- English (UK)

It's quite the sell-down in the USD today with the USD lower by 1% and down against all major currencies. While the SEK has worked best on a percentage basis, it’s the GBPUSD that has been the star performer for me, gaining 1.7% - while most will put this down as the “Rishi rally”, it feels its feeding off the relief from lower gilts yields as well as the broad risk rally.

The DXY sits on the 50-day MA, which has acted as a reliable trend filter since late Feb. For those looking to buy USDs into this period of weakness one should question if the move will be similar to 10 Aug when price traded below the 50-day average for 3 days and then resumed its bull run, or 30 May when it kissed the average, reversed, and rallied – or indeed could this time be different, and we see the start of a prolonged drawdown?

(USD index – daily)

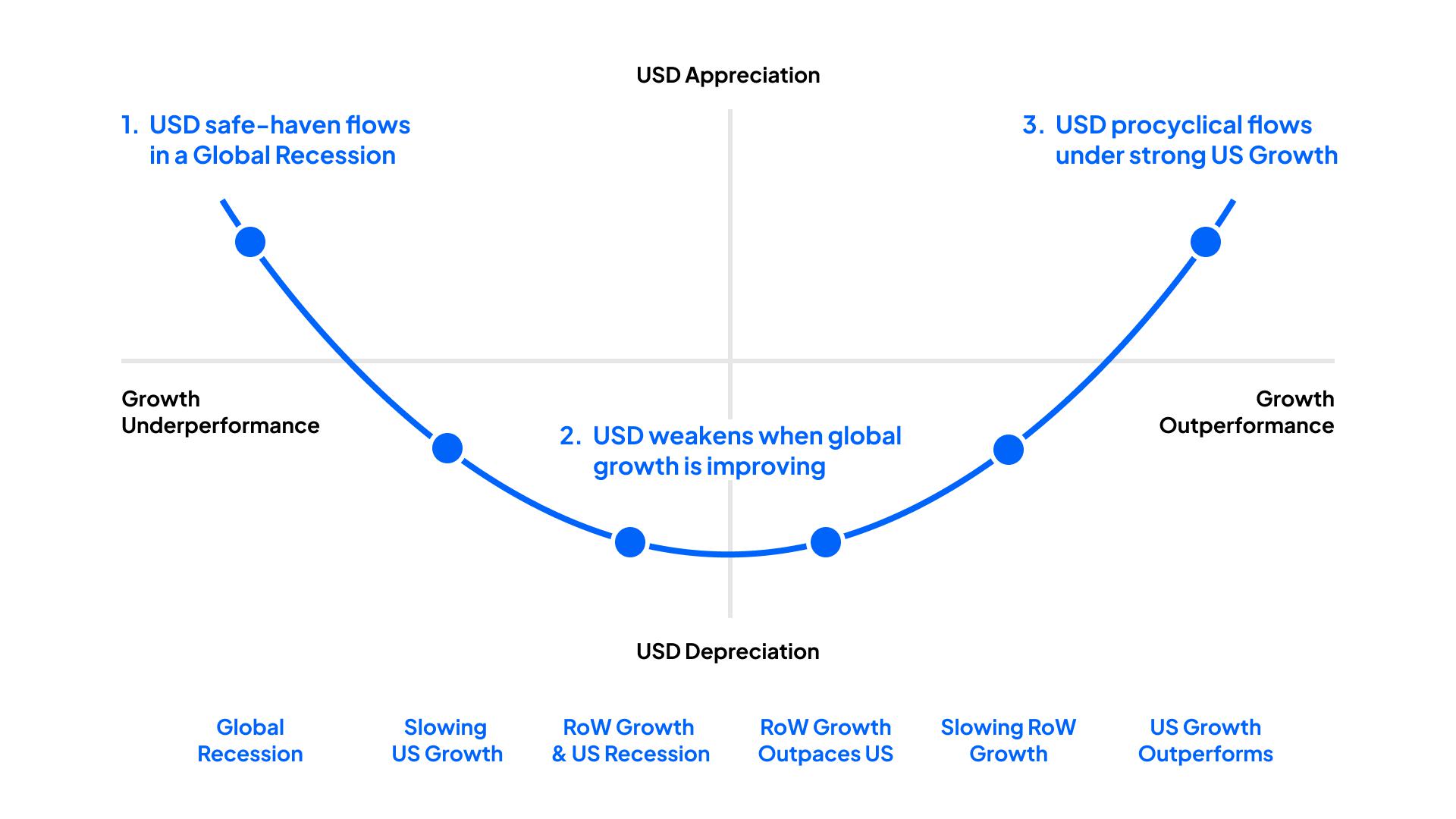

Under the USD ‘Smile’ theory I guess we’re looking at the right-hand side of the Smile – US exceptionalism – that has been called into question in US trade.

