- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

WHERE WE STAND – Another day of nonsense on the trade/tariff front on Friday; and yes, you’d be correct in thinking that all this is getting as tiresome as my tone suggests.

In fact, it wasn’t just on the trade front that there were a deluge of headlines as the week wrapped up, but on almost every front imaginable, courtesy of a wide-ranging TIME interview with President Trump. In brief, Trump remarked in this interview that the US is in “active talks” to strike a deal with China; that President Xi has called him; that Trump himself “wasn’t worried” during the Treasury market stress earlier in the month; that he “loves” the concept of raising taxes on the wealthy; and that even tariffs of as much as 50% on imports a year from now would represent “total victory”.

Quite a lot to unpack, there, and quite a lot of political spin to get round. Again, in short, China continue to refute claims of talks between the two nations; even if Trump wasn’t worried about Treasuries selling-off, someone in the Admin clearly was; raising taxes on the wealthy is about as much of an anti-GOP, market-unfriendly policy that you could conjure up; and, such chunky tariffs remaining in twelve months’ time would be catastrophic from a macro perspective.

The broad takeaway, though, from all of that and the bulk of the rest of last week’s reporting, is that there remains a considerably greater degree of ‘noise’ than there is ‘signal’ on the trade front at present. Given the incoherent and uncertain way in which policy continues to be made, the base case must be for the deafening din of trade headlines to continue, but also remain that it will be hard to get especially excited unless and until concrete progress towards deals is made.

Nevertheless, a rather substantial dose of ‘hopium’ seems to have been administered to the equity market, with the S&P notching a 4th straight daily advance on Friday, bringing its weekly gain to just over 4.5%. Solid earnings from Alphabet will have also helped sentiment here, while there seems to be an increasing consensus that the peak of trade uncertainty is now in the rear view mirror.

I’d argue against this stance, however. The 90-day pause on ‘reciprocal’ tariffs has actually served to embed uncertainty, at least for the next three months if not longer, while the detrimental economic impact of the tariffs that have been imposed will only be felt in data released over the next 4-6 weeks. I wouldn’t be surprised if, all of a sudden, we’re much more worried about the US economy having hit a proverbial wall, as opposed to jesting about Trump negotiating with himself but having claimed to speak to China instead. With this in mind, I still favour fading upside in equities for the time being.

That may explain why Treasuries advanced fairly significantly across a broadly flatter curve on Friday, with benchmark 10- and 30-year yields falling around 8bp apiece, the former ending the day below 4.25%. The old adage ‘stocks for show, bonds for dough’ springs to mind here, with the rally in Treasuries potentially being something of a ‘canary in the coalmine’ signalling potential headwinds ahead for riskier assets. Still, I’d expect investors more broadly to continue to favour other DM Govvies, given how developments over the last month have substantially eroded the trust, reliability, and credibility of the United States.

Despite those gains across the Treasury curve, the dollar ticked higher against most peers into the weekend, though the day was ultimately an incredibly choppy one across the G10 board. These USD gains likely came by virtue of the usual month-end USD buying flows, which this month could prove more significant than normal owing to the underperformance of US equities against global peers.

That said, I remain a USD rally seller for the time being, given what seems an imminent and inevitable softening in economic data, while the technical analysts out there will note that that is now two days on the spin that the greenback’s gains have stalled just shy of 100 in the DXY.

I’ll leave them to play with their crayons, though, and instead finish up with a word on gold. Though bullion slid once more on Friday, what was of more interest is that buying demand out of Asia appears to have dried up, at least for the time being. This could suggest more downside being on the cards for the yellow metal, which may well be exacerbated by some weaker longs bailing out of what has become an incredibly crowded trade. Still, given all the uncertainty and tumult elsewhere, gold still looks like a better bet as a haven than pretty much anything else.

