- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Will falling confidence in GBP drive the UK100 index higher?

The unresolved and ongoing issue of Brexit casts a shadow over anything related to trading UK assets, yet one of the things we traders need to do is to look through the personalities and politics of a situation and decide exactly what they mean for the markets and what the end game will be.

Predicting exactly how Brexit will end might be something of a fool's errand. I think the outcomes are narrowing down to either the Prime Minister's previously rejected withdrawal agreement or a no-deal Brexit, but of course, there could easily be another twist in the tale.

A change in sentiment

Over recent weeks the British pound has appreciated in value as the market backed the idea that a deal could or would be struck, and that the cliff edge of a no-deal would be avoided or at the very least deferred for many months, in which time a more palatable solution could be found.

However, by the time you read this report, we’ll be just eleven days away from the EU's revised deadline for a no-deal Brexit of April 12th, and likely no nearer to a solution that avoids that outcome.

That being the case, it's my contention the market's optimism is misplaced and therefore that pound may be mispriced. Rather than looking at the UK currency itself, I’m inclined to explore the UK100 equity index, its valuation is closely related to that of Sterling.

The equity benchmark tracks the price of the top 100 stocks by market cap in the UK, many of which are global brands and or market leaders in their fields.

Overseas earnings

A less obvious but no less important common denominator is the fact that many of the constituents of the index earn their living from markets that are outside of the UK.

Indeed some of 70% of the UK100 index earnings are thought to originate from foreign shores.

That means that the index will often move in the opposite direction to sterling exchange rates, falling when the pound rises and rising when the pound falls.

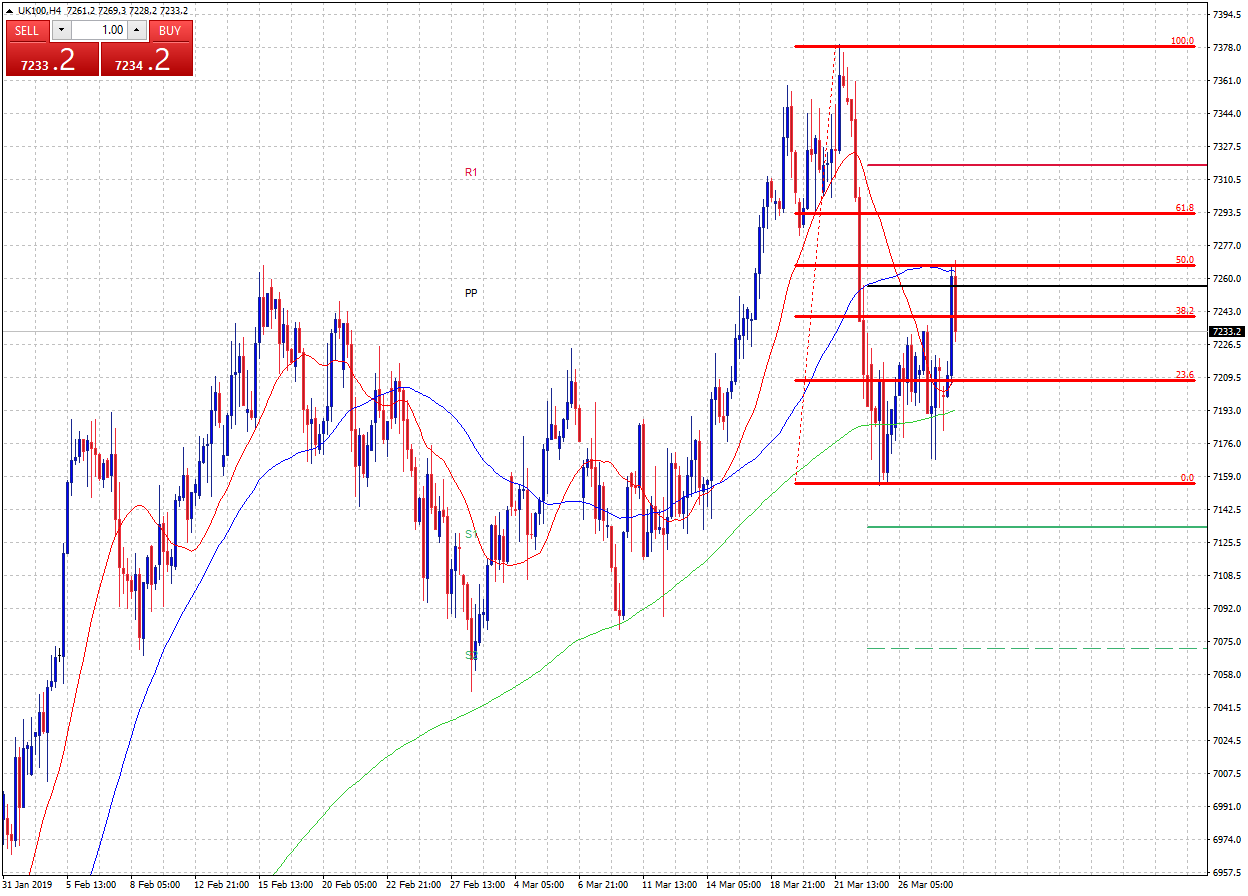

We can see that relationship in evidence in the four-hourly chart of the index shown above.

Reacting to a change

As the pound gave ground last week against the US dollar, the index rallied from just below 7159. That low point forms the bottom end of Fibonacci retracement I’ve applied to the previous downside move, much of which came about because of an appreciation in the UK currency.

The index subsequently tested back to the 50% retracement line, circa 7266, before falling back to the 38.2% line at 7240. I believe there’s support for the UK 100 index around 7200/7210, which encompasses the 23.6% line. While that remains the case I’m interested in the upside, simply because as the Brexit clock continues to countdown towards a no deal the market should become less and less confident in its previous thinking and its valuation of GBP.

Proceed with caution

Trading UK100 index in the current climate needs to be considered in the light of the geopolitical background. Any trade size and money management decisions need to made with the strong likelihood of additional volatility in those markets as we get ever closer to the EU deadlines.

If sterling weakens, we can potentially see the market pushing 7378, which was the recent March high and would suggest the continuation of the bullish trend seen since the 24th of December.

Stop-losses on any long positions could be placed below 7200 or for those who are looking for a deeper stop, the 0.00% retracement circa 7159 is an obvious choice.

This is something to consider over the week of the first of April but I wouldn't suggest that it be pursued into the following week without a material change in the Brexit backdrop.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.