- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Per FactSet, for the S&P 500 in aggregate, earnings growth is seen at 7.3% YoY in the first quarter, which if delivered would mark the seventh consecutive quarter of growth, albeit being some way below the double-digit pace seen in the final quarter of last year. Meanwhile, in terms of revenue, growth is seen at 4.2% YoY, which would mark the 18th consecutive quarter of revenue growth, albeit considerably slower than the 5.1% pace foreseen for Q1 25 at the end of last year.

In any case, despite recent declines, the market remains ‘over-valued’ per traditional valuation metrics, with a 12-month forward P/E of 20.5 being above the 5- and 10-year averages.

_spx_v_2025-04-02_10-54-24.jpg)

On a sectoral basis, expectations are somewhat more mixed. In terms of earnings, 7 of the S&P’s 11 sectors are seen notching YoY growth, with Healthcare and Information Technology likely to outperform, while Energy and Materials lag. As for revenue growth, expectations are solid in broader fashion, with all sectors beside Industrials likely to notch YoY growth.

That said, guidance issued by S&P 500 constituents does potentially point to stumbling blocks ahead. With 107 firms having issued EPS guidance for the upcoming quarter, 64% of those have issued a negative outlook, considerably above both the 5- and 10-year averages. Of course, some of this will be due to firms massaging expectations lower, to make beating them easier, though caution is still required.

In light of that, and the degree to which the broader political and macroeconomic backdrop has shifted during the first quarter, market participants will likely pay much more focus to the commentary and guidance that accompanies incoming earnings reports.

Chiefly, focus will fall on commentary around the broader macroeconomic outlook, especially as uncertainty continues to mount, and policymaking from the Oval Office continues in incredibly incoherent fashion. There will also be a heavy focus on ongoing trade tensions, particularly the issue of tariffs, and whether businesses feel they are able to pass these rising costs onto consumers – carrying inflationary implications – or whether they will have to absorb said costs – carrying downside growth risks.

