- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

July 2025 FOMC Preview: Still In ‘Wait & See’ Mode

Upcoming Policy Decision

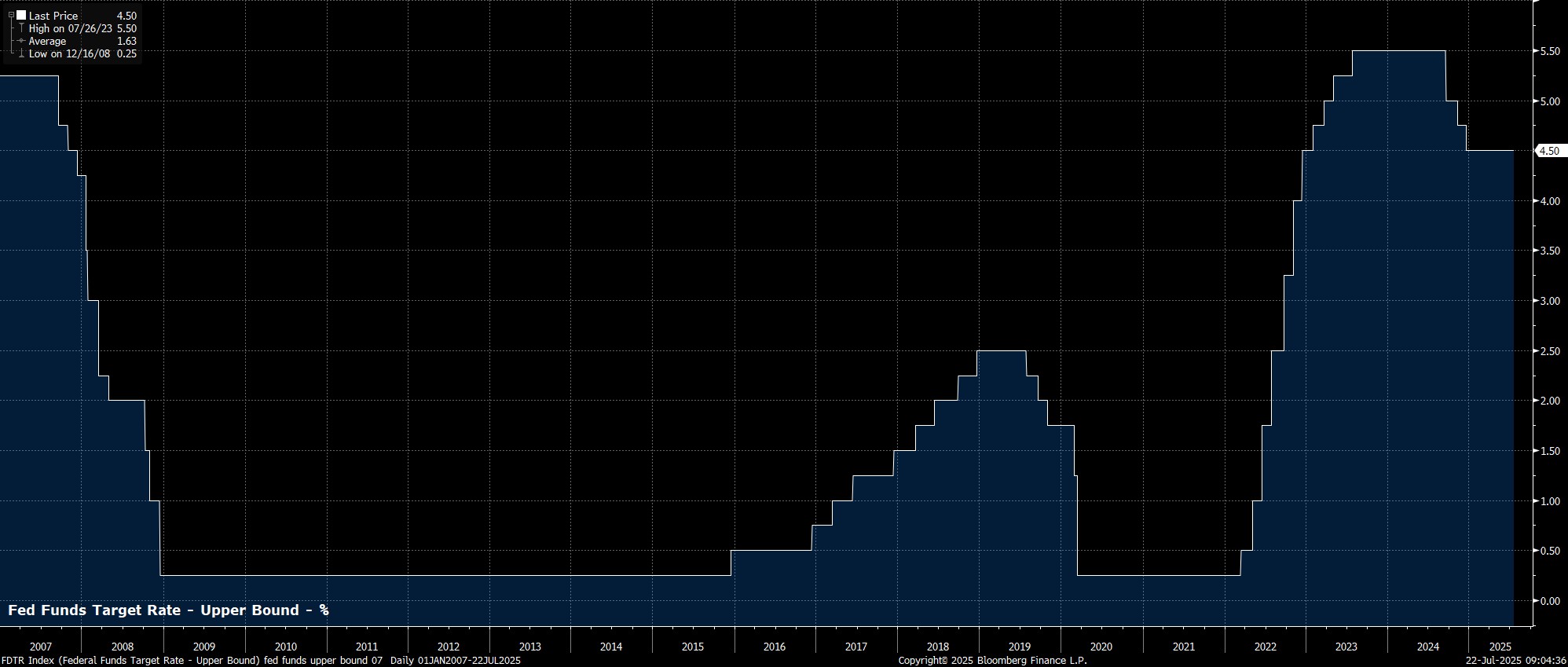

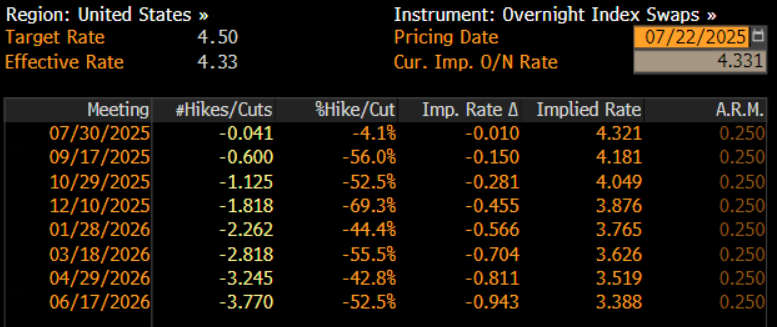

As noted, the target range for the fed funds rate is set to be held steady at 4.25% - 4.50% at the conclusion of the July FOMC meeting. Money markets, per the USD OIS curve, price next-to-no chance of any action this time out, with the next 25bp cut not fully discounted until October, and with around 45bp of easing in the curve by year-end.

