- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Over the past week, gold bulls faced significant resistance as market volatility spiked sharply. Rapid developments in U.S.-China trade tensions and global geopolitical events have been the main drivers of recent price swings. Nevertheless, the market’s firm bets on Fed rate cuts this year, alongside large-scale ETF holdings, continue to provide solid medium- to long-term support.

Beyond updates on U.S.-China relations, traders’ attention this week will focus on U.S. CPI data scheduled for Friday and a series of corporate earnings releases, which could trigger short-term pressure on gold prices.

Technical Observation: Bulls Under Pressure, Momentum Takes a Breather

On the XAUUSD daily chart, the bulls remained firm until last Friday. Intraday prices hit a record high of $4,379 but faced heavy selling during European hours and U.S. market open, briefly dropping below $4,200, closing down 1.8%—the largest single-day decline since last Thanksgiving.

Despite this, gold still posted a 5.7% gain for the week, marking its tenth consecutive weekly advance. This underscores that the medium-term bullish trend remains intact, though the rapid ascent calls for a healthy pullback to relieve pressure.

This week, gold is trading around $4,250–$4,260. A close above $4,300 could confirm a new leg of upward momentum. However, with RSI in overbought territory and the widening gap from the 20- and 50-day moving averages, short-term corrective risk is rising. If the pullback continues, the $4,200–$4,208 zone may act as key support.

Safe-Haven Demand Cools Temporarily, Rate-Cut Support Remains Strong

Gold’s core investment thesis remains unchanged: safe-haven demand, rate-cut expectations, and central bank reserve diversification continue to underpin long-term support. Short-term swings largely reflect amplified sentiment driven by rapidly unfolding macro events.

U.S.-China relations remain a central focus. Both sides are cautiously testing the balance between showing strength and preserving negotiation flexibility, seeking to maintain political credibility while avoiding economic costs.

Last Friday, former President Trump called 100% tariffs “unsustainable” and confirmed a meeting with Chinese leaders in two weeks. This statement eased market tensions temporarily, prompting profit-taking in gold. However, uncertainty remains high until face-to-face talks resume, with traders awaiting new negotiation signals, sustaining underlying buying support.

Geopolitical risks also continue to support the bullish case. Escalation in the Israel-Palestine conflict and stalled ceasefire talks, along with slow progress in Russia-Ukraine negotiations, maintain safe-haven demand. While the impact of a U.S. government shutdown has largely been digested, this week’s ACA vote could be a turning point—if it leads to government reopening, risk appetite may rise, pressuring gold short-term; if the stalemate continues, safe-haven demand will continue to support prices.

Beyond political risks, financial system vulnerabilities are also affecting risk sentiment. Last week, Zions bank reported large loan loss provisions, sparking concerns about credit risk spreading and pushing gold higher briefly. As investors recognized that the issue posed no systemic threat, safe-haven buying gradually faded, and gold, along with bond yields, retraced.

At the macro level, Fed signals have reinforced rate-cut expectations. In his speech last week, Powell highlighted a clear cooling in the labor market and suggested that balance sheet reduction will end in the coming months, signaling a shift toward more accommodative monetary policy. The October Beige Book also noted continued economic pressures, with risks to employment and inflation, heightening market concerns about stagflation and further supporting gold’s medium- to long-term appeal.

The market largely expects a 25bp Fed rate cut in October, with some even betting on a further 50-basis-point cut in December. The U.S. dollar index hovering around 98.5 provides additional support for dollar-denominated gold amid ongoing volatility.

