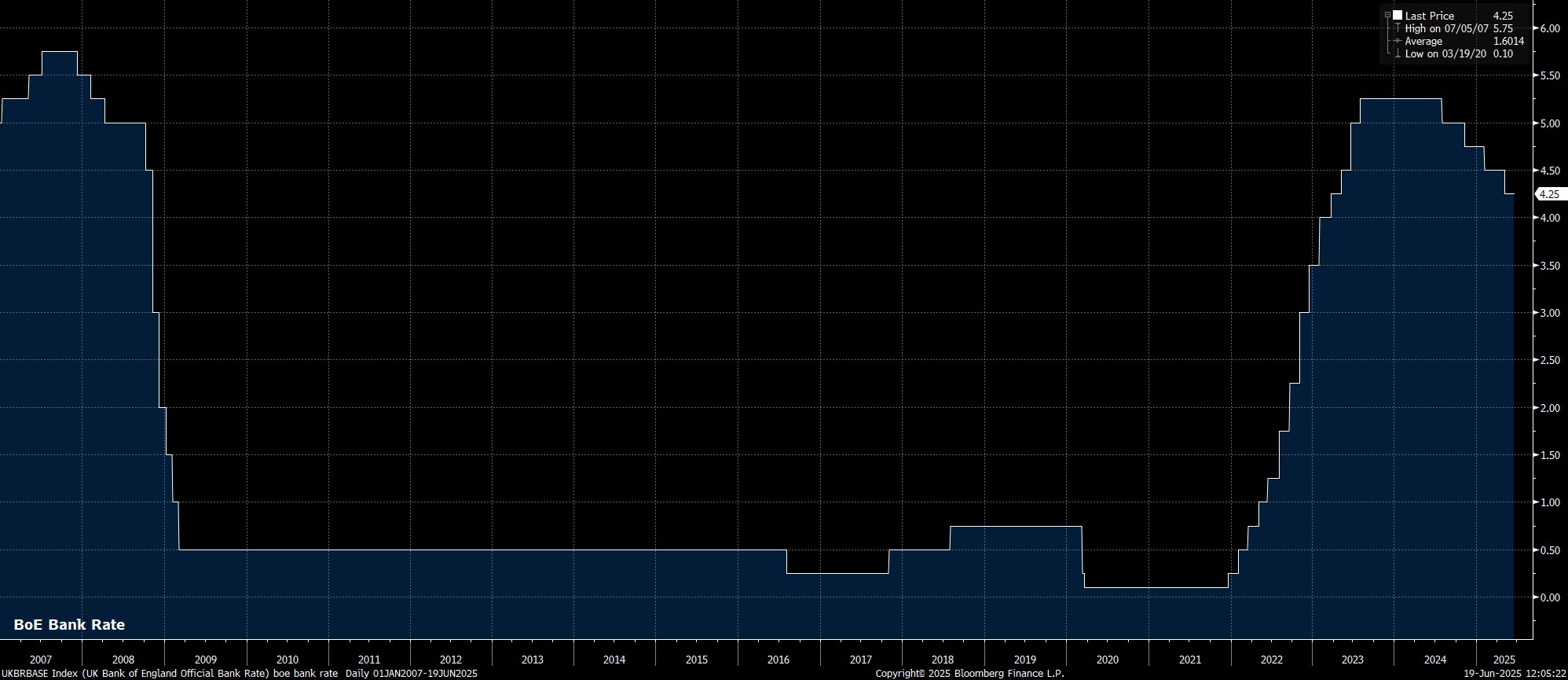

As expected, and fully in line with money market pricing, the Bank of England’s Monetary Policy Committee held Bank Rate steady at 4.25% at the conclusion of the June meeting, standing pat having delivered a 25bp cut last time out, in May.

The decision to stand pat, however, wasn’t a unanimous one among MPC members, with the 9-member Committee again obviously divided over the appropriate path that policy should follow. Three policymakers – external members Taylor & Dhingra, plus Deputy Governor Ramsden – dissented in favour of a 25bp reduction, broadly in line with expectations heading into the meeting.

Despite the vote split, the policy statement was a much more straightforward affair.

Once more, the MPC reiterated that a ‘gradual and careful’ approach will continue to be taken in removing policy restriction, with policy still needing to remain ‘restrictive for sufficiently long’ in order to bear down on the risks of persistent price pressures. The MPC also re-confirmed that a ‘data-dependent’ and ‘meeting by meeting’ course will continue to be taken with regards to future rate decisions.

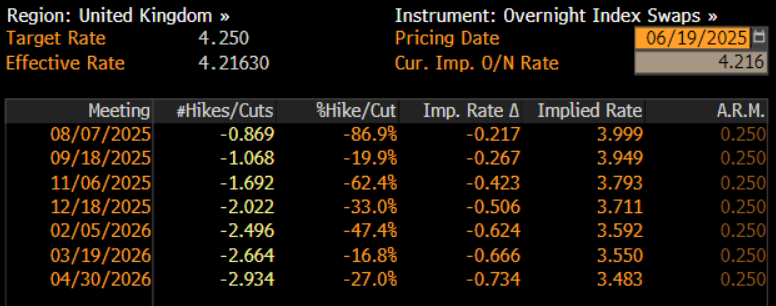

In reaction to this, money markets repriced marginally in a dovish direction. The GBP OIS curve now discounts around an 80% chance of an August cut, up from about 75% prior to the June decision. By year-end, 51bp of easing is now priced, up modestly from the 48bp seen pre-meeting.

Overall, the June MPC meeting is hardly going to go down as a gamechanger for the ‘Old Lady’, as policymakers continue their autopilot approach of delivering a cut at every other policy meeting, removing restriction at a snail’s pace.

Still, this ‘slow and steady’ approach is increasingly likely to be on borrowed time, with the labour market now weakening rapidly, as downside growth risks continue to emerge, both factors which substantially reduce the risk of stubborn price pressures becoming embedded within the economy.

This cycle’s next 25bp cut is likely to be delivered in August, by which point CPI metrics will likely have clearly peaked, while further labour market slack is likely to have developed. Should the economy evolve in line with these expectations, the August meet could well be when the MPC finally make a long-overdue dovish pivot, abandoning their current approach of ‘burying their heads in the sand’, and opening the door to a more rapid pace of easing, potentially including cuts in bigger clip sizes, from the autumn.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.