- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

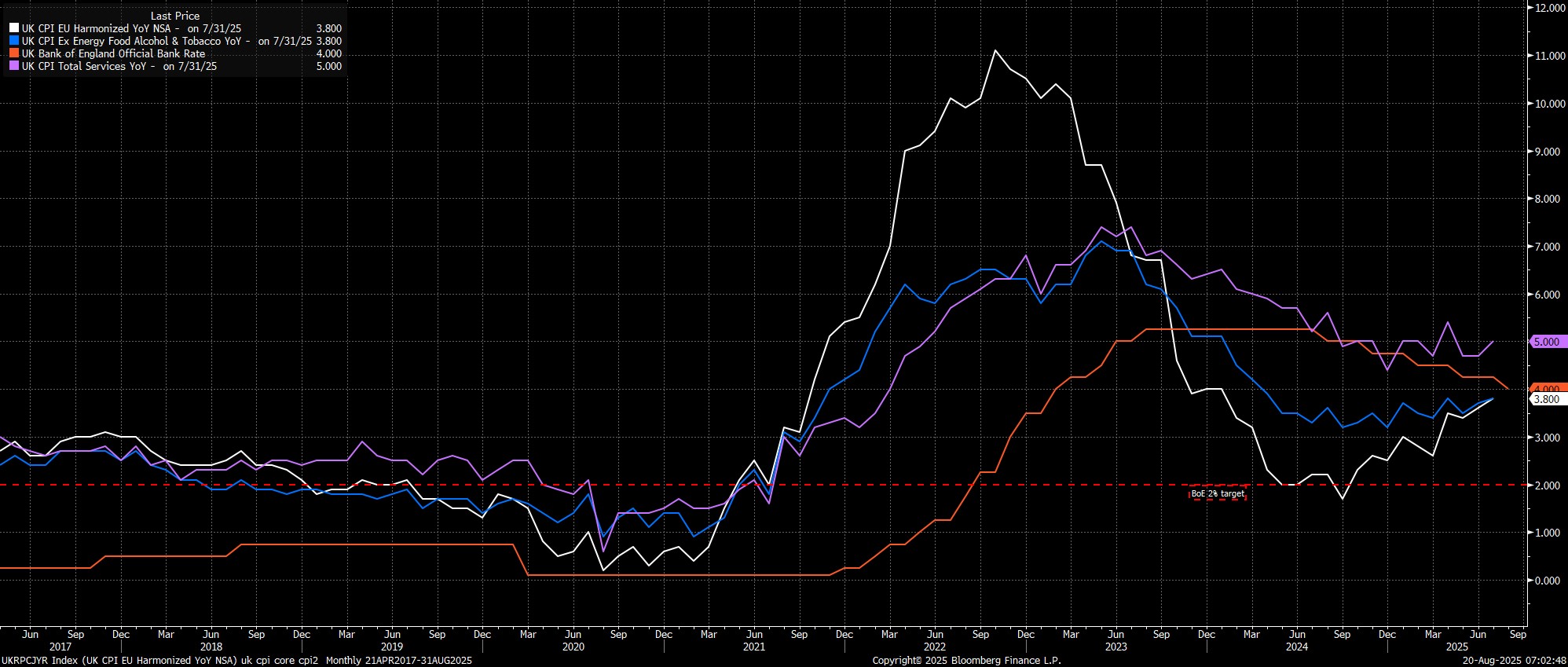

July 2025 UK Inflation: Price Pressures Intensify Further

Headline CPI rose 3.8% YoY in July, the fastest pace since January last year, albeit in line with the Bank of England's latest forecasts. Those same BoE forecasts, however, foresee a further rise in inflation in the months ahead, with CPI set to peak at 4.0% YoY in September, double the MPC's target.

Measures of underlying inflation also pointed to price pressures having remained intense, and incompatible with the Bank's 2% inflation aim. Core CPI, excluding food and energy, rose 3.8% YoY last month, the fastest pace since April, while the closely-watched services CPI metric rose 5.0% on an annual basis, also the highest level since April, and above the Bank's 4.9% YoY forecast.

Overall, the rise in headline prices came largely as a result of yet another chunky rise in food prices, but also by virtue of an upward impulse from consumer energy costs, with the Ofgem price cap this year seeing a much smaller drop than in July 2024, and as a result of the largest July increase in airfares since the start of the millennium. However, these one-off factors do little to allay concerns over those aforementioned underlying metrics remaining at elevated levels, though there may be some upwards skew in certain sections of the services metric, in particular, owing to the sampling having fallen in the middle of a number of major concert tours this summer.

Frankly, though, none of this is likely to move the needle especially much for the Bank of England, with the MPC having voted in favour of a 25bp Bank Rate cut a fortnight ago, by the narrowest possible 5-4 majority.

Today's figures are unlikely enough to persuade those 4 'hawks' that the risks of price pressures becoming embedded within the economy are subsiding in material fashion, though the next 'live' MPC meeting is now not until November, with the September meeting set to see Bank Rate held steady.

With the MPC having retained their guidance around a 'gradual and careful' pace of easing, my base case remains that a cut will be delivered at that November confab, given the continued preference for a regular, quarterly pace of cuts if possible. That said, the bar for further policy easing is clearly now considerably higher than it was mere weeks ago, while there also remains a long way to run until that November decision, especially with the autumn Budget, and likely sizeable fiscal tightening, in the mix during this period as well.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.