- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

The severe epidemic has reminded people of H1N1 swine flu in 2009, SARS in 2002/03 and even the Spanish flu in 1918, despite there being clear differences among these diseases. Since coronavirus is highly contagious, the Consular Department of China's Ministry of Foreign Affairs reported that 62 nations have now imposed travel restrictions on Chinese citizens after the World Health Organisation (WHO) declared a ‘public health emergency of international concern’.

For so many trading strategies it’s hard to get away from the influence the Coronavirus is having on broad financial markets. However, perhaps two of the most-watched instruments that have captivated the minds of traders and portrayed market sentiment amid the coronavirus outbreak is the FTSE China A50 Index (CN50) and the offshore Yuan (USDCNH), which are available to trade with Pepperstone.

FTSE China A50 Index (CN50 on MT4/5)

For those who have limited ways to directly invest in China’s equity markets (due to capital controls), we provide clients with the ability to trade the A50 index (CN50), an excellent proxy to access mainland China’s equity markets and to express a view on its macroeconomic developments.

The A50 index is a benchmark listed in the Singapore Future Exchange, including the largest 50 A-share companies by market capitalisation from the Shanghai and Shenzhen stock exchanges. It’s also considered a leading indicator reflecting current sentiment in China, where the coronavirus originated and is concentrated.

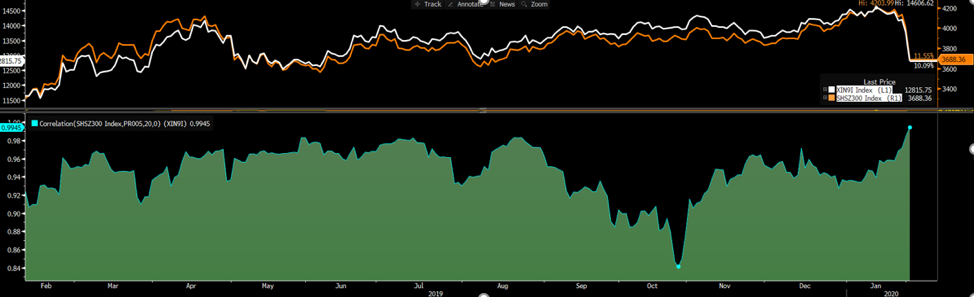

The lower pane of the chart below shows the 20-day rolling correlation between the China A50 index (white line) and the CSI300 (orange line), an index that replicates the performance of the top 300 stocks traded in China. Here we see the correlation at an incredibly high 99.45%, indicating that these two indexes are effectively moving tick by tick.

Source: Bloomberg

Mainland markets were closed between January 24 to February 2 due to the Chinese Lunar New Year. However, the A50 index was open for trade during the same time and plunged nearly 7% amid the panic and uncertainty caused by the coronavirus outbreak. Many other global equity markets also slumped over the period. It was therefore understandable that the CSI 300 followed the decline on Monday when markets reopened and played catch-up to the A50 index.

The PBOC’s impressive 1.2 trillion yuan cash injection was designed to lower the short-term borrowing costs and to calm market sentiment. In the short-term, it seems to have helped, however, whether it’s enough to support stock markets in the long-term remains to be seen.

The economic impact is expected to be severe. The lockdown and holiday extension will heavily hit the service industry, which accounts for half of China’s economy. The first round of shocks affected transport, restaurants, hotels, travel, entertainment, and the list goes on.

We also can't ignore the second wave of the economic blow. Manufacturing is likely to suffer due to the shortage of labor and material supply, while still paying rent, loan interest and salaries. Lower production capacity coupled with subdued confidence could in turn harm export and Investment, overshadowing the entire economy at least in Q1 2020. It’s reported by Bloomberg that China might consider cutting the 2020 GDP forecast during the NPC gathering scheduled in March.

On the flip side, if we take SARS as an example, you’ll find the impact on retail sales and GDP growth was short-lived. We’re already seeing sign authorities are stepping up, putting in measures to shore up the economy in the following months, and to do whatever it takes. One piece of good news regarding the coronavirus is that the total cured patients for the first time outnumbered the death toll.

It will be fascinating to watch how Chinese equities perform, and perhaps the best vehicle for traders to express a view here is with the China A50 index.

Offshore Yuan (USDCNH)

Since onshore yuan (CNY) is restricted and controlled in China, we provide offshore yuan (CNH) as a tradable instrument, which reflects the view on China’s economic mood and the PBOC’s anticipated actions.

Source: Bloomberg

In addition to cash supply, the PBOC said it would alter the costs around its open market operations, the standing lending facility, and other tools to ensure liquidity and stability. It also urged banks to increase lending, rollover matured loans, and not to withdraw loans from the stressed corporates.

Beyond that, lower reserve ratio requirements (RRR) and even a rate cut could be the options for the PBOC.

The easing policy, in theory, should further weaken the currency (USDCNH higher). However, if it proved a positive factor for economic growth, it could even strengthen the currency (USDCNH lower) and we would see that in its daily ‘fixing’ mechanism which takes place each day at 09:15am (06:15am AEDT). As it stands the technicals look bullish for this cross and it seems the market is reacting to the liquidity measures and selling of CNH.

Keep USDCNH on your radar as it is a great guide for many traders on China’s likely monetary policy response.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.