- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

A Traders’ Guide to Australia’s Q4 CPI: The Key Input for the February RBA Rate Decision

Like the Federal Reserve, the RBA have a dual mandate: Price stability and full employment. On face value the Australian labour market is strong enough that if the RBA were to skew its mandate towards labour market trends, then we’d unlikely see rate cuts anytime soon – even if a large degree of the recent hiring has been seen in the public sector and largely driven by increased fiscal spending.

Conversely, If the RBA’s mindset is to skew its reaction function towards the inflation side of its mandate, which I feel is where they’re siding, then it makes the Q4 CPI release a potential volatility and risk event for AUD traders to manage. In the December RBA meeting statement, the statement detailed that they are “Gaining some confidence that inflation is moving sustainably towards target”. This suggests that any further progress in the Q4 CPI print may be enough to see RBA cut rates by 25bp on 18 February.

The Q4 CPI Playbook

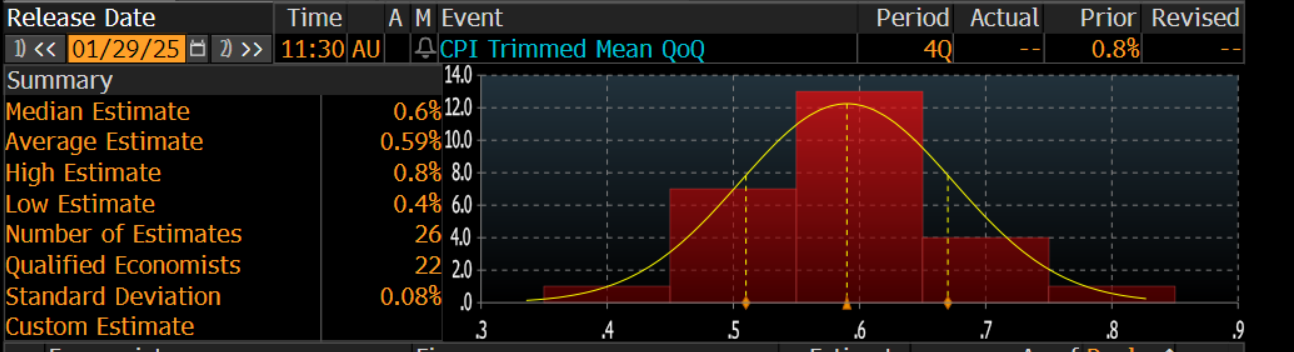

If we use the Q4 trimmed mean CPI measure for a playbook, we see that the median expectation from economists is for a +0.6% quarter-on-quarter (q/q) rise, an outcome which would reduce the year-on-year pace to 2.5% (from 2.8% in Q3).

Simplistically, I would argue that any outcome at or below +0.5% q/q would offer the RBA enough confidence to cut the cash rate by 25bp on 18 February. Conversely, a trimmed mean CPI print at and certainly above +0.7% q/q would likely see the RBA hold rates at 4.35% in February, with a view to reassessing its situation at the April meeting.

What is important to stress is that at this point any interest rate cut would be a pure risk management exercise and designed to gently take the cash rate towards a more neutral setting. Rate cuts, at this stage, would not be enacted to actively stimulate demand and drive animal spirits.

Swaps traders price a high probability of a cut in February

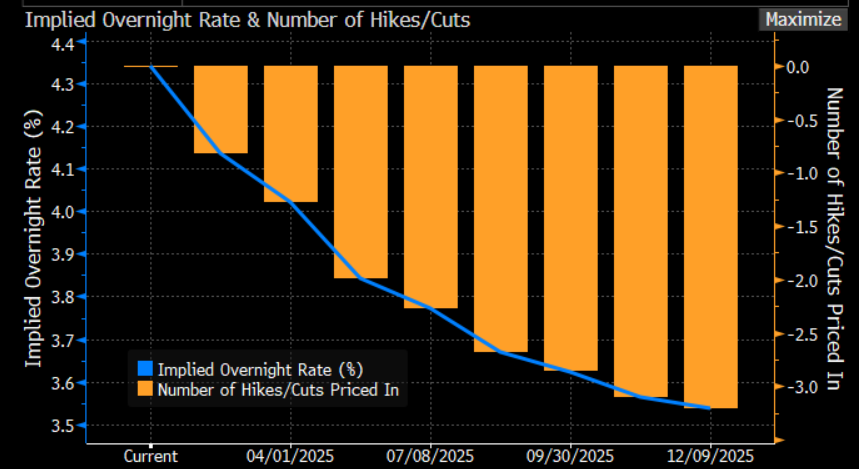

Aussie interest rate swap traders have held a strong level of conviction throughout January that the RBA should ease in the February meeting, with swaps currently pricing 20bp of cuts for the 18 February RBA meeting, and essentially implying an 80% chance that rates will be lowered by 25bp.

Just as important are expectations for the extent of rate cuts in this cycle and the pricing for the RBA’s ‘terminal cash rate’. Currently, the forward swaps curve prices three 25bp cuts over the coming 12 months. So, while borrowers may feel some relief that the RBA could be lowering the cost of capital, a shallow easing cycle is unlikely going to offer huge relief and result in a spike in demand for credit.

The balance of risk for the AUD over Q4 CPI

Given the market is already implying an 80% chance of a 25bp rate cut in the February RBA meeting, and with FX players already holding a punchy AUD net short position - I would argue that we’d likely see a far more pronounced upside move in the AUD on a 0.7%+ q/q trimmed mean CPI print, than a potential move lower in the AUD on a 0.5% q/q TM CPI print.

There does, therefore, appear to be an asymmetric risk for the AUD over the Q4 CPI print that may compel some tactical traders to trade the skew in risk over the Q4 CPI print.

Trading economic data and news is never something I would ever actively promote, as the outcome is obviously outside of our control. However, for the ‘special situation’ trader who looks at a wide range of inputs and assesses the probability for a more pronounced short-term directional move, I would argue that the risk for the AUD is skewed towards an initial spike higher.

Another tactical approach would be to simply stand side over the CPI release and react to the outcome. Where if I were to see a +0.6% q/q trimmed mean CPI print, with the AUDUSD rallying into 0.6300 then I would look to sell into that move.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.