- English (UK)

Analysis

Playbook For The June ECB Decision

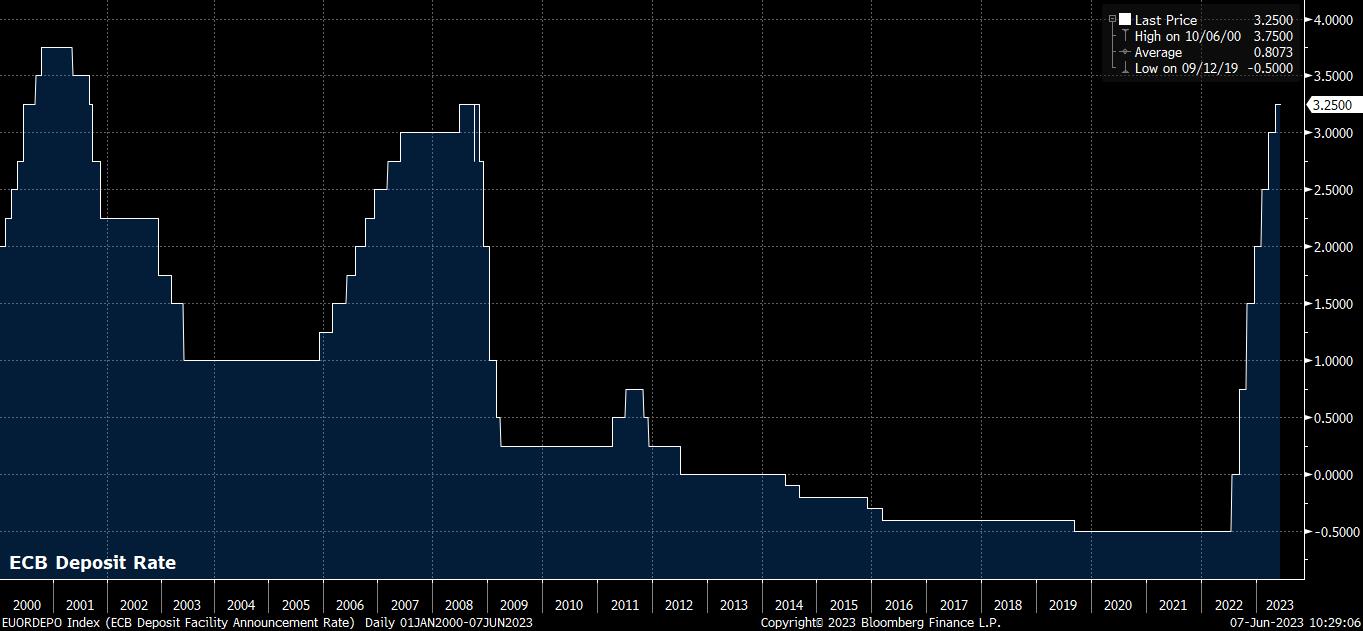

Markets, as near as makes no difference, fully price a hike from the ECB next Thursday, with OIS implying a roughly 95% chance that the deposit rate is raised to 3.5%, a move which would represent the highest depo rate since 2001.

While the Governing Council don’t publish a formal record of the vote split after ECB decisions, it seems likely that there will be a significant degree of unanimity among policymakers, with recent remarks from even the most dovish members of the GC indicating that further tightening is required before declaring victory in the battle against inflation. In a similar vein, and given the ease with which markets have digested the news, it seems unlikely that the ECB will alter their present plan to halt reinvestments under the Asset Purchase Programme (APP) next month.

On the subject of inflation, although both headline and core CPI have begun to roll over in recent months, both measures remain substantially above the 2% target, while President Lagarde has been explicit in noting that there is “no clear evidence underlying inflation has peaked”. With this in mind, the accompanying policy statement should retain a tightening bias, though we are unlikely to see policymakers pre-commit to any action in July; a meeting where the market, currently, sees a three-in-four chance of a further 25bps increase.

The June ECB meeting also sees the release of the latest set of quarterly staff macroeconomic projections. While recent data has tended to favour the doves – PMI gauges have shown softening momentum, retail sales held broadly flat, demand from China appears to be waning rapidly, and Germany has dipped into technical recession after notching two consecutive quarterly GDP contractions over winter.

Despite all of that, and the downward inflation trend that is trying to embed itself, it seems unlikely that the staff projections differ too significantly from the prior round unveiled in March.

