Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Divergence between Fed members and the market

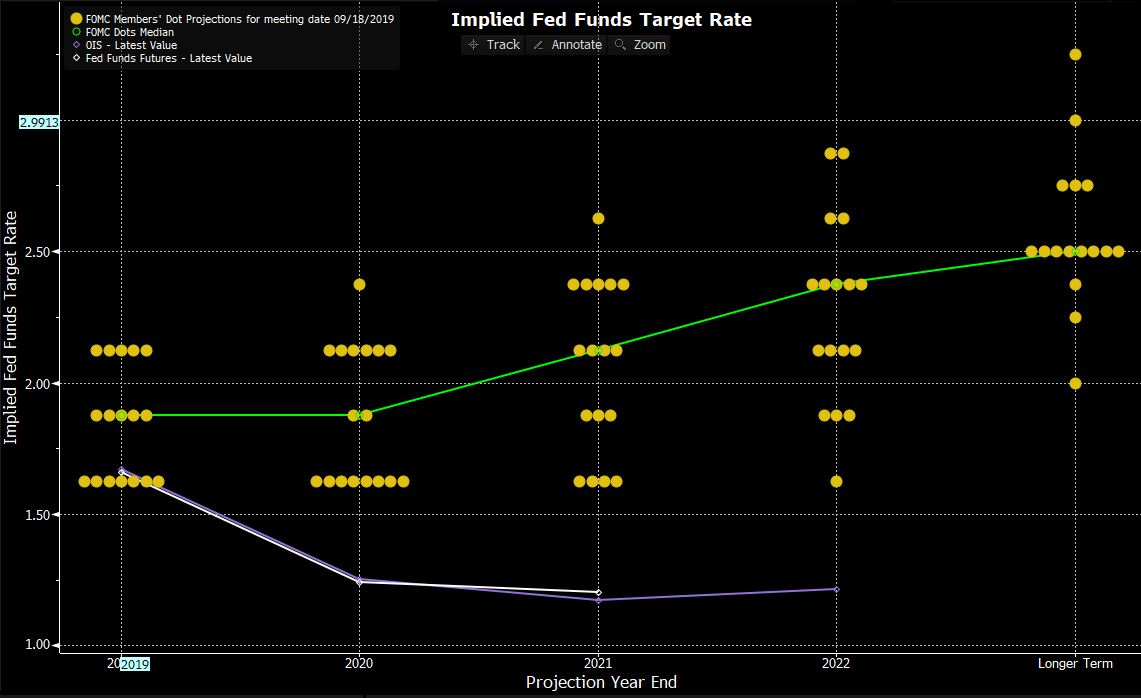

While there are several areas of consideration, I feel there are two standout points that I touch on the video review. The first being the clear divergence within the Federal Reserve’s ranks, although we can take that out further and see an equally impressive divergence between the Fed’s median estimate on the future rate setting and market pricing (seen in the swaps or the fed fund futures curve).

Consider that in 2020, there’s a 62bp differential between where the market sees the fed funds rate and the median forecast from the Fed. While we see one member calling for the fed funds at 2.37% and another 1.62%, the mismatch between the market and the Fed blows out to 92bp in 2021 — a near-four-cut differential.

"Source: Bloomberg"

Bigger balance sheet?

The second issue centres on liquidity. There’d been some disappointment that we didn’t hear of a Permanent Open Market Operation (POMO), which would have essentially seen the Fed supporting the repo market and keeping the money markets in check. This would bring implications for the Fed’s balance sheet, but the Fed feels the current temporary operations will suffice. What’s resonated, however, is Powell’s comments that we could see “organic growth” in the balance sheet. This is music to the market’s ears, although the devil will always be in the detail here. And it’s for very different reasons than that of the other three bouts of asset purchases, or “QE.” This time around it isn’t for reflation purposes, but reserve scarcity and the Fed want to increase excess reserves in the system to stave off risks in the funding markets.

