- English (UK)

A Trader’s Playbook: Navigating Market Reversals & Key Risk Events

Multi-year weekly gains in the USD pairs saw FX volumes ramp up, with the USD driven lower in part by a radical shift in relative bond yield spreads and interest rate differentials - while on the week, the HK50 and DAX outperformed the S&P500 by an impressive 8.7% and 5.1% respectively.

S&P500 Futures Supported at the 200-day MA - Can it Build?

S&P500 futures held the 200-day MA (currently 5764) and that may offer the remaining bulls some hope that much of the forced selling from systematic accounts (CTA’s) is close to being worked through – with these selling flows likely reduced, it may require a further leg lower to 5600 to set off a new round of liquidations.

Hedge funds and the more active players have aggressively shifted equity portfolio exposures either into HK/EU equity and to tactical align with the outperformance seen in these regions. The shift seen within US equity factors and styles was into high-quality defensives, and low volatility plays, and away from higher beta, high momentum and cyclically sensitive US equities.

However, with so many of the moves having moved so hard and so fast, I am now open-minded to the idea of short-term reversals set to kick in in select markets, with traders looking at tactical counter trades, feeling the bearish sentiment is overdone and that the risk vs reward has shifted just enough. The price action will obviously dictate.

On Friday, the daily charts highlighted exhaustion in the price action in both S&P500 and NAS100 futures, and that could offer some belief that the buyers are stepping up and making a stronger statement. A push through Friday’s high of 5791 (S&P500 futures) would be a small win, with a further move through 5861 (38.2 fibo of the sell-off) potentially taking us back to 5920, perhaps even 5977. It also wouldn’t surprise to see some mean reversion creep into the well-subscribed long HK50/short NAS100 trade.

It's aggressive to play for a rally in risk, as the risks from tariff headlines and from the incoming US data flow are numerous - but as they say “sell to the sound of trumpets, buy to the sound of cannons” – and right now, the cannons are out and pounding sentiment.

Eyeing Moves in Tesla and Nvidia

The MAG7 plays remain central to the ensuing moves at an index level. Tesla remains the standout attraction from the short sellers – The price action already has downside momentum already working, but with the CEO being outspoken towards Tesla’s key sales regions, and with a stigma building that those who buy a Tesla going forward may as well be wearing a red MAGA hat, it's easy to see why the shorts are going hard on this name – however, as is the way with bear market rallies, should one materialise, be cognisant that they can be violent and pronounced, but ultimately short-lived.

Nvidia will be central to the MAG7 basket, and a look at the high timeframes and we see better buying support below $110, with signs that it may be putting in a short-term base. With Nvidia’s GTC developers conference (due 17-20 March) in the market’s sights - an event which has seen the share price rally 8% on average – one questions if traders cover shorts and look to layer into longs through the week and ahead of the GTC. Clearly, the overhang issues of export controls and tariff risk are still a risk keeping the would-be buyers of Nvidia’s equity away and they remain the big known unknowns.

FX Moves - The Prospects for a USD Reversal?

The USD has few friends in this market, but after the DXY index closed -3.5% w/w – the worst week for the USD since November 2022 – USD positioning has now become susceptible to profit-taking. The market’s reaction function in the USD has likely shifted, with good news likely causing a far more pronounced USD rally, notably with Jay Powell offering a more reassuring view on the US economy on Friday.

Short USDSEK was the play last week, with an incredible decline of 6.8% w/w, although the spot rate has run into big support at the Sept 2024 lows.

EURUSD was where client flows focused most intently, with the spot rate going on quite the run and gaining 4.4% w/w - its best weekly performance since March 2020. This is of course entirely justified, and outsized moves should be expected when any key official starts throwing “Whatever it takes” comments out to the market. However, with the yield spread between the German 10yr bund vs US 10yr Treasury collapsing from -215bp to -146bp in a month, this is a radical move, and it would not surprise to see bond traders countering this move and looking to play long bunds/short USTs as a mean reversion trade. Should that play out, then EURUSD should retrace lower in sympathy.

