- English (UK)

Key measures

According to the monetary policy statement, the BoJ will:

- Provide ample supply of funds through Japan’s Government Bonds (JGB) purchase and US dollar funding operations, in which the BoJ, coordinating with other central banks, will lower swap rate by 25 bps and offered US dollar weekly with an 84-day maturity in addition to current 1-week maturity

- Introduce a new loan program with 0% interest rate up to one year and increase the upper limit to purchase commercial papers (CP) and corporate bonds by 2 trillion yen in total

- Actively purchase Exchanged Traded Funds (EFT) and Real Estate Investment Trust (J-REIT) with the upper limit of 12 trillion yen and 180 billion yen, respectively.

Prime Minister Abe noted that the central bank’s decision was swift and appropriate to combat the coronavirus impact, which has caused slumping exports, production and inbound tourists as well as weak CPI recently.

Market reaction

The joint efforts of global central banks failed to boost sentiment or improve the economic outlook. The S&P 500 plunged 11.98% with another circuit breaker triggered, while the Dow Jones wiped out 12.93% or nearly 3000 points. Far worse-than-forecasted data from China also dragged the Asian and European stocks lower, with Australia’s S&P/ASX 200 posting its worst day (-9.7%) on record.

JPN225 has been running below 200 SMA and touched a multi-year low of 16039 on Monday, near the long-term support level coming from November 2016. The RSI index is firmly moving south in the oversold territory.

During 911 and the global financial crisis when the oversold conditions of RSI were also seen on the weekly chart, the index recovered shortly. Will that be the case this time?

While the BoJ’s active ETF purchase plan might help in the short-term, the index in the long-term will still be affected by the market sentiment and global economic outlook.

MT4: JPN225 weekly chart

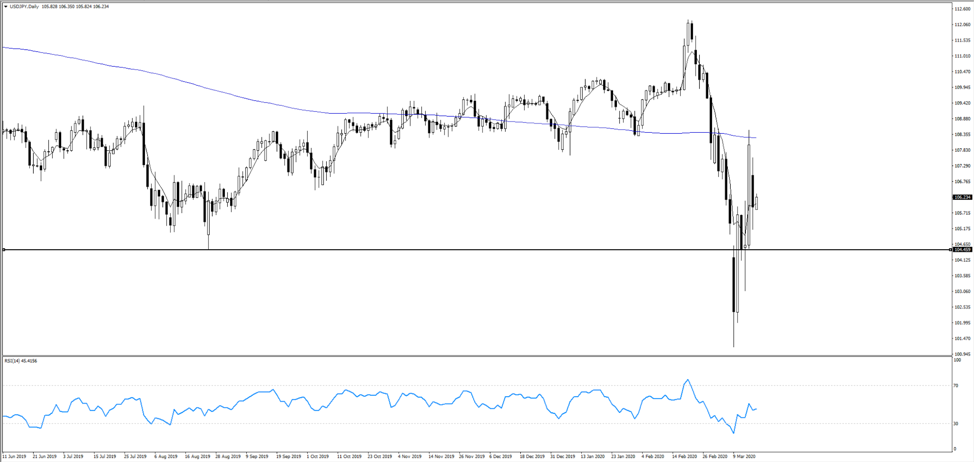

Now shift to USDJPY. Despite coordinated efforts by major central banks, mounting fears over coronavirus continues to weigh on investor sentiment and underpins the JPY’s safe-haven demand. JPY strengthened 1.69% to 105.83 on Monday.

As long as the volatility remains extremely high and there is a rush to cash, JPY will continue finding buyers and USDJPY rallies will be limited.

MT4: USDJPY daily chart

106.02 or 5-day EMA offers immediate support to the pair. The next support level appears at 104.45. On the upside, 108.23 or 200-day SMA is the barrier, which is also a good entry point for the buyers should the pair close above this level.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.