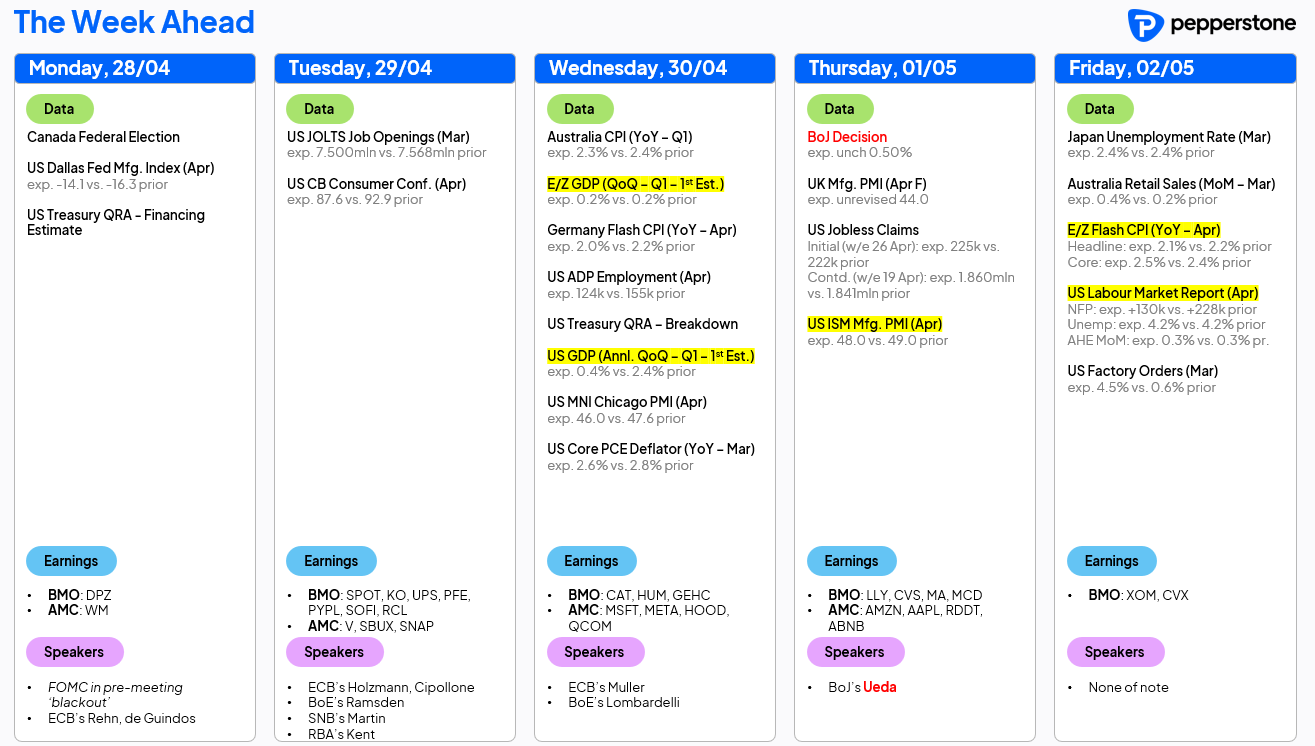

LOOK AHEAD – It is, frankly, a monster of a week up ahead.

On the data front, we have the first reads on Q1 GDP from both the US and eurozone, which will lay bare the initial economic impact of tariff-related uncertainties, most notably Stateside where a surge in imports to front-run expected tariffs is likely to have dramatically depressed growth in the first quarter. This week also brings a smattering of PMI prints, the latest ‘flash’ eurozone inflation data, as well as April’s US labour market report, which will likely point a slowing in nonfarm payroll growth, to +130k from the prior +228k.

Meanwhile, a jam-packed week of corporate earnings awaits as well, with this week being the busiest of Q1 reporting season, as around a third of the S&P by market cap release figures. Naturally, focus will fall on reports from the ‘magnificent seven’ names, with Microsoft (MSFT) and Meta (META) reporting after hours on Wednesday, followed by Amazon (AMZN) and Apple (AAPL) on Thurs.

That’s not all, though, as it’s also a busy week on the political front. Canadian PM Mark Carney is set to win today’s federal elections, though the key question remains whether the ‘unreliable boyfriend’ is able to win a majority in the House of Commons, with 172 seats being the magic number in order to achieve such an outcome. Then, on Saturday, Australia heads to the polls, with incumbent PM Albanese likely to see his Labor Party returned as the largest grouping in the House of Representatives, though again question marks hovering over whether the required 76 seats to win a majority will be obtained. Outside of the respective domestic markets, though, these elections shouldn’t have any kind of broader impact.

Treasury participants will also have a busy week, as the latest Quarterly Refunding Announcement (QRA) is due. As always, the financing estimate will be released today, before the issuance breakdown is unveiled on Wednesday. It seems unlikely that the Treasury will announce any major shifts, with the recent market turmoil further strengthening the case that policymakers shouldn’t seek to ‘rock the boat’ in any way. Focus, hence, will likely fall on whether guidance that auction sizes will be maintained “for at least the next several quarters” is tweaked in any way.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.