A Divided FOMC

That decision, however, is unlikely to be a unanimous one among FOMC members. While the majority of the Committee continue to view a patient, ‘wait and see’ approach as the appropriate policy stance, a couple of Governors have, in recent weeks, marked out a much more dovish position, advocating vocally for more rapid, and sooner, rate reductions.

Governor Waller’s Likely Dovish Dissent

The most vocal on this front has been Governor Waller, appointed to the Board by President Trump back in 2020. While debate rages over whether Waller’s sudden dovish pivot has been caused by macroeconomic developments, or by political opportunism as he attempts to put his name in the hat for the Chair’s job next May, in public at least Waller has framed his argument for a 25bp cut at the July meeting around the labour market.

Per Waller, such a rate reduction, which could be seen as an ‘insurance’ move, is needed due to the ‘frozen’ nature of the labour market, whereby hiring in the private sector has slowed, albeit with layoffs having failed to accelerate. The problem with this argument, though, is that this labour market inertia has almost nothing to do with the cost of credit, and almost everything to do with the significant degree of trade policy uncertainty which continues to cloud the outlook. As such, it is doubtful that lower rates will have much, if any, stimulatory effect on the labour market, unless that trade uncertainty lifts, and businesses begin to feel more certain about the economic outlook.

Possible Additional Dissents

In any case, Waller is set to dissent in favour of a 25bp cut, and may well be joined in that dissent by fellow Trump appointee Governor Bowman. The latter, though, has made her dovish case in a considerably more caveated manner, noting that a July cut would be appropriate ‘if inflation remains subdued’ – which it hasn’t. Hence, there is every chance Bowman votes with the majority, to stand pat on policy.

Expected Policy Statement

Speaking of the economic backdrop, it seems likely that the FOMC’s assessment of the economy will be broadly unchanged from that issued last time out, with the policy statement set to largely be a ‘copy and paste’ of that issued after the June confab.

As such, the Committee are again likely to describe economic activity as expanding at a ‘solid pace’, unemployment ‘remaining low’, and inflation being ‘somewhat elevated’. Meanwhile, policymakers will reiterate their ‘attentiveness’ to risks on both sides of the dual mandate, while also describing economic uncertainty as ‘remaining elevated’; the description that uncertainty has ‘diminished’ may be dropped, in more of a housekeeping-related language change than anything else.

Data Supports A Patient Stance

Recent data supports both those statement comments, and the FOMC’s ‘wait and see’ policy approach.

Headline CPI rose to 2.7% YoY in June, the highest level since February, while core prices rose 2.9% YoY, also a 4-month high. Of more concern, core goods prices rose 0.7% YoY, the fastest pace in almost 2 years, in an obvious sign that tariff costs are slowly but surely being passed onto consumers, in the form of higher prices. Said tariff pass-through is set to continue for the next few months, as inventories continue to be drawn down, and as the threat of even higher tariffs on US imports from 1st August continues to loom large.

