CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Gold Outlook: Prices Break $3,600! U.S. Inflation Becomes Short-Term Focus

.jpg)

Over the past week, gold bulls have been unstoppable, with prices breaking through the $3,600 level. Weak U.S. nonfarm payrolls, political turbulence in Japan, central bank gold buying, and ongoing geopolitical risks have collectively supported the upward move. This week, the release of U.S. CPI and PPI may provide further guidance for price action.

Looking at the XAUUSD daily chart, gold’s upward momentum remains strong, successfully holding above the key psychological level of $3,600. Although “buying the dip” has become the dominant strategy recently, with widespread warnings against selling, the market shows signs of technical divergence after the rapid rally: prices have remained above the 5-day EMA for the past three weeks, confirming overwhelming bullish consensus and strong control by the bulls.

However, the RSI momentum indicator shows that gold is in overbought territory, meaning traders are likely to be more cautious when adding new long positions at current levels. This also suggests that there may be short-term pullback or consolidation as the market gathers strength.

If gold manages to hold above $3,600, it could open further upside potential, possibly reaching $3,700. Conversely, if technical resistance pressures prices downward, the $3,450 high of the April trading range may provide support.

Weak Nonfarm Payrolls and Japanese Turmoil: Supporting Gold’s Upside

Undoubtedly, the U.S. August employment report came in far below expectations, fueling the gold rally. Nonfarm payrolls increased by only 22,000, well below market expectations, while June payrolls were revised down to -13,000, the first negative print since 2020. The three-month average for new jobs is just 29,000, roughly half of what is needed to maintain equilibrium, and the unemployment rate ticked up slightly to 4.3%.

These figures reinforce market expectations for a 25-basis-point rate cut by the Fed in September and increase the likelihood of three rate cuts by year-end. The U.S. Dollar Index trades below 98, and the 2-year Treasury yield briefly fell below 3.5%, hitting its lowest level since April. From both opportunity-cost and safe-haven perspectives, these factors support gold’s appeal.

Meanwhile, former Japanese Prime Minister Ishiba abruptly announced his resignation yesterday. Until his successor and market reactions become clearer, uncertainty over the Bank of Japan’s interest rate policy and the need to hedge yen-denominated assets with gold has further supported the metal.

Central Bank Buying and Geopolitical Tensions: Bulls Stay in Control

Beyond U.S. data, traditional bullish drivers such as central bank purchases and geopolitical developments continue to underpin gold demand.

With confidence in the dollar under scrutiny, central banks are strategically adjusting reserve asset allocations, shifting from dollar-denominated bonds to physical gold. Since Q3 2020, global central banks have bought gold for fourteen consecutive quarters. Notably, China’s central bank added to its gold reserves in August for the tenth consecutive month. Strong demand from emerging-market authorities, combined with portfolio managers seeking diversification and low correlation with the dollar and U.S. equities, has collectively supported gold’s upward move.

Geopolitical uncertainty further fuels bullish momentum. On one hand, the Russia-Ukraine conflict remains unresolved. At the SCO summit, leaders from China, Russia, and India convened, putting pressure on the U.S., while Russia’s oil exports and India’s 50% tariffs added further complexity. On the other hand, tensions in the Middle East and U.S. military deployments in Latin America could escalate geopolitical risks.

U.S. CPI/PPI Ahead: Key Short-Term Risk for Gold

Overall, gold’s bullish momentum remains strong, with prices continually reaching new highs. Weak U.S. employment data, political uncertainty in Japan, central bank purchases, and ongoing geopolitical tensions continue to support the market. In the medium term, gold’s path of least resistance remains upward, but short-term price swings will largely depend on this week’s U.S. CPI and PPI releases.

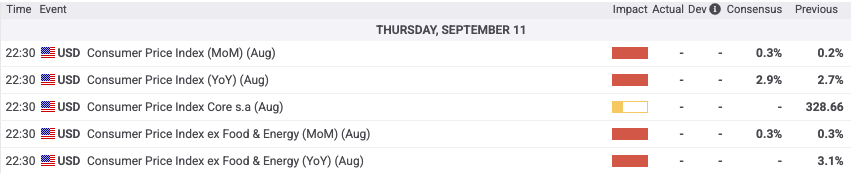

Markets anticipate August PPI at 3.3% YoY, with the MoM rate declining from 0.9% to 0.3%. Headline CPI is expected to rise slightly by 0.2 percentage points to 2.9% YoY, while core CPI remains at 3.1%.

If inflation data comes in soft, the probability of a 50-basis-point Fed rate cut in September could rise slightly, pressuring the dollar and giving gold room to test higher levels. Conversely, if there is a hawkish surprise - such as core annualized inflation exceeding 3.2%, accompanied by a wait-and-see Fed stance - the dollar may rebound slightly, Treasury yields could rise, and gold may face short-term pullback pressure.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.