- English (UK)

Analysis

As always, if you want to explore these ideas or need assistance getting set-up on MT5, do reach out to your relationship manager or our support staff.

Baidu

Baidu has been savaged 50% in just 58 sessions and as a CFD trader I'd always recommend buying strength and selling weakness. We may be looking at an inflection point in the bear move. Consider George Soros just announced a sizeable $77m purchase of Baidu, buying the weakness in several stocks that were sold down in the Archegos blow up. If it’s good enough for Soros.

The consensus 12-month price target from analysts is $338.08, which given the current price suggests some 81% upside. Then, consider that of the 44 analysts who cover, 38 have a ‘buy’ recommendation, a function of the expected return. To the fundamental crowd Baidu is considered incredibly ‘cheap’ on 14.9x 2022 earnings, especially when we contrast to other large-cap internet peers, who trade largely around 30x 2022 earnings. The market clearly ascribes limited value to its equity holding of Trip.com, Baidu cloud, DuerOS, or the future of autonomous driving solution.

Will the Q1 earnings prove to be a catalyst that sees price move close to the fundamental value?

We shall see, but as always, as CFD traders we tend not to focus on long-term ‘value’ and cut our craft reacting to price action. It does play into risk vs reward assessment though and we understand that if the bullish catalysts are there and the street are this constructive, if they hear something that resonates that it may start attracting serious capital from funds.

Baidu also have an outstanding pedigree at quarterly results having beaten estimates both on earnings and revenue in seven of the past eight quarters. I'd argue that the valuation cushion and the recent artificial sell-down suggests the barrier to rally is low. Let’s also consider the market is implying a 6.7% move on the day of earnings, so expect some fireworks – and that's a consideration for position sizing.

(Source: Tradingview)

As a short-term trade – if price can push above $190 in the near-term we may see a re-test of the $220 neckline of the head and shoulders. This would likely be driven by better earnings. Conversely, we need to respect the trend and a closing break of $176.90 would see a resumption of the bear trend, suggesting short positions for $140 – possibly $120. The head and shoulders target resides at $100.

Tesla

Tesla is the poster child of the low and no earnings equity movement that have worked incredibly well as markets saw ever-increasing central bank liquidity through 2020 – when Tesla moves, it can become a momentum and trend juggernaut. That time is over, at least for now it seems and in a world where market participants are debating the timing around a reduction in the Federal Reserve’s bond buying (QE) program, and other central banks (such as the Bank of Canada) are already tapering theirs, the market has moved from high growth stocks to value.

We’ve also seen a barrage of negative news flow, specifically around halting production plans in Shanghai, Chinese social media protests and a decline in deliveries in April (month-on-month). Sentiment is poor, but one does question how much of the bad news is in the price?

Having closed below the long-term uptrend on 7 May, much of the momentum crowd took profits and some increased short exposures. That’s a factor that Michael Burry is banking on as he detailed a huge put position.

Price has also closed below the 200-day moving average, although it's not convincing (yet) and one questions if we see a similar situation as we did in March 2020, where this average was the platform for a sizeable rally. If we do see the buyers kick in, especially on volume, I would use that to build exposures for a move into $630/40. Strength begets strength.

As the macro picture evolves though and funds question inflation (and liquidity) and want exposure to financials and energy, and not high growth names that trade on 90x 2022 earnings - Is this time different? If the 200-day MA goes, the move lower could be powerful as nothing good happens below the 200-day MA. A move through $560 and $460 is on and shorts would clearly be the way in my opinion.

(Source: Tradingview)

Having closed below the long-term uptrend on 7 May, much of the momentum crowd took profits and some increased short exposures. The 200-day moving average is now in play and one questions if we see a similar situation as we did in March 2020, where this average was the platform for a sizeable rally. If we do see the buyers kick in especially on volume, I'd use that to build exposures for a move into $630/40. Strength begets strength.

As the macro picture evolves though and funds want exposure to financials and energy, and not high growth names that trade on 90x 2022 earnings - Is this time different? If the 200-day MA goes, the move lower could be powerful as nothing good happens below the 200-day MA. Shorts would clearly be the way in my opinion. It’s make or break for the big EV.

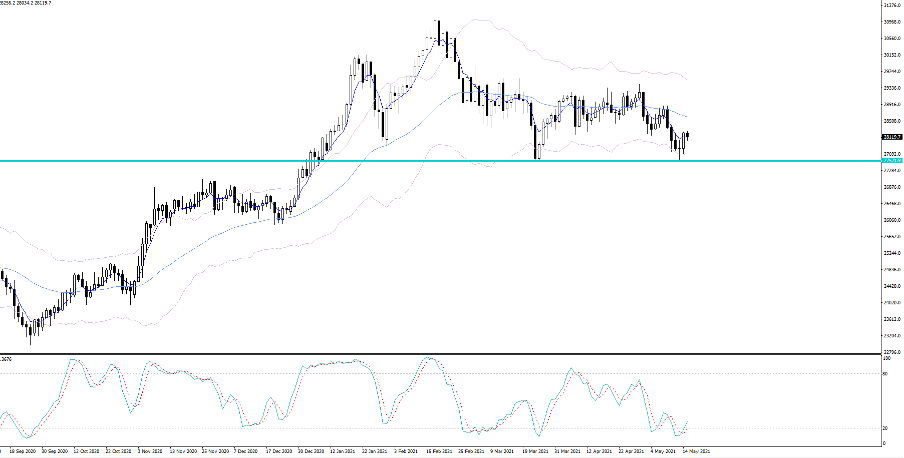

Hang Seng – HK50

Watch exposures of HK50 as we look out for quarterly earnings from Tencent on Thursday. Consider that the implied move in Tencent on the day of earnings (derived from options pricing) sits at 2.1%, which seems fitting with moves we’ve seen in prior reporting quarters. However, importantly for index trader’s, Tencent is the second biggest stock in the HK50, commanding a near 10% weight on the market.

Subsequently, if we see earnings which create volatility, the move should impact the broader index given the relatively high level of concentration risk. One for the radar, but the bulls will want to see the double bottom at 27,520 hold or it could mark a more bearish trend in the index. Solid earnings numbers from Tencent should aid those calling for mean reversion and a move back to the 20-day moving average, where I would look for more bearish positioning again.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.