- English (UK)

Analysis

Coming into the week we knew the rates/swaps market had priced in fairly aggressive easing in 2024, notably in the US and Europe, where the market was implying over 4 cuts by Dec 2024. Many, including myself, saw hawkish risks to the bank meetings, given it was always going to be tough to ‘out dove’ a market positioned for such easing.

That was obviously not the case especially in the Fed meeting, in fact, it couldn’t have been further from the outcome.

The trade of the week

In effect, the trade in FX this week was straightforward; buy any currency where the central bank was resolute in its fight against inflation and pushed back on market pricing.

Conversely, if the central bank refrained from fighting the recent easing of financial conditions and market pricing, then traders sold the currency.

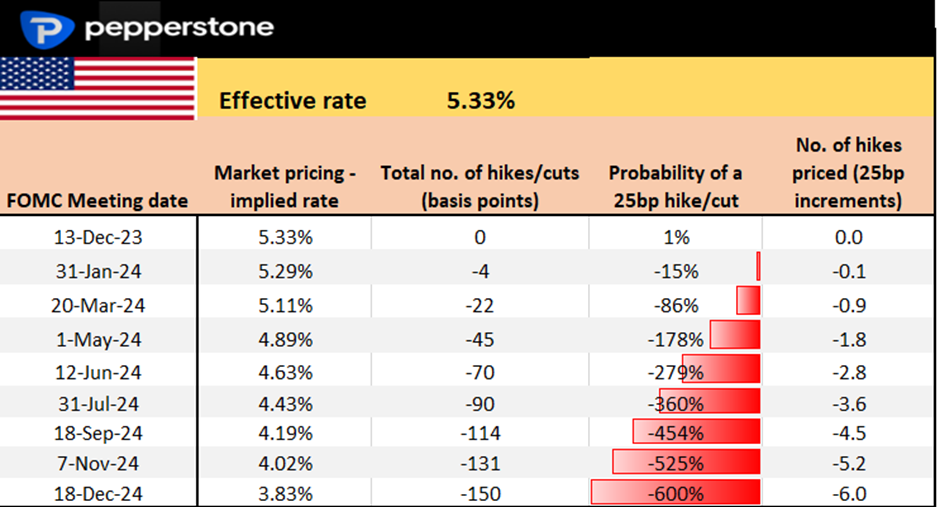

We obviously saw that in the Fed meeting, where the ‘dots’ were taken down to 4.6% (implying 3 cuts in 2024) and closer to the market pricing. Where Jay Powell loosely pivoted, surprising many by suggesting the Fed was talking about the timing of cuts. The lack of pushback from Powell on market pricing was key, and the USD has followed front-end US Treasury yields lower.

The ECB took a different stance and were resolute in their fight against inflation, detailing they were united in their belief that rate cuts would come later than market pricing. Christine Lagarde added this was not the time to be “loosening their guard”. EURUSD is subsequently testing 1.1000 and eyeing a break of the 29 Nov swing high.

The BoE held a 6-3 split on policy, with 3 members (Greene, Mann and Haskel) still calling for hikes, when there was a belief that this split could move to 7-2. The bank maintains a higher for longer stance. GBPUSD has broken out, and while traders faded the move into 1.2800, the pound looks well supported here.

We had an outlier play from the Norges Bank who hiked by 25bp when markets were pricing 3bp, setting off a solid rally in the NOK. NOKSEK should be on the radar, with a bullish outside on the daily – a move through 0.9764 and there is real scope for 0.9900. In a world where central bank divergence is still a compelling strategy in FX trading, the Norges Bank are a relatively hawkish play.

The timing of central bank cuts brought forward

The aftermath of the central bank fest is that the market has brought forward the timing of cuts expected in 2024. We knew 2024 was a year of normalising policy, but the timing and the start date were a growing debate.

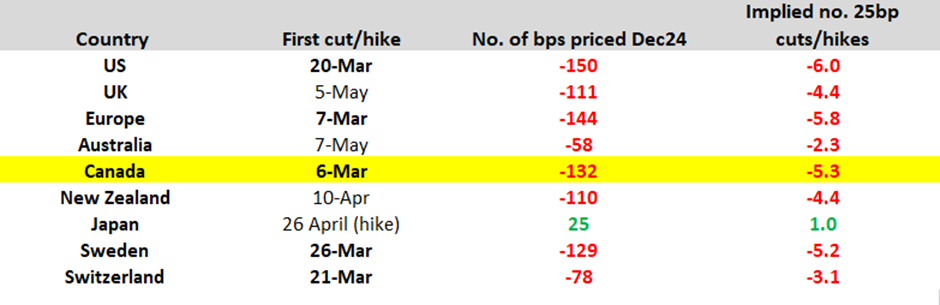

Assessing the current expectations priced into OIS, we see the Fed, ECB, BoC, Riksbank (Sweden) and SNB are now all expected to ease in March – Here, the first cut is determined if there is a greater than 50% probability of cut ascribed to that meeting.

By virtue of the date of the meetings, the BoC is currently expected to lead the charge, joining LATAM central banks in cutting rates.

The market places a 90% probability the Fed cut by 25bp in March, although that could be thrown around by NF payrolls (6 Jan) and CPI (12 Jan), but these risks don’t eventuate until January. The market looks for 6 cuts from the Fed by December 2024, and further out a terminal fed funds rate of 3.2%.

The ECB have more scope than most to ease, given low growth and a rapid decline in inflation. However, the pushback from Lagarde and co suggests conjecture on the timing of initial easing – perhaps this is a function that its desirable to keep one’s currency strong to limit imported inflation. Either way, rates traders see March as the start date, although the conviction is not as high as Fed pricing (at 66% implied). Again, we see nearly six cuts priced by end-2024.

We also now see rate cuts emerging in Australia sooner, with May brought forward as the date by which the RBA may ease.

The markets are dynamic, and discount all known news in real-time. After all we’ve heard this week, the wash-up is rate cuts are coming not just sooner but more aggressively. This could easily change given the incoming data, but for now, conviction levels are higher and the big theme for 2024 – policy normalisation – evolves.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.