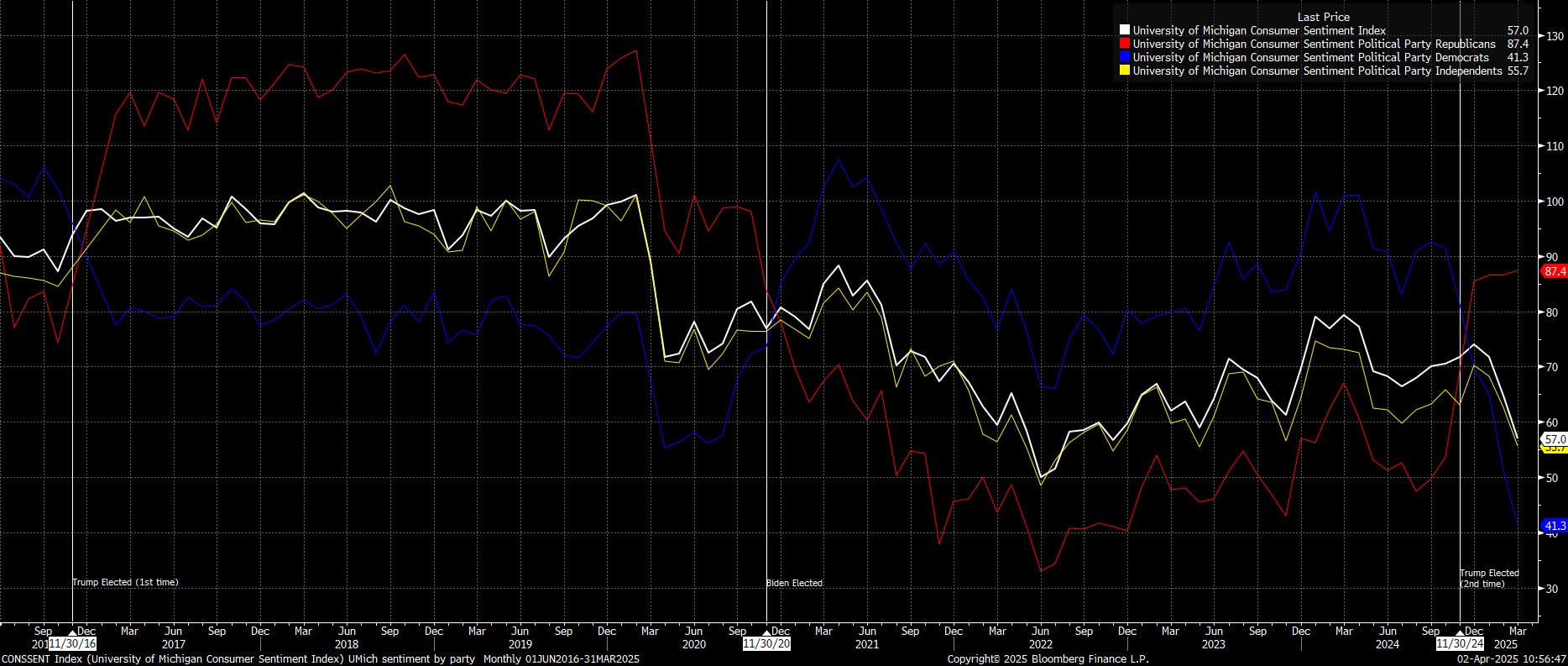

On the subject of consumers, earnings in both the Staples and Discretionary sectors will come under close scrutiny, particularly as concern over a broader economic slowdown continues to mount, amid a dramatic souring in consumer sentiment in recent months.

Meanwhile, in terms of guidance, the bar is likely to be a particularly high one for stocks to unlock post-earnings upside, with participants seeking not only top- and bottom-line beats, but also guidance nodding towards said performance continuing into coming quarters. Any guidance that is given, though, is likely to be heavily caveated, given the prevailing uncertainty which continues to cloud the outlook.

As always, earnings season kicks off with the banks, beginning to report from 11th April onwards, acting as a barometer, and setting the tone for the remainder of reporting season. Here, there is the potential for downside surprise, with dealmaking activity having slowed to a crawl in the early days of the Trump Administration, and broader economic uncertainty likely also crimping demand for credit, even if huge market volatility will likely be a boon for equities and FICC trading revenues.

_kbw_b_2025-04-02_10-53-22.jpg)

Besides the banks, focus naturally falls on the so-called ‘Magnificent Seven’ group of stocks, which propelled the market higher in both 2023 and 2024. This group’s fortunes, though, haven been dismal so far in 2025, with all of the seven trading in negative territory on a YTD basis – we might have to revise that moniker somewhat!

Despite this recent poor performance, though, earnings from the MAG 7 will continue to be closely eyed, not only for the names’ broader impact on market sentiment, but also owing to the huge concentration that these stocks continue to have in benchmark indices such as the S&P 500 and Nasdaq 100.

_mag_7_2025-04-02_10-52-08.jpg)

Taking a step back, it seems unlikely that, on its own, earnings season will give participants the confidence that they need to step in and buy the dip.

For the time being, at least, the path of least resistance on Wall Street, in the short-term, continues to lead to the downside, with rally selling the preferred strategy, amid ongoing jitters over the stalling US economy, and uncertain nature of political policymaking. In fact, risks around earnings season seem asymmetric, with solid figures unlikely to be enough to soothe ongoing worries, but weak figures crystallising those very concerns.

Despite that, if the Trump Administration are able to succeed in their aims to trim the size of the federal government, and re-allocate resources towards the much more productive private sector, the longer-run bull case for both the economy, and for Wall Street, would be a very solid one indeed. The question participants must mull for now, is how tough the short-term ‘pain’ may be, in order for that long-term ‘gain’ to be delivered.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.