- English (UK)

The market had thoroughly expected this outcome and had May’s departure fully priced, with GBPUSD having fallen from 1.3185 on the sixth of May into 1.2606. In fact, through this period, GBP fell against all G10 currencies with the most significant move seen against the safe-haven CHF and JPY, where there were literally no buyers. All intra-day rallies were contained into the 5-day EMA, and when price broke through the prior day’s low, it just attracted new sellers to the mix – hence the strong downtrend. The fact, then, that we saw GBP buyers on the news of May’s resignation reeked of a classic ‘sell the rumour, buy the fact’, with GBPUSD building on the break of 1.2700 on the re-open of trade today.

GBPCHF Daily Chart

In the short-term, the pair is eyeing a possible move into area 1.2800/30, which is where I would expect the short covering to abate and the sellers to initiate shorts again.

GBP positioning and sentiment

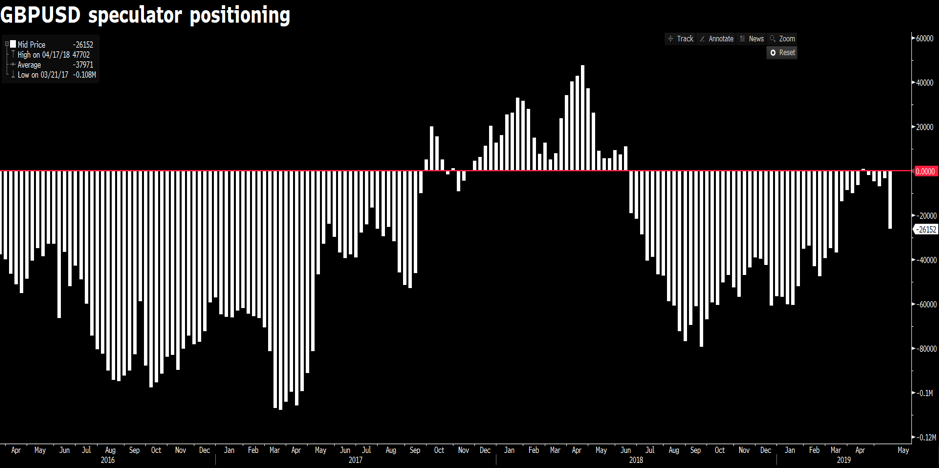

From a positioning perspective, the speculative FX community increased its net short GBPUSD futures exposures last week to -26,152 contracts – see the Bloomberg histogram below. Consider that while we saw a sizeable increase in GBP shorts on the week, current positioning is hardly at levels that can be considered ‘stretched’ or at extremes. We can also look at options market and eye one-month risk reversals, which portray the skew in demand for GBPUSD ‘put’ and ‘call’ volatility, to get a sense of where traders see the higher probability of a directional move over this period. Here, we see the skew at -0.1675x, which shows traders almost see symmetrical risk over this period, with the cost of putting on bearish options positions almost the same as bullish ones.

We can also see GBPUSD one-month implied volatility (IV) sitting off recent lows at 7.46%, which gives an implied move (up or down) from current spot levels of 227-pips. This gives us an expected trading range of 1.2953 to 1.2499. This hardly suggests the market fears fireworks ahead and consider this is half of IV we saw in March. With the market now staring at a challenge for the Conservative Party leadership, one questions if the market is too complacent or whether it is just a touch too early in the market’s thought process.

The process from here - choosing a new leader

I’d argue the process started at least a month ago, with the various runners and riders seeing Theresa May’s position as Prime Minister (PM) as untenable and her time slipping by the day. Not only have MP’s been considering if they would run, but also, it has given MPs a chance to consider who they would vote for and strategically how it would influence their own careers.

There is now a two-stage process, which commences on the 10thof June, with the 313 Conservative members asked to hold a series of knock-out votes, taking place at least twice a week. The candidates are subsequently whittled down until the two remaining candidates go into a final run-off vote to the full Conservative Party of some 120,000 members. This vote should play out before September, which doesn’t give the incoming PM a lot of time until the Conservative Party Conference (29 September), theEU Council meeting (17 October), and ultimately the extended Brexit deadlineof 31 October.

The key players

There are some 25 candidates who have put themselves forward for the role as PM, but we should focus on five standouts.

- Boris Johnson- The former Foreign Secretary and the clear favourite. His charisma and sheer celebrity status may help in any future general election, and Labour fears him as a leader above all others. Johnson seems happy to engage all factions of the Tory party but is not averse to pushing without a deal and onto WTO terms if it’s the only option. In theory, Johnson as PM is a GBP negative, but is it mostly priced in?

- Dominic Raab– Knows the EU well having been Theresa May’s former Brexit Secretary. Seen as the most ‘no deal’ Brexit candidate in this list, which will appeal to the European Research Group (ERG). He will find it harder to garner support from the moderates, and certainly Labour, should a re-worked Brexit solution need to be put to the Commons. Raab as PM is a GBP negative

- Michael Gove- The Environment Secretary and an under-priced contender. An astute operator, who will appeal to both the Brexiters and the remain factions of the Tory Party. One to watch, especially given his history with Boris Johnson in the 2016 election. A small GBP positive given he has previously voted for May’s Brexit Withdrawal Agreement.

- Jeremy Hunt– The Foreign Secretary, but made his name as the former Health Secretary. According to conservativehome.com, has already picked up a strong following of Tory MPs, but is the most ‘remain’ leaning candidate here. Although, he has given hints at warming to a ‘no deal’. A small GBP positive.

- Sajid Javid– The Home Secretary. Supported remain in 2016, but has recently suggested a no deal Brexit would not harm Britain, which likely won him support from the ERG party.

How to trade this process:

The overriding consideration has to be the 31stof October Brexit deadline, where at its most simplistic, GBP trades on the notion that the new PM will need more time to rally the troops and work a compromise. So, either a deadline extension is granted through to, say, March. Or, given the EU have already made it clear they won’t alter the continuous Irish backstop (despite a change of leader), the UK parliament is subsequently unable to find a compromise and hit the October deadline without a deal – a scenario we know the majority of the Commons are against, with the passing of the Cooper Amendment in April. However, should it happen, it will see GBP volatility rise significantly.

While the new PM may be a far more efficient negotiator than Theresa May and find ways of reaching compromise among the various party divisions, even across-party, unless the Commons agree on a deal that will ironically most probably look a lot like the three deals May already put to parliament. Then the only reason why the EU allows an extension is because of a political event – that being, either a General Election or a second referendum, which would contain ‘no deal’ or ‘no Brexit’ on the ballot paper.

With the current awful polling of the Tory party, a general election would create huge uncertainties, where the threat of a Corbyn led government sending the GBP heading toward 1.15, perhaps even lower.

MP’s have to think very carefully, not just about who would best unite a fractured Tory party, but also who would be best at going toe-to-toe with both Jeremy Corbyn and Nigel Farage, who will likely see his newly established Brexit party gain its first Commons seat in the Peterborough by-election on the 6thof June.

At this juncture, most roads are leading to a lower GBP, with the preference to sell further short covering in the GBP.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.