CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Gold Reclaims $3,400 as Geopolitical Risks Flare Up—But Can the Rally Last?

.jpg)

Following more than two weeks of narrow consolidation, gold finally broke above key resistance at $3,380 on Friday and reclaimed the $3,400 mark. The immediate trigger was a sharp escalation in Middle East tensions, which reignited safe-haven demand.

At the same time, steady central bank buying—most notably by the People’s Bank of China—continues to provide a solid underpinning for gold prices. However, ongoing optimism about US-China trade talks and resilient US economic data have capped the metal’s upside for now.

Resistance Tested but Not Breached

On the daily chart, XAUUSD has posted five consecutive gains, with especially strong momentum in the past three sessions. After clearing the 5-day exponential moving average, prices pushed to test the upper boundary of the recent trading range around $3,380 and the psychologically important $3,400 level. Intra-day on Friday, gold briefly hit $3,430, an important resistance last tested in early May, but it ultimately failed to close above this key level.

A confirmed breakout above $3,430 would open the door toward retesting the all-time high of $3,500 reached on April 22. Conversely, should the price retreat, attention will likely return to support near $3,380 and $3,280, which mark the upper and lower edges of the prior consolidation zone.

Geopolitical Risks & Central Bank Buying Drive the Rally

While the breakout had been widely anticipated, the catalyst was not the trade disputes or recession fears many expected. Instead, it was the sudden escalation of geopolitical risks that sparked the rally.

On Friday, Israel conducted airstrikes on targets inside Iran, causing casualties including senior officials. This event swiftly raised concerns about further regional escalation. Iran’s vow to retaliate added another layer of uncertainty to ongoing diplomatic efforts between the two countries. Meanwhile, the Russia-Ukraine conflict remains unresolved, with new Western sanctions reportedly in the works. Against this backdrop, gold’s traditional role as a safe-haven asset has once again come to the forefront.

But even before these geopolitical developments, strong and consistent demand from central banks had been providing a firm floor for gold prices.

Since the freezing of Russia’s foreign reserves by the US and its allies in 2022, central banks worldwide have significantly increased gold purchases. Inflation worries, along with fears that US debt might be weaponized against foreign creditors, have further strengthened gold’s appeal as a reserve asset. Notably, the PBoC added to its gold holdings for the seventh consecutive month in May, underscoring the ongoing push toward de-dollarization and continuing to support the market from the ground up.

Why Gold Failed to Hold $3,430

Despite the breakout above $3,400, gold’s failure to close above $3,430 indicates that certain headwinds remain. In addition to markets digesting geopolitical headlines, two key factors continue to weigh on sentiment.

The first is the tariff negotiation concluded between the US and China. Although no formal agreement has been reached, Trump mentioned on Truth Social that China may offer rare earths and magnets in advance, and Lutnick noted that the 55% tariff on Chinese goods is essentially set. There are also expectations that the tariff implementation deadline might be postponed. This continued engagement and improving sentiment have reduced the need for safe-haven hedges, dulling gold’s appeal in the near term.

The second factor is the resilience in US economic data. The latest nonfarm payrolls report showed a solid gain of 139,000 jobs in May, exceeding expectations, with the unemployment rate holding steady at 4.2%. While May’s CPI cooled overall, the “super core” inflation metric (core services ex-housing) rose 2.9% YoY, up from 2.7%, pointing to lingering upside risks. So, even though Trump has been calling for a full 100bp rate cut, the Fed has opted to stay on the sidelines, taking more time to assess the inflationary and employment impact of the new tariffs. The market is currently pricing in only two 25bp cuts by year-end—not exactly a bullish setup for a non-yielding asset like gold.

What’s Next: Geopolitics, Retail Sales & the Fed

In my view, gold’s recent breakout is an important technical milestone but not yet a definitive trend change. The balance between geopolitical shocks and economic fundamentals creates a delicate tension in the market. Staying alert to evolving geopolitical risks alongside key US data releases will be crucial for traders and investors looking to navigate this complex environment.

Looking ahead, gold’s near-term direction will heavily depend on the Middle East conflict developments. Should the Middle East conflict escalate further, or US-Iran talks falter, gold could push even higher. Conversely, signs of de-escalation would likely dampen panic-driven buying and see prices settle in a range between $3,280 and $3,430.

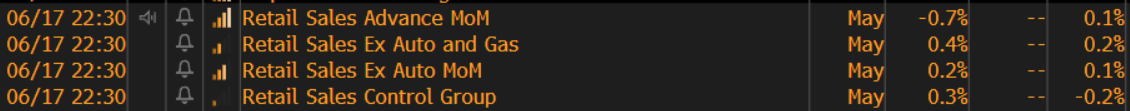

Aside from geopolitical risks, market attention will also focus on US retail sales and the upcoming FOMC meeting. Consensus expects May retail sales to rise 0.1% year-on-year, with the control group rebounding from -0.2% to +0.3%. A stronger-than-expected print could reinforce the Fed’s wait-and-see approach and weigh on gold.

Although the Fed is widely expected to hold rates steady this meeting, if Chair Powell continues to signal stagflation risks while emphasizing a cautious, data-dependent stance, gold’s upside may remain limited in the near term.

As gold market volatility heats up and key events unfold, seize the moment with Pepperstone’s gold CFDs - now offering spreads reduced by up to 30% to explore market opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.