EURUSD found sellers on Friday at the 200-week MA (1.0867), and this may be telling in the near term. Should we see better sellers of EURUSD this week, I would look for the downside to be contained into 1.0687. The medium-term suggests further USD downside is the base case, but I would hesitate to chase further USD downside at current levels.

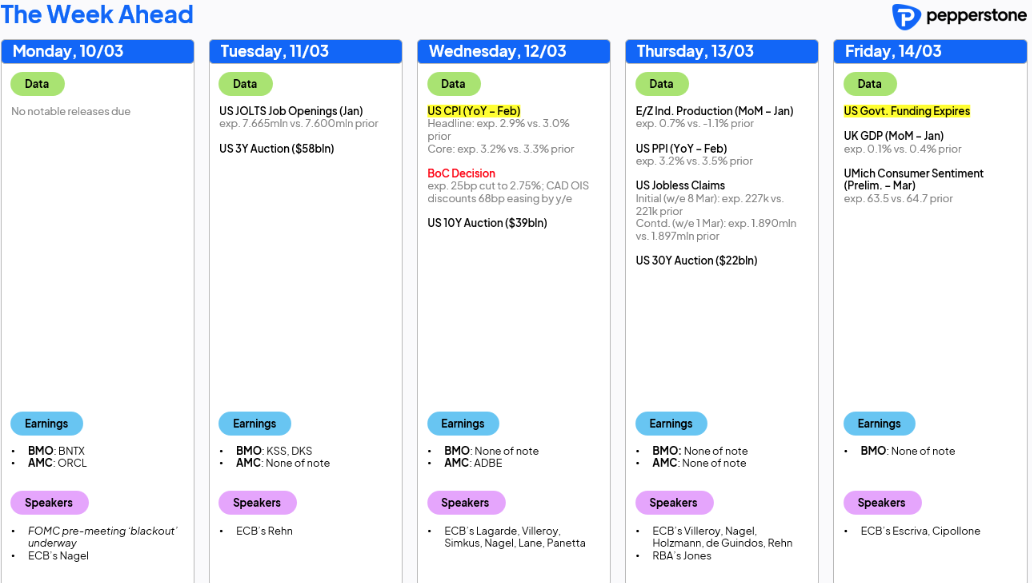

US CPI the Marquee Event Risk this Week

Clearly, tariff headlines remain a threat but considering the risks from the headlines to markets ahead of time is a challenge, as no one has any real confidence the Administration knows what they’re going to do on any given day. Talk of the stagflation risk in the US has risen in market conversations, notably after the weaker new orders/hotter prices paid sub-components in both the ISM manufacturing and services reports – this dynamic puts additional market sensitivity to this week’s US data, with the NFIB small business survey (Tuesday), JOLTS job openings, core CPI and the Uni of Michigan inflation survey in play. The Fed is in a blackout period ahead of the 19 March FOMC meeting.

After last month’s far hotter US core CPI reading, the Fed will be hoping for a moderation – the consensus is for a 0.3% m/m read in this week's core CPI, with the year-on-year clip eyed lowered to 3.2% (from 3.3%). US equity longs will want to see a print that rounds to 0.2% m/m, however, a re-run of what we saw in January would see sentiment turn lower in earnest and notably if we were to also see a deterioration in NFIB small business confidence.

Outside of US data, the Bank of Canada should cut rates by 25bp on Wednesday, and this is 90% priced by markets. China will offer its February credit data this week (no set date), having reported a 0.7% fall in CPI on Sunday, which is a big dent to its inflation drive and just cements the need to go hard on boosting consumption. So, it’s another huge week ahead but after some incredible moves across markets last week, the question of whether we see a continuation of these moves or a short-term tradeable reversal from oversold levels is a factor front of mind.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.