- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A Divided FOMC: Holding Rates Steady In December Implies No Action Until March

Summary

- December Hold: The balance of risks increasingly tilts towards a divided FOMC standing pat in December

- A Pause Not A Skip: Standing pat in Dec implies little chance of a cut until March, barring material data deterioration

- Behind The Curve: Such a reactive approach runs the risk that policymakers may, ultimately, fall far behind the curve

The December FOMC meeting is still a little under three weeks away, but is already posing plenty of intrigue for market participants.

The Path To A December Cut Has Narrowed

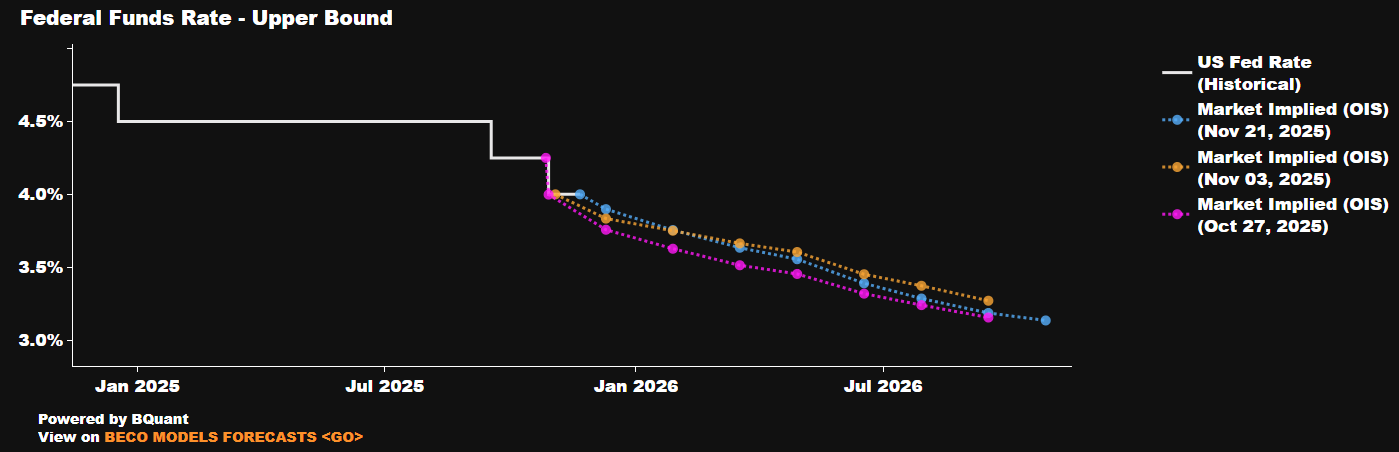

A couple of months ago, another 25bp cut to round out the year had been seen as essentially a done deal. However, since then, the path towards such a cut has narrowed almost by the day, such that the base case has now become that the FOMC will stand pat at the final meeting of the year, holding the fed funds rate steady at 3.75% - 4.00%.

That path actually began to narrow during the October FOMC press conference, where Chair Powell was at pains not only to stress the divided nature of the Committee, but also to ram home the point that another cut in December was ‘far from’ a foregone conclusion. Since, those divisions have been clear for all to see, with regional Fed presidents adopting an increasingly hawkish tone in public remarks, flagging concern over elevated inflation, and expressing a general reluctance to proceed on ‘autopilot’ by cutting at every meeting.

These divisions were further laid bare by minutes from the October meeting, released this week, which noted that while ‘several’ policymakers potentially saw a December rate cut as appropriate ‘many’ believed that such a move would not be the correct one to make. In Fedspeak, ‘many’ is a couple of rungs higher on the ladder than ‘several’, suggesting that the hawks outnumber the doves rather significantly at this point.

The Reaction Function Has Shifted, Again

Taking all of that together suggests that the FOMC’s reaction function has shifted once again. Earlier in the year, the inflation side of the dual mandate took precedence, as policymakers remained nervous over upside price risks posed by tariffs. Then, as the labour market begun to stall over the summer, the reaction function pivoted at Jackson Hole to a laser-like focus on supporting the employment backdrop, hence the rate cuts that were delivered at the last two meetings.

Now, however, not only does the reaction function appear to be more balanced between the two sides of the mandate, but the overall approach to policymaking appears to be one of ‘wait and see’, as opposed to policymakers seeking to get ‘ahead of the curve’.

