- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Apple Q4 2025 Earnings Preview: iPhone 17 Boom Drives Strong Market Expectations

.jpg)

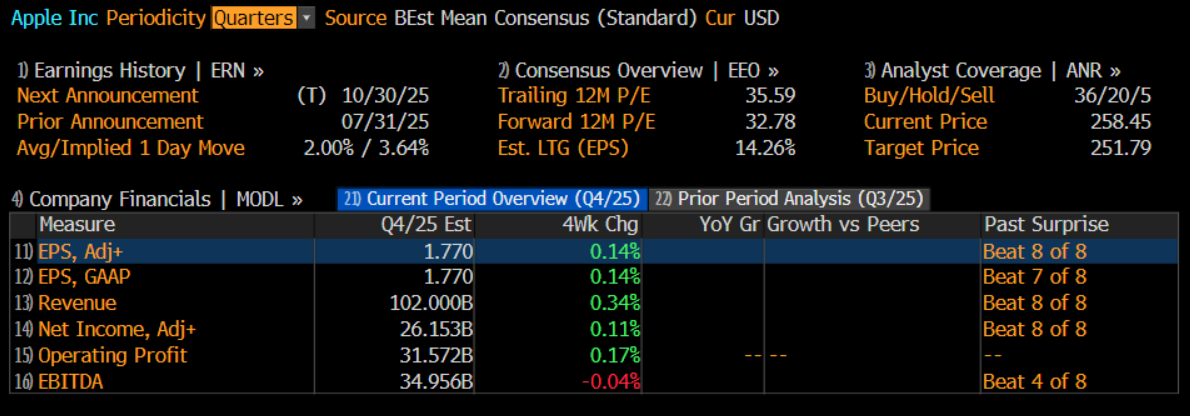

Apple is set to report its Q4 2025 earnings after the U.S. market closes on October 30 (morning of October 31 in Australia). The market expects revenue of around $102–103 billion, up roughly 7.5% year-on-year, with net profit projected between $26–27 billion, representing an adjusted annual increase of about 4.7%. Earnings per share (EPS) are estimated at $1.77. While the pace of growth in most key metrics is expected to slow from Q3, overall market sentiment remains broadly positive.

Apple’s stock performance has been a comeback story. During the July earnings season, Apple was still down year-to-date, lagging peers like Meta and Microsoft — even trailing the S&P 500 average. At one point, some analysts questioned whether Apple and Tesla still deserved their place among the “Magnificent Seven.”

But over the past three months, Apple’s stock has surged over 33%, ranking third among the group and coming within reach of the $4 trillion market cap milestone. The rally has been fueled by better-than-expected results last quarter, robust iPhone17 series demand, and steady growth in higher-margin services revenue.

Heading into earnings, traders are focused on three key questions: Can the iPhone 17 series regain market share in China? Will the services segment maintain double-digit growth? Can Apple offset potential cost pressures from U.S.–China tariff risks?

Given the implications of ongoing U.S.–China trade talks on Apple’s market share and supply chain, this earnings release could set the tone for whether Apple’s rally continues into year-end.

iPhone 17 Sales Surge — China Leads the Way

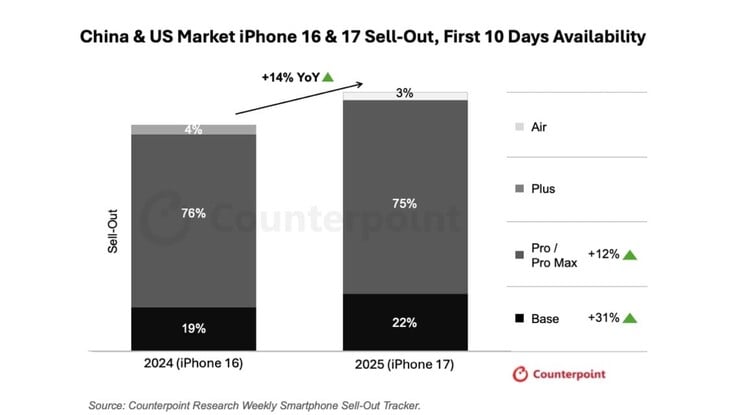

The iPhone 17 upgrade cycle has become the single biggest profit driver for Apple this quarter. Data shows that in just the first 10 days after launch, total iPhone 17 sales were 14% higher than those of the iPhone 16 series.