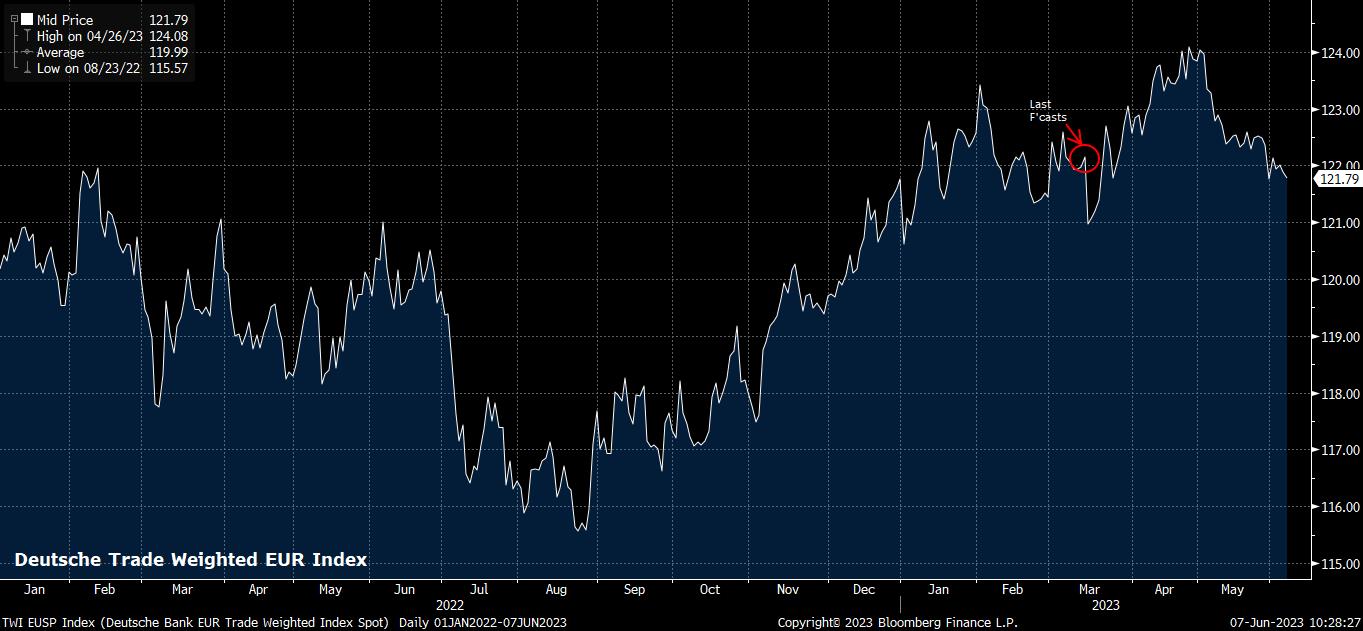

On inflation, there is unlikely to be a large shift, with the decline in natural gas prices since the last round of projections being offset by crude prices sitting marginally higher than during the previous forecast round. The weakness in the EUR, not only in EUR/USD, but also to the tune of around 2% on a trade-weighted basis over the last six weeks, is also unlikely to have a significant impact, with the currency still marginally firmer than when the March forecasts were compiled. Consequently, the ECB is again likely to see HICP around 5.3% at the end of the year, before continuing to decline to just north of 2% by the end of the forecast horizon.

As for growth, it will be interesting to what the projections make of what has been, at the very best, a mixed slate of economic data over recent weeks. A marginal downward revision to GDP expectations across the forecast horizon seems likely, particularly considering policymakers’ recent acknowledgement that the full impact of previously delivered policy tightening has yet to be transmitted across the eurozone economy, leaving the expectation for 1.0% YoY growth this year looking rather punchy.

Turning to markets, and the ECB decision comes at an interesting time for the EUR, with the common currency having softened significantly over the month of May, though with losses appearing to have stalled, perhaps temporarily, at 1.0650. Further complicating the situation is that the ECB decision comes a mere 18 hours after the FOMC announce the conclusions of their latest policy meeting.

_eurusd_mb_2023-06-07_10-27-15.jpg)

Taking this into account, volatility is likely to be sharply elevated next Wednesday and Thursday, a consideration that traders should bear in mind when evaluating position sizing, leverage, and orders over the two key decisions. In terms of levels to watch, 1.0650 stands out as immediate support for EUR/USD, though it is 1.05/1.0510 that is the more significant region to have on the radar, given not only the big figure’s psychological importance, but also the presence here of the 200-day moving average, which spot has traded above all year.

To the upside, resistance immediately stands at 1.0750, before the 100-day MA at 1.0810, and the 50-day MA at 1.0890. Overall, with the bar for a hawkish surprise being a rather high one, risks to the EUR appear tilted to the downside, over the ECB in isolation.

As for European equities, we come into the ECB meet with the DAX having traded in a relatively tight 15,800 – 16,300 range for much of the last two months. These levels stand as the most important to watch, though the 50-day moving average at 15,905 also bears some consideration.

Given that policymakers seem unlikely to surprise in a hawkish direction, equities may enjoy something of a relief rally post-release. However, any gains seem likely to prove short-lived, with the index’s longer-run trend set to be determined by external developments, namely the progress of any further economic recovery in China.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.