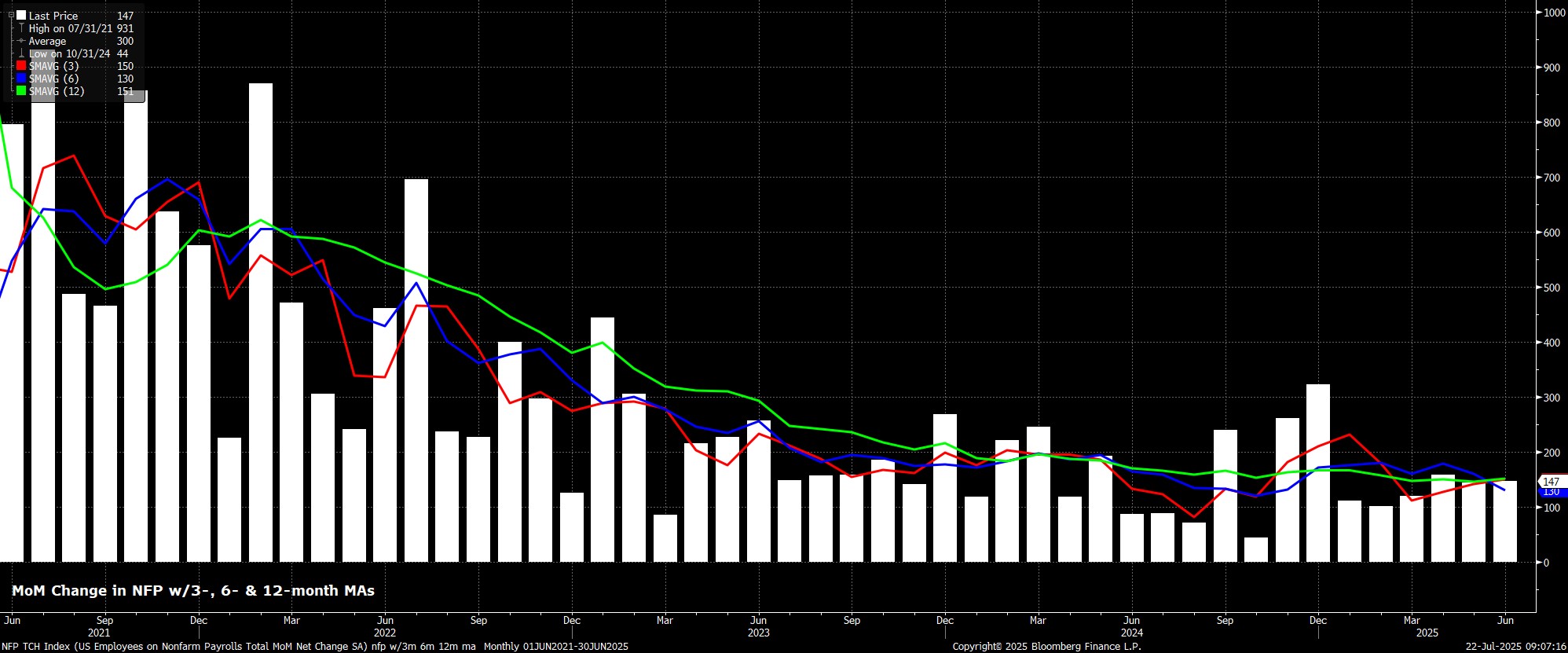

Meanwhile, the labour market remains resilient. Unemployment surprisingly fell to 4.1% last month, while headline nonfarm payrolls rose by +147k, in turn taking the 3-month average of job gains to +150k. Such a pace is comfortably above the breakeven rate and, even if private sector job creation has slowed a touch in recent months, the labour market as a whole is still in robust health, despite the significant degree of prevailing economic uncertainty.

This, in turn, continues to underpin other areas of the economy, with consumer spending healthy, and underlying economic growth still solid, even if many business investment decisions continue to be postponed, pending greater clarity on the trade front.

Powell’s Presser

At the post-meeting press conference, Chair Powell is likely to nod strongly towards the resilient nature of the economy, which in turn allows policymakers to continue to take a patient approach to future policy decisions, biding their time until greater clarity is obtained on whether tariff-induced inflation is likely to pose a risk of persistent price pressures becoming embedded within the economy.

Naturally, given recent events, including President Trump reportedly preparing to fire Chair Powell, media questioning is likely to focus heavily on both Powell’s future, and the issue of monetary policy independence. Here, Powell is set to play things with a ‘straight bat’, stressing that he has no intention of resigning from his post, while also re-affirming that policy is set objectively, based on the Committee’s assessment of the balance of risks to the economic outlook, and not based on the whims of the occupant of the Oval Office.

Powell is also likely to make no comments on his plans after next May, particularly as to whether he will remain a Governor once his term as Chair concludes. On the policy front, Powell should reiterate that a ‘wait and see’ approach remains appropriate, seeking to preserve as much optionality and flexibility on the policy front as possible.

The Policy Outlook

Taking a step back, the remain two plausible policy paths that the Fed may follow over the remainder of the year.

Firstly, were inflation to remain subdued, or cracks in the labour market to emerge, easing policy as soon as the September meeting could become appropriate which, in turn, would likely lead to the FOMC delivering two 25bp cuts (in Sep & Dec) before 2025 is out, in line with the median expectation in the June ‘dot plot’. However, providing that the labour market remains resilient, as it presently does, and assuming that inflation continues to move higher, as seems likely, policymakers are likely to remain in their present ‘wait and see’ stance, not seeking to deliver any further rate cuts unless, and until, the initial tariff-induced inflation fades, and a forecast of disinflation is once again included in the SEP. This latter path, which remains my base case, would point to just one 25bp reduction coming this year, most likely in December.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.