CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Bitcoin at a Crossroads: Topping Out or Gearing Up for Another Breakout?

.jpg)

Following Moody’s downgrade of the U.S. credit outlook, the House passed Trump’s ambitious tax cut proposal—a combination that has heightened concerns over America’s fiscal health and debt sustainability. U.S. Treasuries saw a broad selloff, with rising long-end yields pushing term premiums significantly higher. At the same time, the dollar, U.S. equities, and risk assets worldwide came under pressure.

Yet just as risk-off sentiment gripped global markets, Bitcoin—often seen as a high-volatility, high-risk asset—broke to fresh highs and has since hovered near record levels. This decoupling from traditional risk assets has sparked a growing debate: what’s driving Bitcoin’s divergence, and is there still room to rally after crossing the $110,000 threshold?

Double Exposure or Risk Hedge? Bitcoin’s Role Is Evolving

Bitcoin’s classification as either a speculative risk asset or an alternative to traditional financial instruments has long been contested. During risk-on phases marked by ample liquidity, Bitcoin has often tracked high-beta assets like tech stocks or the Nasdaq, amplifying bullish moves.

But recent data tells a different story. Over the past month, Bitcoin’s intraday correlation with Nasdaq, growth ETFs, and the dollar has been remarkably low. It has also shown limited sensitivity to gold and 10-year Treasury yields. These shifts suggest Bitcoin may be increasingly viewed as a hedge—or even a non-correlated asset class—rather than just a speculative trade.

This evolution isn't entirely surprising given the shifting macro backdrop. With the 90-day tariff pause underway and the U.S. debt ceiling crisis intensifying, policymakers are left with few options—either adopt a tougher stance on tariffs or turn to monetary expansion. Either path may stoke inflation expectations and accelerate de-dollarization, reinforcing Bitcoin’s appeal as a scarce, inflation-resistant asset.

With a fixed supply cap of 21 million coins and the advantage of 24/7 global liquidity, Bitcoin offers an alternative tool for portfolio diversification—especially as speculative positioning in gold nears saturation.

Institutional Flows and Trump’s Support Fuel the Rally

Alongside the evolving narrative around Bitcoin’s role, institutional buying has emerged as a key engine of this bull run.

On-chain data and fund flows confirm this trend. For example, between May 19 and May 25, Strategy Corp. bought 4,020 BTC at market price, investing over $427 million—underscoring strong conviction in current price levels.