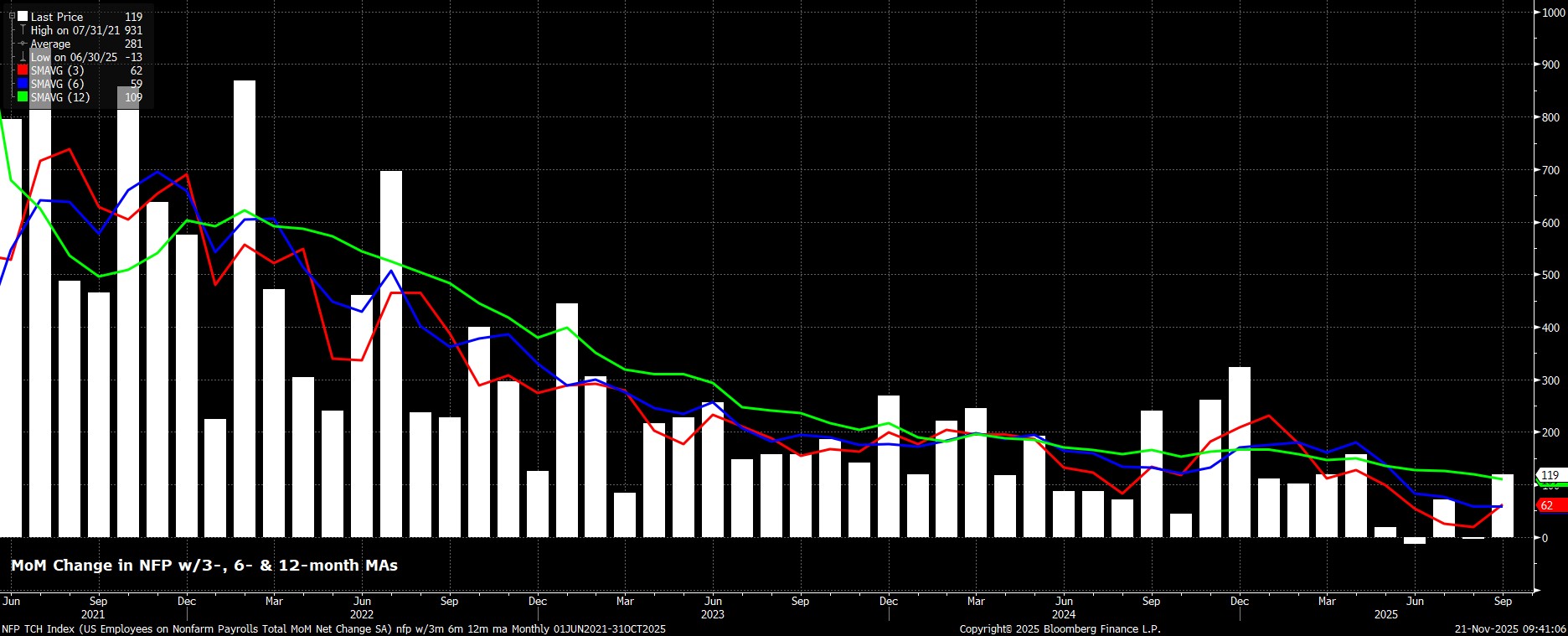

It is through this lens that we must view the September jobs report which, while stale, is the final one that we will receive before the last FOMC meeting of the year. The report was a shaky one, despite headline payrolls having risen +119k, almost the entirety of the jobs gain came from both Healthcare, and Leisure & Hospitality, while unemployment rose to fresh cycle highs at 4.4%. Clearly, this is a labour market that is continuing to operate at, essentially, stall speed.

Fed Rhetoric Doesn’t Tally With Forecasts

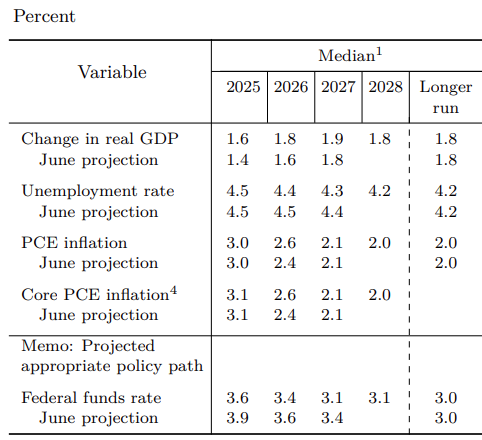

This is the point at which things start to get a little strange. In the September SEP, the FOMC pencilled in that unemployment would end the year at 4.5%, headline PCE would be at 3.0%, and that 3x 25bp cuts would be appropriate in light of those two variables. Although we are now, as near as makes no difference, at those aforementioned levels, it appears that a majority of the Committee no longer view the same degree of policy easing as appropriate.

As a result, it is logical to conclude that, based on the minutes, and recent statements, many on the FOMC now view risks to the labour market as having been adequately managed. After all, if you embark on easing for ‘risk management’ purposes, and then cease that policy easing, the message is that you don’t see that risk as being present anymore.

December Hold Is A Pause Not A Skip

This, in turn, poses a bit of a problem. If the Fed do indeed stand pat in December, as I believe they now will, then a January cut is very unlikely as well, barring a major deterioration in incoming data – as a policymaker, there is no point in skipping December if you know that you’re going to cut next time out, you may as well just get it over & done with. Consequently, standing pat in December would represent a ‘pause’ in the easing cycle, seeing policymakers retire to the sidelines, believing that risks have been managed for the time being.

With that in mind, the next ‘live’ FOMC meeting could well not come until next March, by which stage the labour market could be in a very different place, naturally meaning that policymakers run the risk of falling considerably behind the curve, by taking such a reactionary approach.

Incoming data, then, must now be viewed through the lens of ‘is this bad enough to make the hawks turn dovish?’. Right now, it isn’t. By the time it is, it might be too late.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.