Reverting back to the technicals, the 4 Oct low of 109.87 in the DXY will be closely watched, and this marries with 0.9999 high seen in EURUSD – EURUSD is threatening to break the bear channel its traded since 10 Feb and clients are starting to fade this strength, with 64% of open positions now held short in EURUSD. Tomorrow’s ECB meeting looms large, although the markets have fully priced a 75bp hike with the deposit rate priced to rise to 2.9% by late 2023 – there is a lot to look out for in the meeting, which makes a playbook hard to consider – I see the risks as two-way and have no clear bias or edge over the news.

The catalyst behind the USD moves

The trigger for the USD sell-off was the S&P CoreLogic Case-Shiller House Price index, with the market seeing house prices falling 1.3% MoM – for context, this is the first consecutive back-to-back monthly declines since 2010 – the interesting aspect is this data point has rarely got a look in from the market for years but has now become a concern – it makes me question the other tier 2 data points and if these need to be event risk considerations. CB consumer confidence also came out below consensus at 102.5 vs 105.9 expected and this compounded the USD selling.

As always, the US bond market has provided the backbone to currency moves, with a solid bid seen through the 5- to 30-year part of the Treasury curve – we’ve seen a decent bull flattening trade put on, with the 2s10s spread coming in 12bp, as 10yr Treasury yields fell 17bp to 4.07%. US real rates have dropped a touch with 5’s -5bp and at 1.60% are eyeing a move to 1.50% - a level I suggested in the ‘Traders Week Ahead Playbook’ that if breached would see risk rip – equity higher and USD lower.

AUDUSD in focus

AUDUSD overlooked the Aus govt budget, but has caught a solid bid on the US data (US yields lower), testing Monday’s high of 0.6411 – the AUD move coincides with a pullback in USDCNH from 7.3749 to 7.3041, where we’re now seeing price stabilise – we watch the PBoC daily CNY fix at 12:15 AEDT as this was the driver of USDCNH upside yesterday – a break of 0.6411 in AUDUSD could see the bulls pushing price to 0.6550, but we’ll need to see a better tape in the Hang Seng and H-shares – our call for the respective cash markets is higher but the recent moves look dark and there’s a lot of concern about the changes underway.

Those with AUD exposures will need to keep an eye on today’s Aus Q3 CPI print (11:30 AEDT) – the consensus is we see 7% headline CPI and 5.5% on the trimmed mean measure – with the market pricing 28bp of hikes for the 1 Nov RBA meeting I question if there is any number that materially changes this position – the move in the AUD may come in terminal pricing with Aus 30-day cash rate futures above 4% in mid-2023.

While we’ve US equity futures finding sellers after the cash market close, driven by weaker-than-expected sales and EPS from Alphabet (Microsoft are also lower). While that is a consideration, US cash equities indices closed on their highs. Equity working nicely as the need for USD hedges rolls off, with the US500 breaking out above the 5 Oct swing and testing its 50-day MA – it’s hard not to like the price action with price running inversely to the lower USD and bond yields – this idea of bad news is good news for risk well and truly cemented here and the market rightly or wrongly feels we’re a small step closer to a ‘pivot’ – again, we ask will the Fed be happy to with the easing of financial conditions?

Digging into the equity move we see 90% of S&P500 stocks are higher and it's only energy which lower on the day – cash volumes are in-line with the 30-day average, but slightly below in the futures markets. Still, the shorts are covering here and the US2000 is leading the charge – the bulls have the upper hand, and it feels like the balance of risk is for further upside – the same is true in the NAS100, although we’ve seen futures drop 0.9% given the poor showing in the aftermarket from big tech.

Interestingly despite a decent sell-off in the USD and real rates moving lower, no one told the gold market, and we see the yellow metal gaining a mere +$3. The same can’t be said of crypto where the bulls have stated their case – they say, “never short a dull market”, well ETH tracked a range of 1383 to 1221 since late Sept, with 20-day realised volatility falling to 23% - the lowest since Sept 2020. One to build one.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.