ETF Heat Remains, Bullish Potential Intact

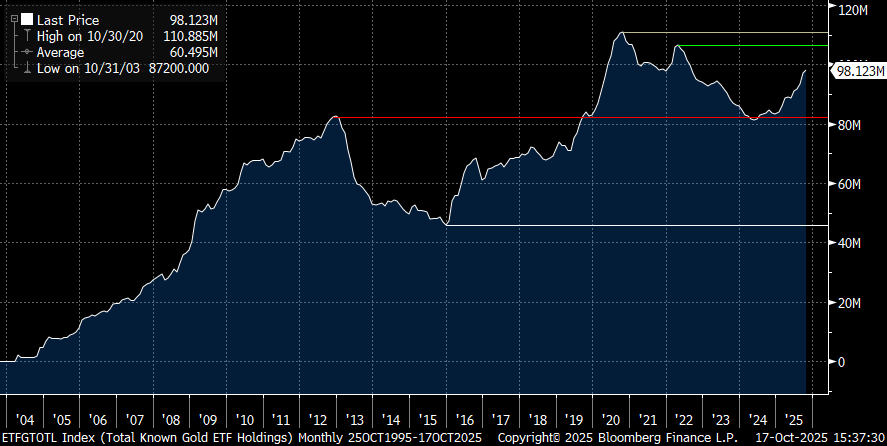

Another measure of this gold rally’s momentum is ETF holdings, reflecting retail participation. Currently, holdings remain below the 2020 all-time highs and have not yet returned to 2022 levels. In other words, despite repeated new price highs, the market structure suggests it is not yet overheated.

Over the past year, sustained buying by emerging market central banks has been a key driver, while retail participation tends to ramp up toward the end of trends. A short-term pullback could therefore create a more rational opportunity for further positioning.

Overall, the easing of U.S.-China trade tensions has reduced safe-haven demand, driving recent price pullbacks. Nevertheless, continued bets on Fed rate cuts, persistent central bank buying, and geopolitical uncertainty continue to provide solid support for medium- to long-term bullish positioning.

Attention is warranted, however, as rapid gains and concentrated bullish positions increase short-term volatility risk. A sudden shift in sentiment or mass profit-taking could trigger sharper price corrections.

CPI and Earnings in Focus: Gold Faces Dual Tests

Looking ahead, in addition to U.S.-China trade updates and government shutdown developments, the Q3 U.S. earnings season reaches its peak this week, alongside inflation data.

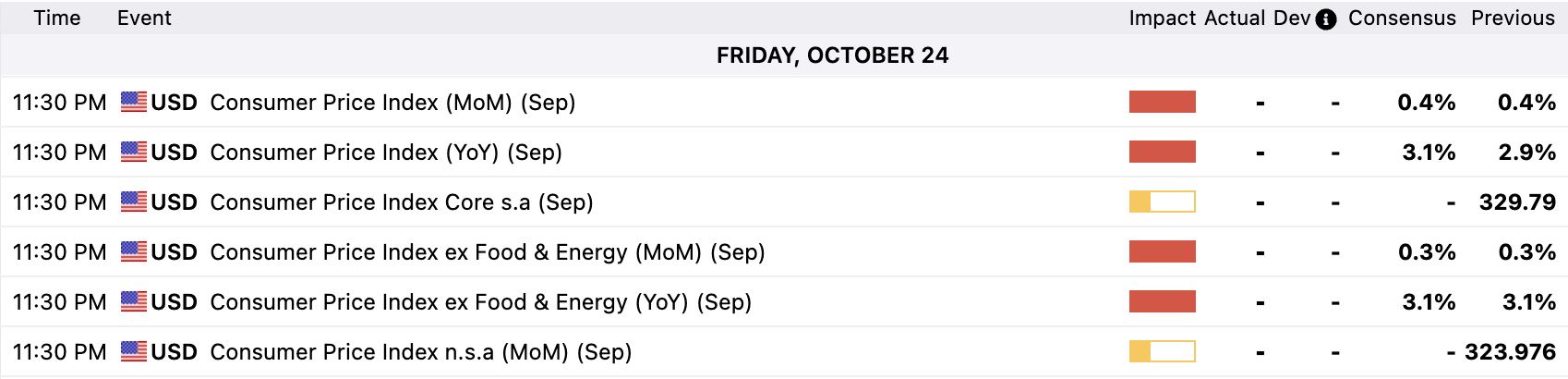

Market expectations project the September U.S. headline CPI to rise from 2.9% to 3.1%, the highest in over 18 months, while core CPI is expected to maintain a 3.1% YoY increase. Unless results significantly exceed expectations, such as core CPI hitting 3.5%, they are unlikely to shake the market’s consensus on a 25-basis-point October Fed cut. Still, higher inflation could weigh on intraday gold.

Earnings season will also serve as a barometer for market sentiment. Financials have benefited from rate-cut expectations and renewed M&A activity, with most recent results exceeding forecasts. This week, heavyweight companies such as Netflix (NFLX), Tesla (TSLA), and Intel (INTC) will report. With potential data gaps from the government shutdown and AI-driven labor market impacts, traders are particularly sensitive to forward guidance from corporate executives.

Strong earnings could ease recent safe-haven demand and trigger short-term gold pullbacks; underperformance, however, may drive funds back into gold and other defensive assets.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)