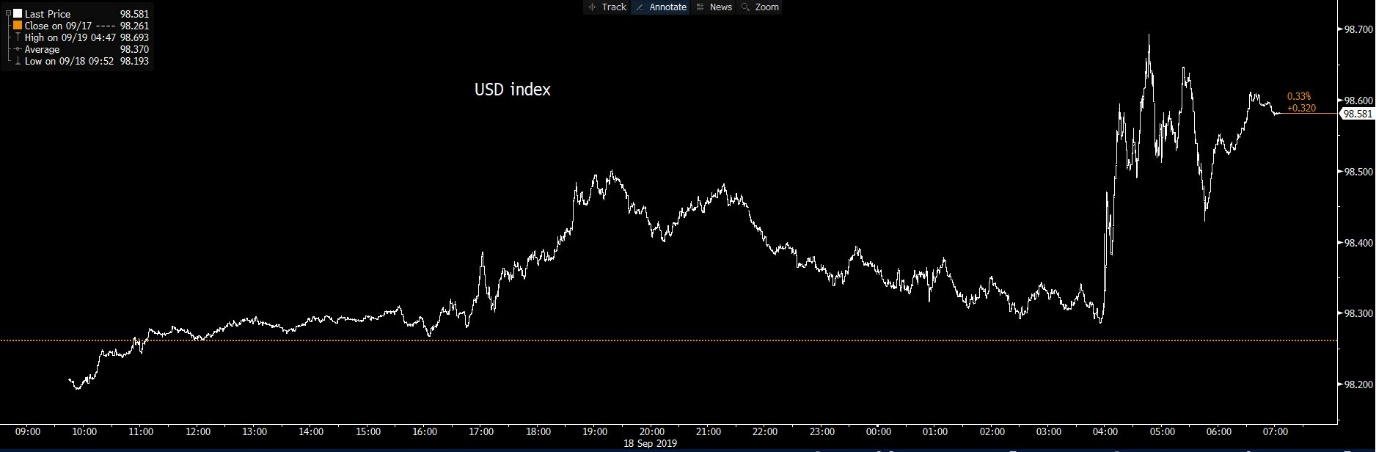

Banks need reserves, but there’s a dwindling level in the system and subsequently the Fed desires a bigger buffer, especially with the reserve issue only likely to become more problematic in the weeks ahead. Regardless of the reasoning, the effect will be seen as “QE lite.” And we head to the 30 October FOMC meeting with expectations high for an announcement, although this will get priced in before the fact. For USD traders, we can see the effect that changes in excess reserves have had on the USD over the years. Now that influence may dissipate, as we consider the Fed is in no rush to ease, and US data and inflation expectations have been hotter-than-expectations of late. But for those bearish on the USD, then this chart will be of interest.

Powell still sees the US in mid cycle

The market was also interested in whether Fed Chair Jerome Powell would continue to formally press a view that the US economy is in a mid economic cycle, as was the case in the August FOMC meeting. The wash-up is that Powell refrained from actually saying this verbatim, but by detailing “you can see from the SEP that we see a favourable economic outlook” and that the cut was insurance against risks, it sent out the same message to the market. Calls that fiscal policy will increase long-run growth married well with comments from European Central Bank President Mario Draghi. It's clear that if 2019 was the turn to a universally more dovish stance from central banks, 2020 would be the year when central banks and governments are moving more closely to cooperation.

Did we learn anything new?

Not really. The Fed sees the US economy is a decent spot even if the market disagrees. There’s broad disagreement in the voting members, although considering the genetic makeup of the Fed takes a dovish turn in 2020 with the appointments of Jody Shelton and Christopher Waller to the team. They’ve been quite outspoken on their views. We’re likely to see a form of QE, although it’s for reasons different from prior asset purchase programs and Powell. They’ll be keen to limit the distortions and moral hazard QE has on asset prices.

The moves in the market tell you how they felt, with initial disappointment being offset by talk of growth in the balance sheet. Are we back to square one, looking at economic data, inflation expectations, financial conditions, the narrative around trade and Brexit? Absolutely.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.