- English (UK)

Analysis

Superior liquidity and spread - How Pepperstone sharpen your edge

Recognising this core consideration we're consistently reviews the bid-offer spread across all instruments on both the Razor and Standard account, as we do commissions and swaps.

We’re proud to announce that we've cut the bid-offer spread on our most actively traded major FX pairs by 40%, specifically on our commission-free Standard account. The standard account offers clients an ‘all-in’ cost, incorporating our raw spread direct from our LP’s as well as the commission and effectively represents the total cost to execute an order.

Our spreads are dynamic and fluctuate throughout the day driven by changes in the underlying market conditions, such as fast-moving markets, news and event risk. We often see the variability of the spread follow predictable patterns through the day, with most of the big flow desk centred in London and New York. Therefore, we’ve taken an average spread through the day over a recent data sample.

For those trading on a zero-commission account, Pepperstone now offers the tightest all-in spread in major FX pairs, in the retail trading industry.

Liquidity – the most important trading consideration you never knew about

Perhaps the most important consideration, regardless of account type is the liquidity conditions at the quoted or displayed buy and sell price. Liquidity is the ease at which a trader can get in and out of a position at the quoted price, and without having to move down the order book to achieve a fill at the next best price.

Obtaining a worse price because the volume offered by a market maker or an LP to transact at the quoted price is lacking is called ‘slippage’ and will result in the trader paying a wider spread.

This happens far more frequently than many would believe, especially by smaller brokers running a zero-spread model. Where traders looking for a fill in 0.1 of a lot of or greater may see their actual fill on the transaction wholly different from price quoted on the platform.

In most cases, a trader will not reconcile the difference, but this slippage will add up as a cost on the portfolio, especially for traders transacting in size and speaks to a lack of transparency in pricing and can damage the trust a client holds for their broker.