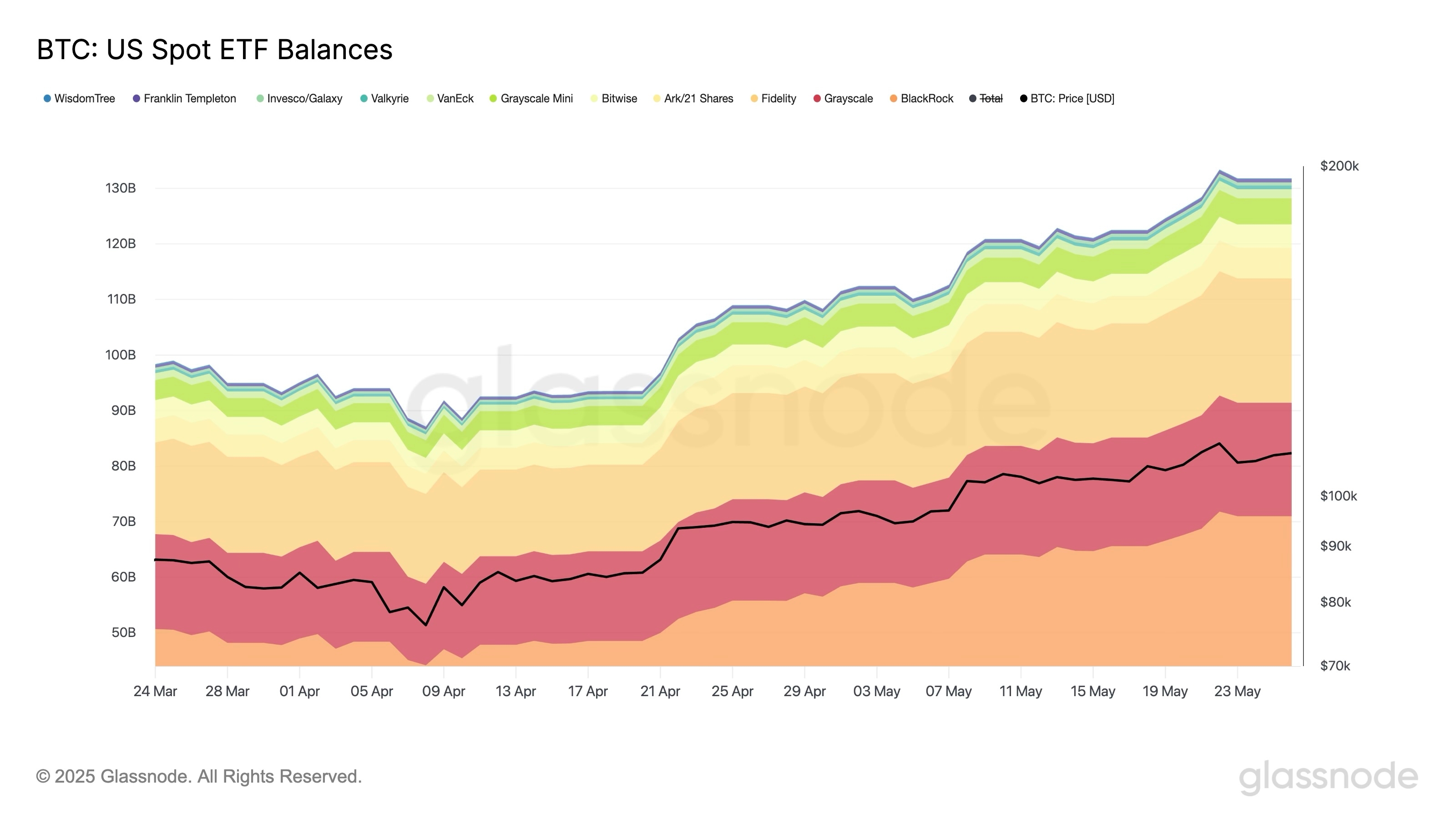

More significantly, spot Bitcoin ETFs have seen robust and persistent inflows. With their regulatory clarity and ease of access, these instruments have attracted capital from pensions, sovereign wealth funds, and traditional asset managers. From April 1 to May 27, net inflows into spot Bitcoin ETFs—including those managed by BlackRock, Fidelity, and Grayscale—surged to $33.4 billion, reflecting growing institutional acceptance of digital assets.

These flows have enhanced market liquidity and stability, anchoring Bitcoin’s price even during periods of heightened volatility. Institutional demand is increasingly acting as a “floor” during dips—helping reinforce Bitcoin’s range-bound resilience.

Adding to the bullish narrative is Donald Trump’s implicit endorsement of crypto. DJT is reportedly seeking to raise up to $3 billion for digital asset investments and plans to launch a crypto-focused financial services platform, potentially in partnership with Crypto.com. These developments have injected fresh optimism into the market.

Trump’s stance could also shift regulatory expectations, potentially drawing younger and Republican-leaning voters toward crypto while improving Bitcoin’s positioning within the U.S. financial system.

Topping Out or Just the Beginning? What Comes Next for Bitcoin

With Bitcoin consolidating after its record-breaking run, the market is asking a pivotal question: is $110,000 a near-term top, or just a stepping stone?

In my view, both the technical structure and macro backdrop point to further upside in the short term.

Technically, Bitcoin has maintained a bullish rhythm since early April: rapid rallies followed by healthy consolidation. This pattern suggests that traders are not panicking at elevated levels, but rather waiting for the next catalyst. Even if short-term pullbacks occur, dip buying near key support zones may build higher price floors.

Macro-wise, the bull case remains compelling. Institutional flows into ETFs show no signs of slowing, and the broader macro narrative—growing deficits and declining trust in fiat systems—continues to chip away at traditional safe-haven appeal. Today’s Bitcoin buyers are not merely seeking short-term hedges; they are expressing structural skepticism toward the fiat-based system itself.

Of course, risks remain. A U.S. recession could trigger a flight to traditional safe havens like gold, the yen, or the Swiss franc—potentially sparking a sharp correction in Bitcoin. However, recent U.S. “hard data” has not yet signaled a definitive slowdown. If inflation or jobs data worsens, that could change the trajectory.

In the near term, one key catalyst to watch is the upcoming “Bitcoin 2025” event in Las Vegas. If DJT reveals more concrete plans around fundraising, platform development, or crypto-focused services, it could unlock fresh inflows and reshape market expectations around crypto policy—setting the stage for another leg up in Bitcoin’s rally.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.