Fueled by this robust demand, iPhone shipments rose 4% year-on-year, marking Apple’s strongest third-quarter performance ever, according to market research firm Omdia. Meanwhile, the surge in orders has also extended delivery times by about 13% compared to last year.

China remains a standout market, with particularly strong enthusiasm for the standard model. JD.com data shows that pre-orders for the iPhone 17 base model were more than 10 times higher than those for the iPhone 16 at launch, while Pro Max pre-orders doubled. On Tmall, Apple’s official flagship store saw iPhone 17 sales in the first hour of the Double 11 shopping festival exceed the entire first day’s total last year.

Behind this stellar performance is not just product appeal, but also policy support and aggressive promotions from e-commerce platforms. Earlier this year, Chinese authorities introduced a “digital product trade-in subsidy”, offering a 15% discount on new devices priced below RMB 6,000.

The iPhone 17 standard 256GB model, priced at RMB 5,999, perfectly qualifies for the subsidy, making it even more attractive to consumers. At the same time, platforms like JD.com, Taobao, and Pinduoduo further cut purchase costs through trade-in programs, cash rebates, and large-value coupons.

The iPhone 17’s impressive performance has shifted market sentiment from concern to confidence, redefining expectations for upgrade cycles and replacement demand. Upgrades are no longer limited to premium users — mainstream consumers are now driving momentum.

This has directly improved Apple’s revenue visibility for the coming quarters and, to some extent, helped cushion margin pressures, providing solid support for the company’s valuation premium.

Services Expansion Reduces Hardware Dependence

Apple’s profits have long been heavily reliant on hardware sales, but its services segment is increasingly becoming a key pillar of stability. Flagship products such as iCloud, Apple Music, and the App Store now account for around 29% of total revenue, boasting an impressive gross margin of roughly 75%, making it a major contributor to overall profitability.

The market broadly expects Apple’s services revenue to maintain double-digit growth in Q4, supported by several positive tailwinds. Some headwinds have already been resolved: Google’s recent antitrust settlement ensures it will continue paying Apple billions annually to remain the default search engine on iOS devices, while the legal dispute with Epic Games over third-party payments has been settled, securing App Store revenue stability.

Meanwhile, App Store revenue grew about 10% year-on-year last quarter, surpassing expectations. The 30% price hike for Apple TV+ in August also provides an additional lift to this quarter’s services revenue.

Looking ahead, Apple’s vast ecosystem and expanding device base, combined with the rollout of AI-driven services, are opening up new revenue streams. Future monetization opportunities — from AI agent subscriptions to next-generation home devices and after-sales services — could further enhance user stickiness and bolster overall margins.

If Apple can sustain or even accelerate its services growth, it would significantly reduce dependence on the iPhone’s cyclical upgrade demand and strengthen the company’s long-term earnings resilience — a crucial shift amid margin pressure in hardware and intensifying industry competition.

Optimism masks underlying risks

Overall, market sentiment toward Apple’s Q4 report remains upbeat. The iPhone 17’s pricing strategy, steady growth in services, and seasonal boosts from China’s “Double 11” shopping festival have all helped reinforce optimism. Should Apple issue a stronger-than-expected earnings outlook, investors may further upgrade valuation forecasts for FY2026 and beyond.

Meanwhile, Apple’s aggressive share buybacks continue to reduce its outstanding shares, boosting earnings per share (EPS). Against the backdrop of elevated valuations, such consistent cash returns and solid profit growth have made Apple a top pick among large-cap tech stocks for institutional investors.

However, beneath this wave of optimism lie several key risks.

The first is tariff uncertainty. While recent U.S.-China negotiations appear to be moving in a positive direction — with Washington possibly scrapping the proposed 100% tariffs on Chinese goods and extending the suspension period — Apple’s heavy reliance on China’s assembly lines leaves it highly exposed. Any policy reversals or rising production costs could squeeze profit margins, while exchange-rate volatility might further weigh on performance in key markets.

The second risk concerns Apple’s AI strategy execution. If the rollout of Apple Intelligence and its ecosystem progresses slower than expected — particularly in China and other major language markets — consumers may shift toward alternatives such as Samsung, Google, or Xiaomi. That would directly dampen both future upgrade demand and service revenue growth.

Traders will be watching closely for developments around Apple’s potential relaunch of Apple Intelligence in partnership with Google in spring 2026, as well as regulatory progress in China. Smooth advancement on either front would likely serve as a strong positive signal for both sentiment and growth expectations.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.