- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Green Shoots in Australia’s Economy: What It Means for the AUD

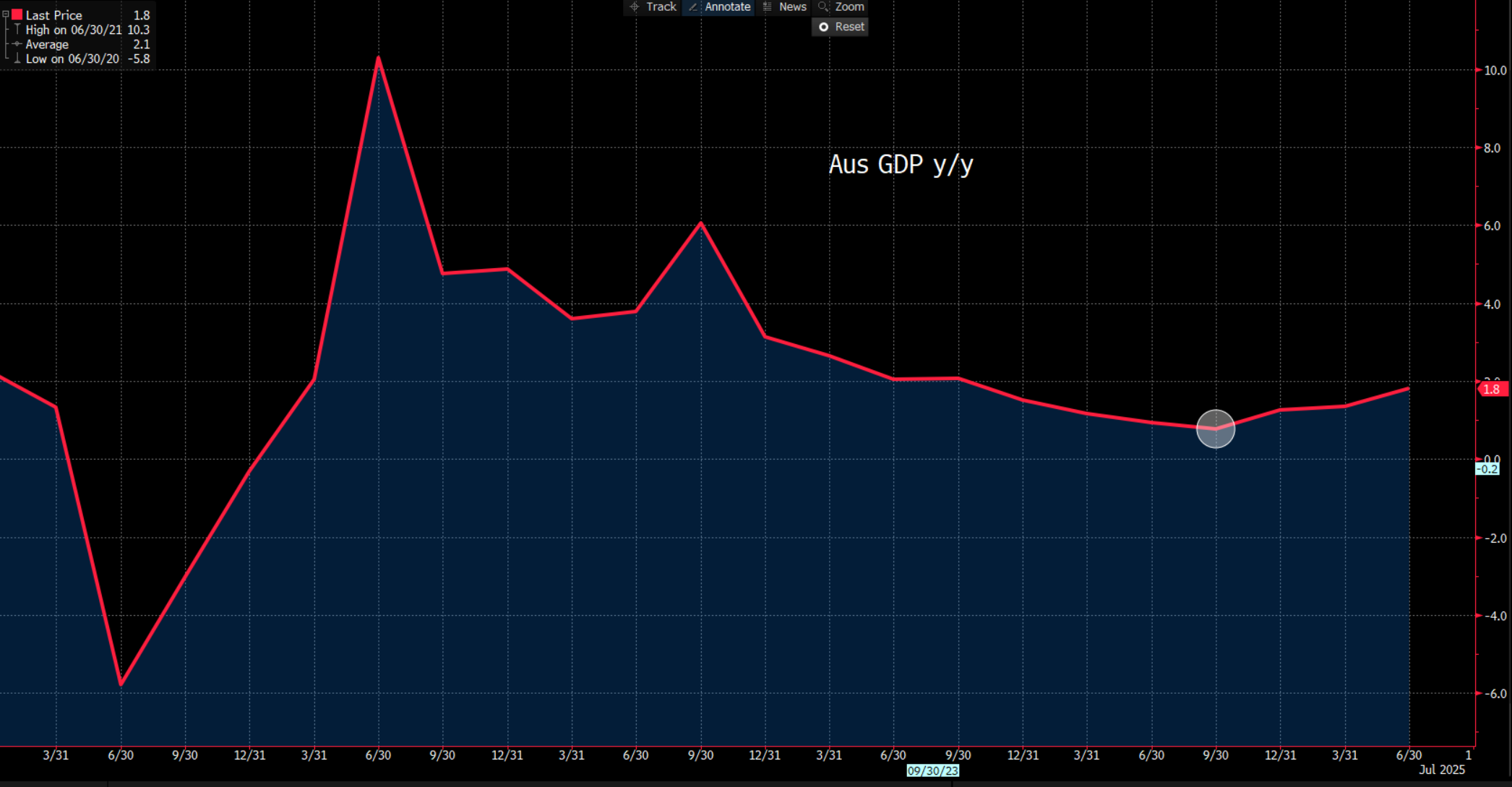

Another important factor is that 1.8% growth is considered by many in economic circles to be the ‘potential’ growth rate. This is key because if Australia’s growth rate were any hotter, it would theoretically spill into higher prices, become inflationary, and mitigate the need for further interest rate cuts.

The Q2 GDP report also showed household consumption expenditures at +0.9% q/q, with consumers taking advantage of EOFY sales and more favourable financial conditions.

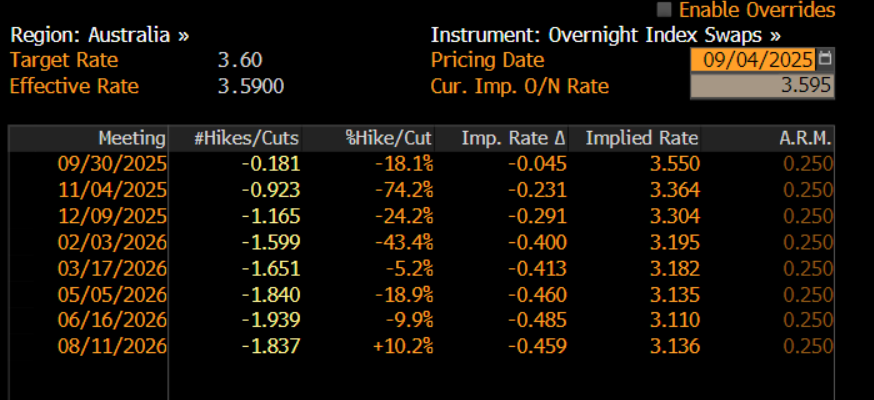

While we need to continue monitoring inflation and labour market trends, despite the improved tone on growth, the Aussie interest rate swaps market remains firm in its view that we’ll see two more 25bp rate cuts in this easing cycle — one priced for November, and another in February/March 2026. If realised, this would take the cash rate to 3.1% by Q1 2026, a level considered a neutral policy setting.

In essence, with growth broadening and at ‘potential,’ the private sector contributing more to economic output, continued elevated fiscal and government spending, 7.5% EPS growth for the ASX200, and house prices remaining strong, this should be seen as a compelling backdrop for the Australian economy and its capital markets.

Another anecdote from the recent ASX200 reporting period was that companies sourcing over 75% of sales/revenues from the domestic market saw sizeable share price outperformance and subsequent consensus EPS upgrades, relative to those with greater offshore exposure.

For Aussie markets, this dynamic remains supportive of domestic cyclical equities. With a shallow easing cycle still to play out and relative growth favouring Australia, this supports AUD upside potential at the margin — notably against the EUR, GBP, and JPY. AUDNZD is a classic play on relative rates and growth, but the rally since April has been impressive and the cross rate has reached multi-year resistance above 1.1100. Tactically, I remain an AUDNZD bull but would view 1.1000/1.0950 as better levels to initiate longs.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.