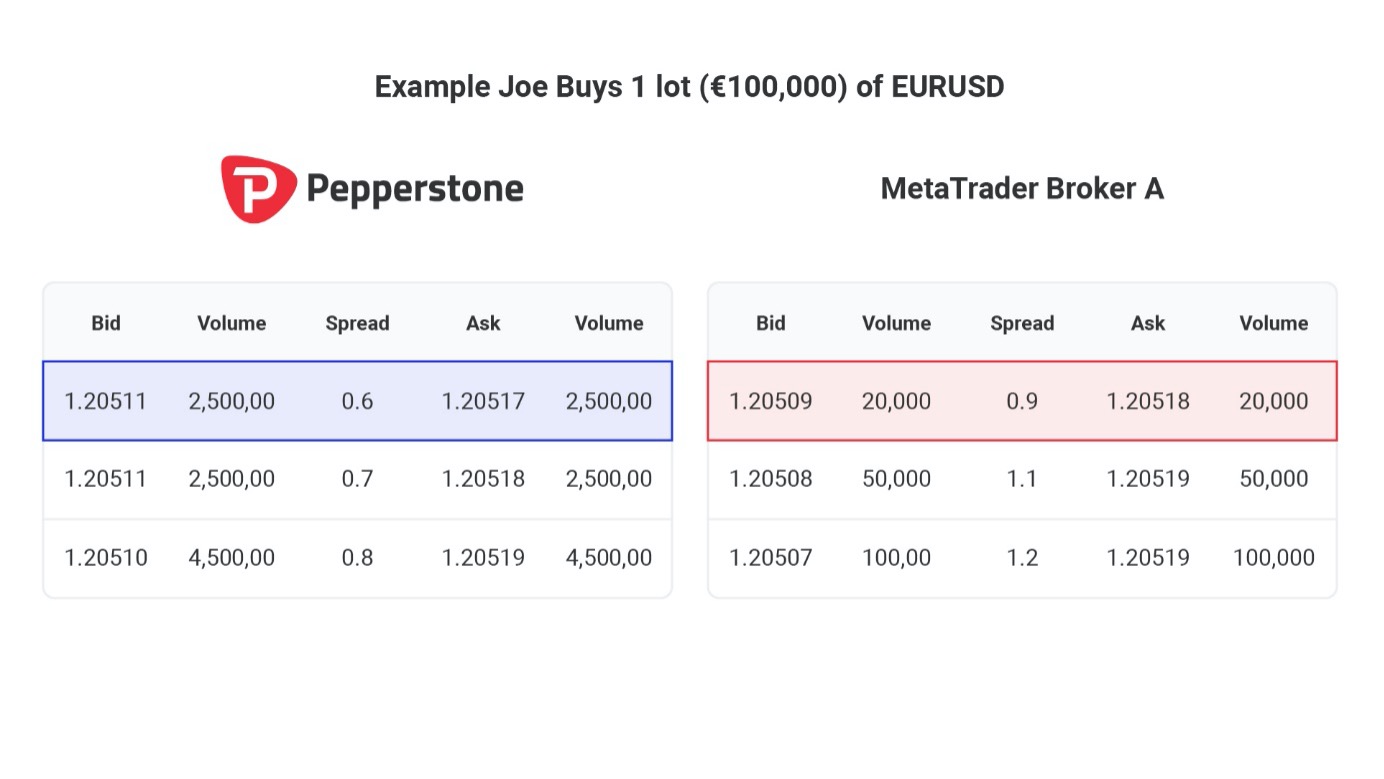

Example – Joe buys 1 lot (€100,000) of EURUSD

With Pepperstone the 1 lot order is executed at the quoted price of 1.20517. With Broker A, however, the volume isn’t there to facilitate the 1 lot request, so the order is filled at the Volume Weighted Average Price (VWAP) of 1.20519, instead of the quoted price.

This may seem like a small difference, but it highlights that the price Joe thought he had transacted at and the actual transaction fill may be different given the liquidity dynamics.

