- English (UK)

The Daily Fix: Solvency fears rise, as risk aversion takes over from reflation

The bulls will point to the bid off the lows in risk and the further confirmation of a central bank inspired buy the dip mentality. The fact the S&P 500 is just holding above the 5-day EMA (2767) is also positive, and until price can close the session below here, it’s hard to put on bearish trades with any conviction.

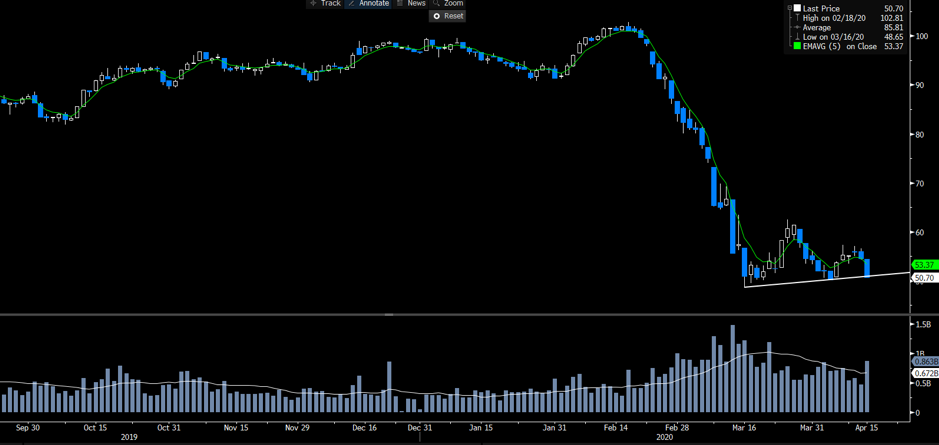

The bears, who haven’t had much going their way of late, will see that despite the rally off the lows in risk, the markets had a broad risk aversion vibe. We ultimately saw strong selling in EU equities, with the MIB given a good working over – see the EU bank index for reference, it looks quite concerning here, especially on rising volume.

EU Stoxx bank index

"Source: Bloomberg"

The S&P 500 closed -2.2%, with energy, materials and financials finding sellers easy to come by. Small caps were savaged (the Russell closed -4.3%) and we’ve seen solid buying across the US Treasury curve (10s are -12bp), with a strong flattening of the Treasury curve. Inflation expectations have been hit hard with 5-yr breakevens -10bp and undoing a decent chunk of the recent reflation move.

HY (high yield) credit spreads have widened, with the HYG ETF -0.9%, while we've seen vols pick up with the VIX index moving +3 vols to reside above 40%. In FX markets the USD has found its mojo and been the place to be in 'major currencies', maintaining its status as the anti-S&P 500. I focused on USDCAD yesterday and it's not hard to see how that one played out, although as we see, the selling in the CAD was outdone by the MXN, ZAR and AUD.

Don’t discount the influence a stronger USDCNH has had too. Moves from the PBoC yesterday to cut the rate on the MLF (Medium-Lending facility) to 2.95% have hit the CNH/CNY (yuan) at a time when safe-haven USD demand has resurfaced. A higher USDCNH could weigh on the AUDUSD and alike, so USDCNH should be on the radar.

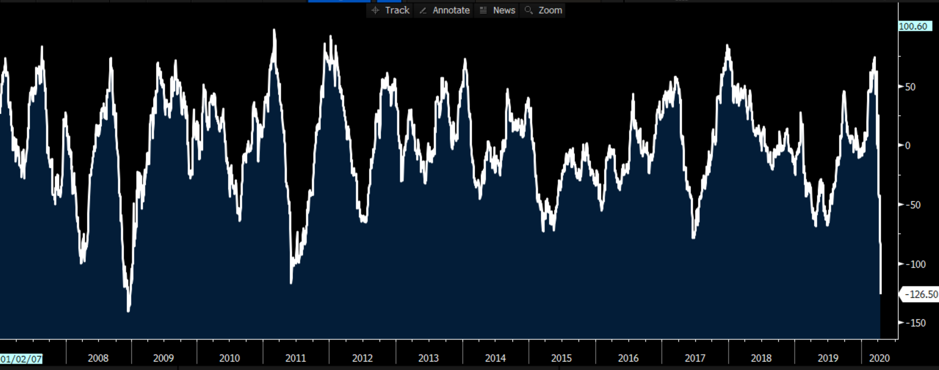

US data was awful

The bears have focused on the US data, where we saw a US retail sales -8.7%, or -4.5% if we exclude auto sales. While (April) NY manufacturing index fell by a record 56 points to -78.2 and more than double the consensus of -35. March industrial production fell 5.4%, while the NAHB housing market index also had its largest-ever drop on record.

One way to visualise the data series is through the Citi US economic surprise index – if this is falling it shows the data missing not just deteriorating but missing the consensus estimates. Clearly not a good look.

"Source: Bloomberg"

Looking ahead - We focus on US weekly jobless claims (tonight 22:30 AEST), where the market is expecting a further 5.5m new claimants – sobering numbers indeed. Timely then that the NY Fed has announced they are launching a weekly economic tracker this will include same-store sales, consumer sentiment, fuel sales and others. I expect this to get a good run by data watchers and there is a growing possibility the market will become more sensitive to it. Loan loss provisions telling a story of future solvency concerns.

Loan loss provisions a focal point

The focus this US reporting season so far hasn’t been on earnings per ce – but rather on loan loss reserves. BAC adding to the announced provisions seen from JPM and WFC reporting a $4.8b provision for the quarter, which to put into context represents around 0.5% of its loan book – either way, the provisions put forward from US banks (JPM, BAC, GS etc) have enforced the view that the next leg to the shutdown crisis is one of solvency.

It’s not just the US, but in Australia, we’ve seen a horrible NAB business confidence and Westpac consumer confidence report in the past two days, and this has just enforced a belief that the economic recovery is not going to V-shaped and it's going to be a long and painful slog ahead. Today’s Aussie (March) employment figures will be of some interest for traders, with the market expecting 30k jobs to have been lost, although, it’s will be the April numbers that will show the greater extent of the layoffs. I am out of AUDJPY exposures (see yesterday’s note), although I am sceptical today's Aussie jobs report will cause too much volatility, as the AUD is focused intently on S&P500 futures. That said if the print comes out over 100,000 jobs lost then we could see a short, sharp move.

Moves in crude

Of course, oil has been a big theme, with WTI May futures hitting a low of $19.20 before rebounding 4.8% to close +0.2% on the day. There has been a focus on the spread between the WTI May and June futures contracts which blew out to a massive $7.29, showing the fears on the near-term inventory build – this was seen case in point in the DoE inventory report which showed some 19.2 million build for the week. Comments from the EIA also very much in play. There has also been interest in trading the WTI/Brent crude spread, with a classic long/short trading approach in play – that is, being long WTI (June) /short Brent (June).

This trade enforced by the headlines that the “US weighs oil output cut by paying drillers not to produce”

A weaker open is clearly expected in Asia, with Aussie SPI futures -2.3%, and NKY futures -and the tape could reveal a lot about sentiment – will traders buy opening weakness given the oil headlines or will we see selling from the get-go?

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.