- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Is Trump Right? Should the Fed Be Cutting Rates or Overlooking Key Risks?

The Federal Reserve raised its central 2025 core PCE inflation forecast to 3.1% while lowering its growth forecast to 1.4%, a combination that reeks of stagflation. But is their emphasis on inflation misplaced? Could a tariff-driven bump in goods inflation depress consumption and deepen the growth slowdown?

Trump making his feelings on Jay Powell very clear

President Trump has been very vocal of late on his disdain for Jay Powell and the Fed’s ‘wait and see’ policy stance, declaring, “We have a stupid person at the Fed”.

William Polte, Director of the Federal Home Finance Agency, took to X after the Fed meeting, demanding that Jerome Powell step down as Fed Chair, claiming tight policy is hurting the housing market and the broader U.S. economy.

Both stand to gain from lower interest rates, so market players are hardly surprised by either comment.

A softening housing market

Current 30-year fixed mortgage rates in the U.S. average 6.88%. Though that’s down from the 8% levels seen in October 2023, the cost of credit remains historically high, and we are seeing noticeable softening the US housing market. The Home Builders ETF (XHB) is significantly underperforming the S&P 500. U.S. home prices are slipping, building permits and housing starts are softening, and the NAHB index sits at its lowest level since 2022.

Warning signs from the US labour market?

In most metrics, the US labour market remains in good health: unemployment sits at 4.1%, and nonfarm payrolls - while clearly softening – are not yet giving off any major alarm bells. However, we’re seeing some early warning signs which require ongoing attention. Weekly continuing claims are rising, and the BLS’s household survey is showing a negative rate of change. Regional business surveys report that hiring intentions are softening and that jobs are seen as ‘harder to find’. We also see that the ‘quits rate’, reported as part of the monthly JOLTS report has fallen to 2% - the lowest level since 2020.

Current inflation does give the Fed scope to cut rates

Turning back to inflation: the next US core PCE print is released on June 27, and the market expects a 0.1% month-on-month rise—equivalent to a 2.6% year-on-year pace. If that comes in as expected, the three-month annualised core PCE inflation rate would run at 1.6%, which in isolation might justify rate cuts.

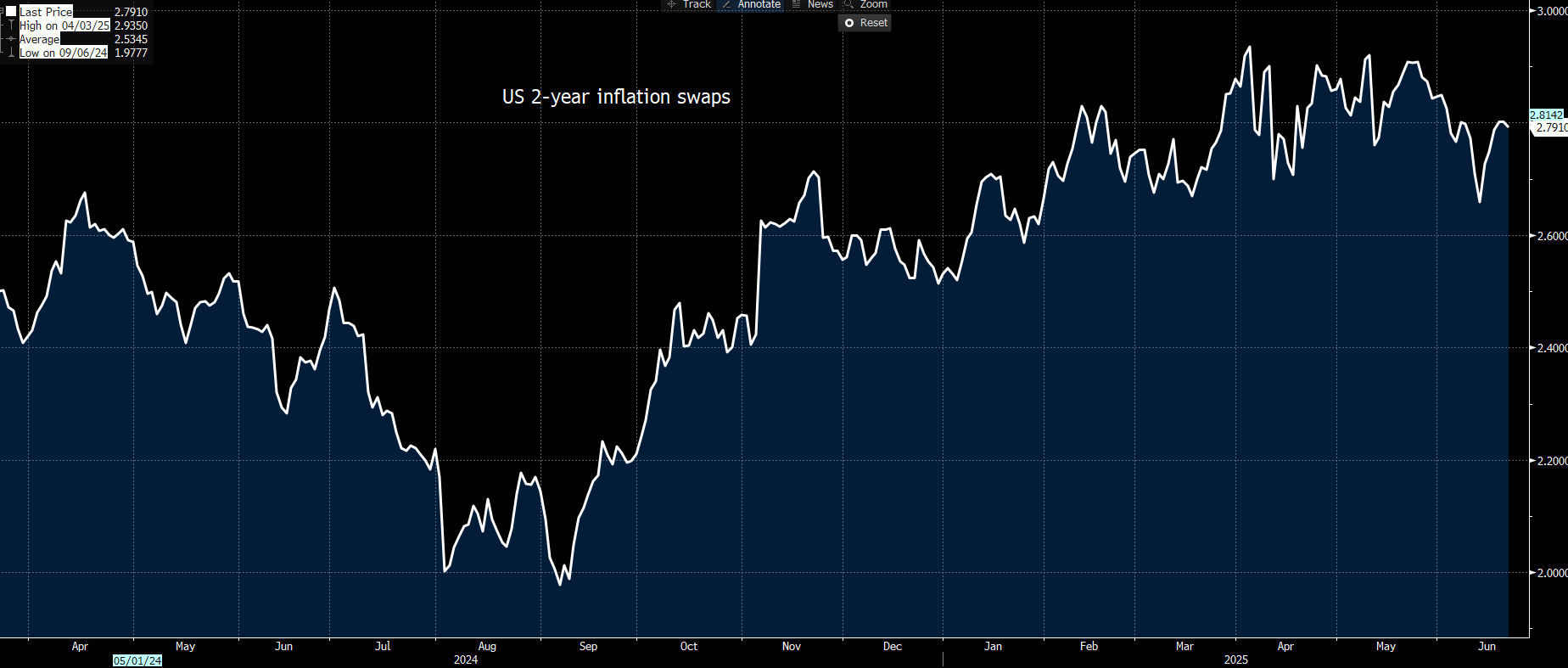

We can also observe market-based measures of future inflation expectations. Two-year inflation swaps stand at 2.79%, while five-year forward inflation swaps sit at 2.46%—both well anchored.

From these metrics, inflation doesn’t look like a major issue right now – and if one was set policy to these present dynamics, perhaps Trump is justified in his view that monetary policy is currently too tight, and the Fed has scope to ease.

Tariffs – therefore – are the missing piece of puzzle and the great unknown. But while tariffs will certainly lift goods inflation, it could also be the trigger that chokes consumption and that could ultimately prove to be disinflationary.

The big question remains: with inflation the Fed’s dominant concern, could the Fed be focused on the wrong risks? Should they pay closer attention to the fragility creeping into the labour market and housing sector—especially given that current inflation readings arguably give them license to maintain policy?

From what we’re seeing unfolding it’s not hard to back Powell & Co in waiting for clarity before acting – and if we do see inflation remaining in check in upcoming reports, and the labour market continues to soften, the Fed will likely take a dovish shift at the July FOMC meeting. This should open the door to renewed broad USD weakness and put renewed upside in gold.

A dovish pivot should also open the Fed increased condemnation from Trump, Pulte, and perhaps other key officials, all making it known that the Fed are behind the curve nd should have acted soon.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.