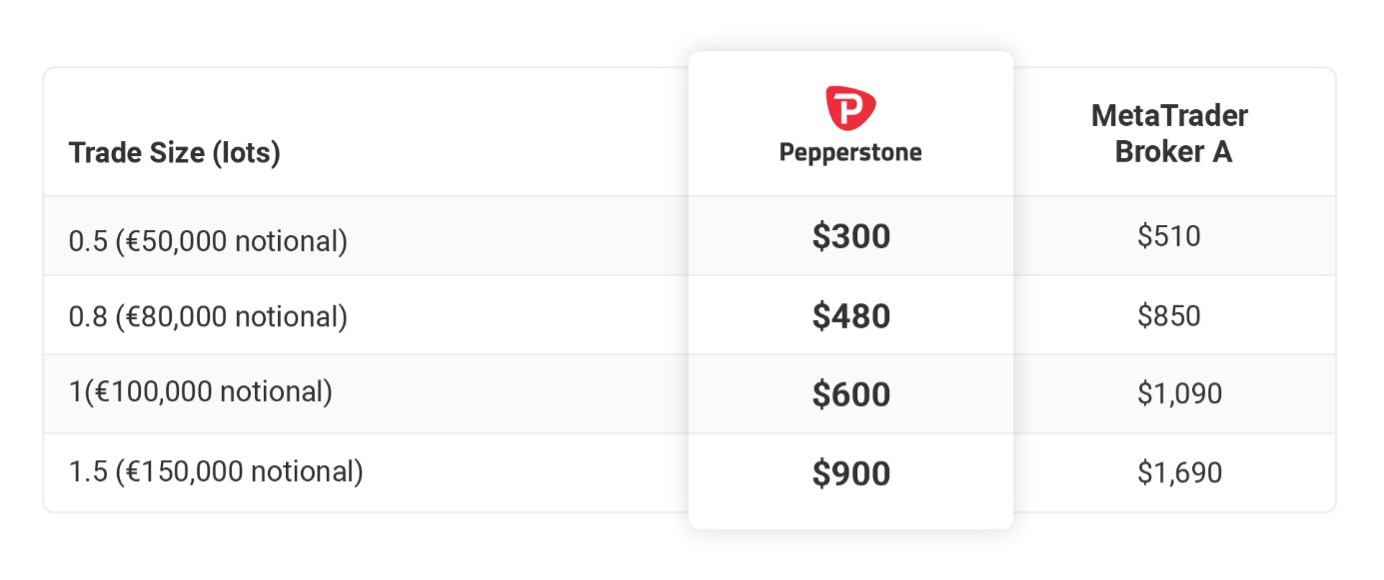

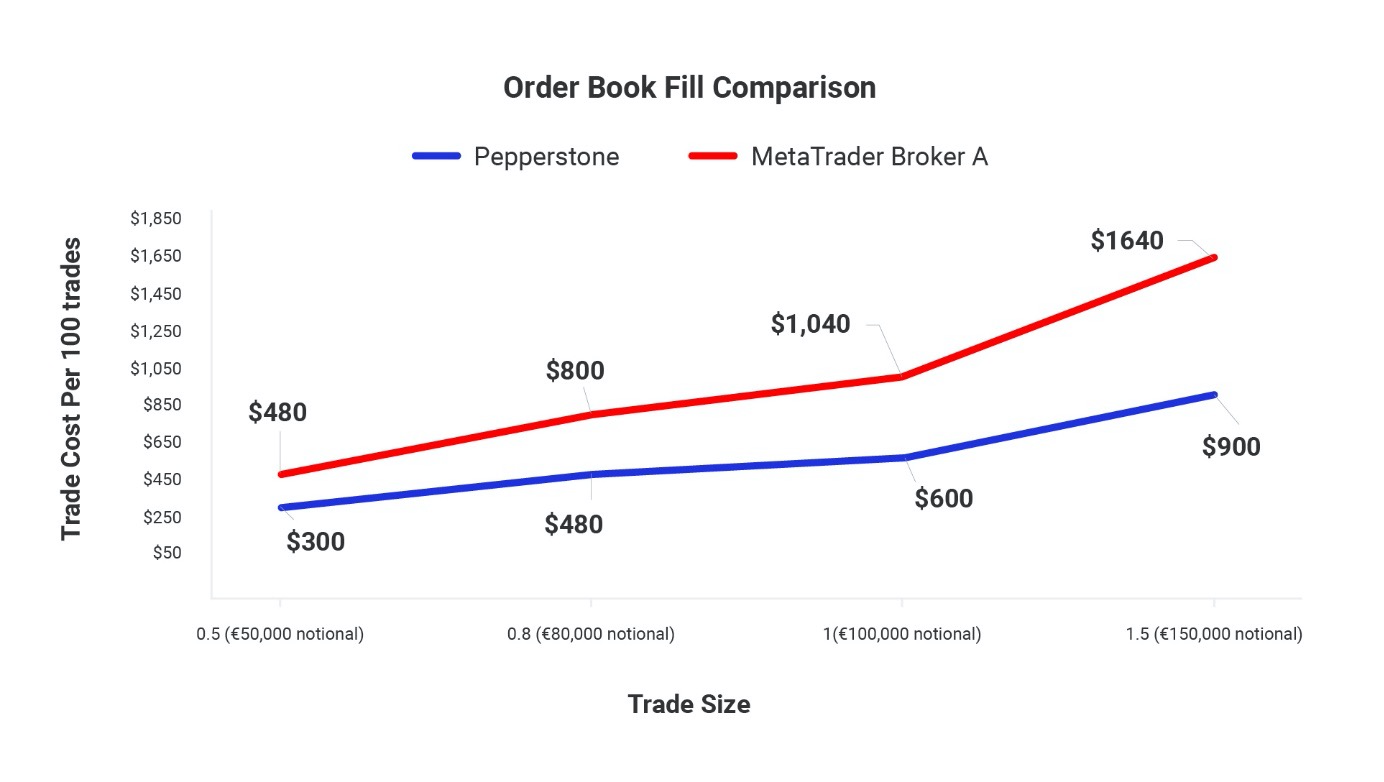

Consider how this scenario plays out over 100 trades. While the price and the bid-off spread will fluctuate (from this example), and liquidity will vary trade-to-trade, if we extrapolate the parameters in this example, we can see how this plays out over time.

We can see the divergence growing over time.

Our superior liquidity conditions can help you obtain an edge

Pepperstone’s deep liquidity at the quoted price (also known as top of book liquidity) is industry-leading and considered the best of the MetaTrader brokers. Typically, if a trader wants to transact in a larger size, they will have a far greater chance to open and close a trade at the price they were quoted than other brokers.

So, with the tightest spreads on the zero-commission account on majors, and industry-leading liquidity at the quoted price, see the Pepperstone edge for yourself.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.